Karur Vysya Bank is a pioneer in the banking industry. It started its operations in 1916 in Karur, Tamil Nadu. It is one of the banks that has adopted technology early. KVB Net banking has satisfied a variety of customers’ needs.

KVB customers can utilize the bank’s multiple online banking services. Customers can check their account balance and transaction history online. They can transfer funds online between two KVB accounts or from KVB to another bank.

KVB internet banking lets customers pay their bills, including utility bills like water, light, and electricity. It also helps them pay taxes, credit card bills, and mobile recharges from one place.

It is important for the users to understand the bank’s net banking processes before utilizing the services. And also it will help them to carry out banking activities online without any trouble.

This article discusses KVB net banking, