ICICI Bank is one of India’s leading private banks with over 5725 branches all across the country. Out of its wide range of products and services, ICICI Bank net banking plays a crucial role in establishing ICICI Bank as India’s second-largest bank.

ICICI Bank introduced net banking in 1998, and it’s available 24*7 throughout the year. The availability of internet banking has made services like online transactions, balance inquiry, fund transfer, etc., relatively easy for its customers.

In the process of internet bankingor mobile banking, IFSC code plays a crucial role. IFSC is an eleven-character unique code combination that helps the bank to segregate its branches. If you want to make an online fund transfer, you need to fill in the IFSC code for a successful transaction.

How to Register for Internet Banking in ICICI Bank?

Below mentioned are the steps you have to follow to register for internet banking-

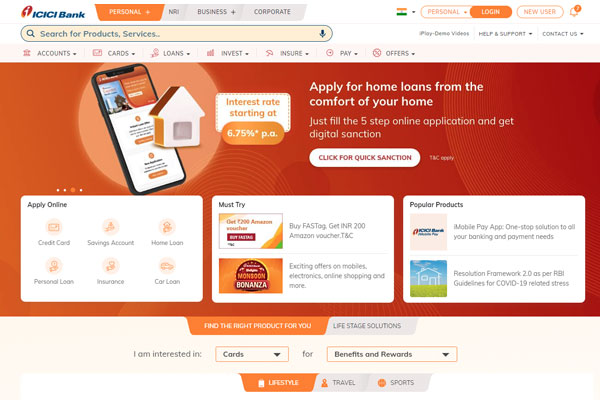

1) Go to the official ICICI Bank website, which is https://www.icicibank.com/

2) After clicking on the website, you will see the homepage. There, click on the tab that says, new user.

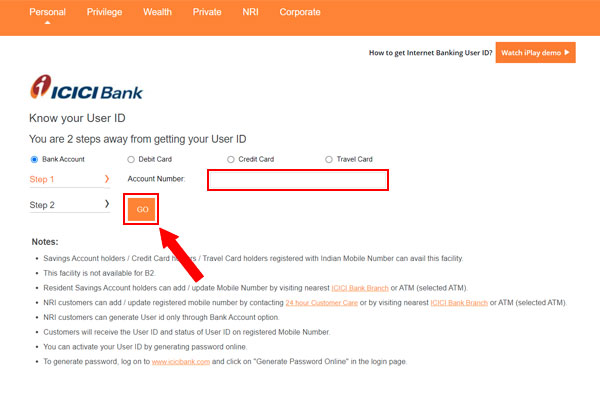

3) After being redirected to another page, click on I want my user id.

4) After clicking on that, you will see a new page saying know your user id.

5) Now you have to enter account details along with your registered mobile number. Then click on “Go.”

6) In the following step, you need to enter your debit card details and click on the go button again.

7) After that, you will receive a message: “your user id has been successfully sent to your registered mobile number.”

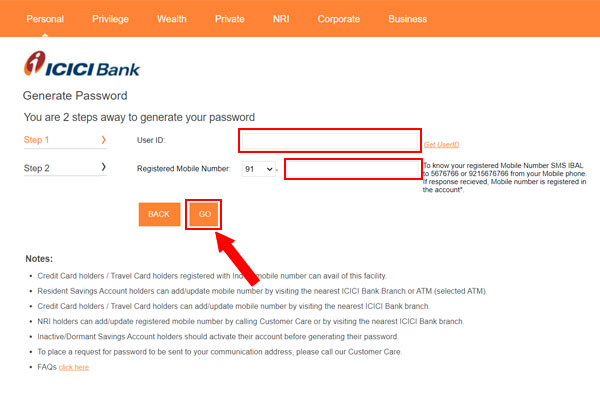

8) For login id and password, go to the option generate now. After clicking on that, click on proceed/continue.

9) Next, you will land on an online password-generating page. You have to enter your new user id and click on the go.

10) Create your new password, and make sure to create a strong password that is not easily accessible. Click on the go again.

11) After you click on the go, you will see a message pop up on the screen with the confirmation of your net banking user id and password.

12) To use all internet banking facilities, you can log in and start availing yourself of the benefits.

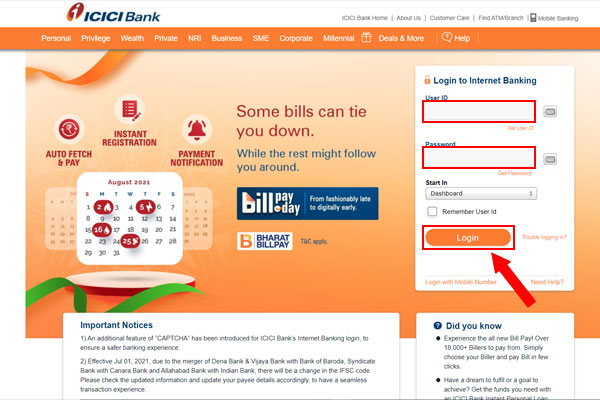

How to log in to ICICI Net Banking Portal?

Follow these easy and simple steps to log in to your ICICI net banking portal-

1) Go to ICICI Bank’s official website’s login page

2) Enter your user id and password

3) Click on the login button

How to Add a Beneficiary to ICICI Bank Net Banking?

1) Open the ICICI bank official website.

2) Next, you have to log in to your account by putting in the user id and password.

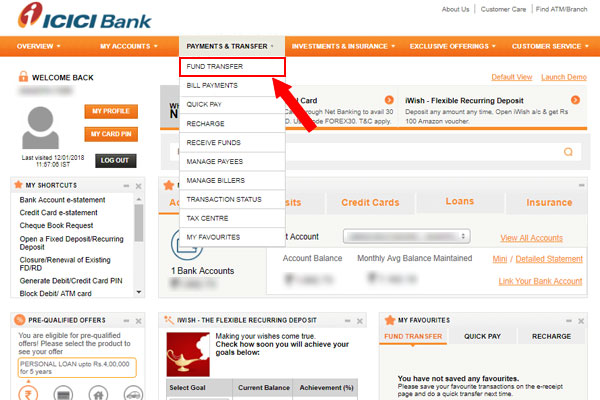

3) On the homepage menu, click on the tab that says- payment and fund transfer.

4) Again click on fund transfer from the drop-down menu.

5) Then click on add payee on the new page.

6) Then you have to select between ICICI bank payee or other bank payees.

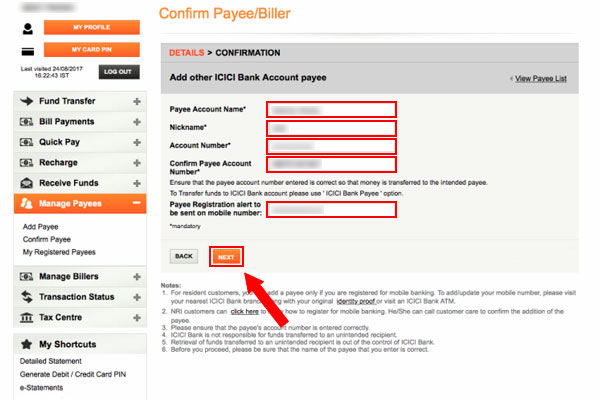

7) In the next step, you have to add the beneficiary name, account number, IFSC code, account type, etc.

8) If you don’t know the ICICI Bank IFSC Code of the beneficiary’s account or other bank’s IFSC code, you can find it easily through find your bank website.

9) After entering these details, click on next and then click on confirm payee.

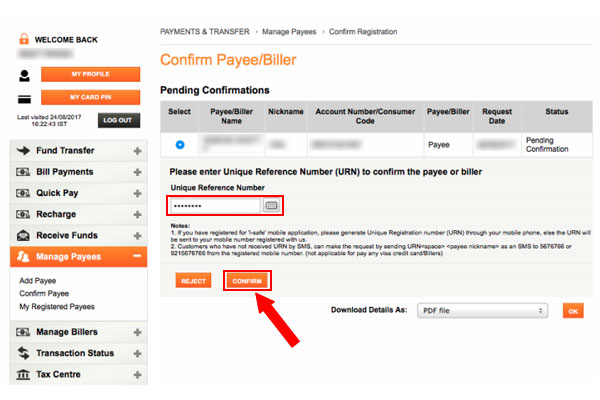

10) The bank will send an OTP to your registered phone number. Enter that OTP and click on confirm payee once again.

11) You have successfully added the beneficiary.

How to Check my account balance in ICICI Bank?

The easiest way to check your bank balance is through online banking. If you have already registered for ICICI Bank online banking-

1) Go to the bank’s website and login to your account.

2) On the home page, click on the check balance tab, and you can see your current account balance.

How to Transfer Money Online using ICICI Bank Net Banking?

1) Login to the bank’s website with your user id and password

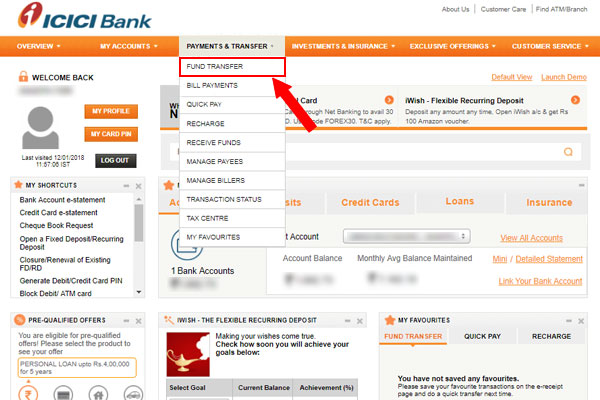

2) Go to the payment and transfer tab

3) Select fund transfer

4) Click on the transfer now tab

5) Select the beneficiary account to which you want to transfer money

6) Enter the amount you want to transfer

7) Select the transfer mode such as NEFT, IMPS, RTGS

8) Click on next

9) Verify all the details, and once you verify them, the amount will be transferred successfully.

How to Reset Transaction Passwords in ICICI Bank?

If you ever forget or want to reset your ICICI bank internet banking password, follow the below-mentioned steps-

1) Open the bank website.

2) Click on get password.

3) Enter your user id and press go

4) You’ll receive an OTP in your registered mobile number. Enter that in the unique box and click on the go again.

5) You can now create a new password following the guidelines. Re-enter the password and click on go

6) You will receive a confirmation message about your password change.

How to Change Mobile Number in ICICI Bank?

Follow these steps to change your ICICI Bank mobile number online-

1) Login to the ICICI Bank website with your user id and password

2) Now you have to fill up a form with basic details like

3) You registered email id

4) Old phone number

5) New phone number

6) Click submit, and you will receive a confirmation mail about your updated phone number.

Transaction Limit and Charges Applicable

| Transfer mode | Limit | Charges |

| NEFT | Minimum limit- Re. 1 Maximum limit- Rs. 10 lakhs | Rs. 10,000 to Rs.1,00,000 to Rs. 5+ GST Rs. 1,00,000 to Rs. 2,00,000 – Rs. 15+ GST Rs. 2,00,000 to Rs. 5,00,000 – Rs. 25+GST Rs. 5,00,000 to Rs. 10,00,000 – Rs. 25+ GST |

| RTGS | Minimum limit- Rs. 2 lakhs Maximum limit- Rs. 10 lakhs | Rs. 2,00,000 to Rs. 5,00,000 – Rs. 25+ GST Rs. 5,00,000 to Rs. 10,00,000 – Rs. 50+ GST |

| IMPS (IFSC and account number) | Minimum limit- Re.1 Maximum limit- Rs. 2 lakhs | Rs. 10,000 to Rs. 1,00,000 – Rs. 5+ GST |

| IMPS (MMID and mobile number) | Minimum limit- Re. 1 Maximum limit- Rs. 10,000 | Rs. 1,00,0000 to Rs. 2,00,000 – Rs. 15+ GST |

FAQs

1) What happens if I enter the wrong account number while doing a fund transaction?

In that case, the money will be transferred to the wrong account. The bank will also not be able to take the money bank without the wrong account holder’s approval.

2) How can the beneficiary know if the funds are credited to his or her account?

The beneficiary’s bank will send a confirmation message regarding the deposit to his or her account.

3) How long does it take for NEFT to get credited?

NEFT gets credited within two hours of the transfer. In certain cases, it may take up to one day.

4) If an RTGS transaction fails, will I get back my money?

Yes, if the money is not credited to the receiver’s account, you will get it back.

5) Can NEFT be used for foreign remittances?

No, you can’t use NEFT for foreign remittances.

Leave a Reply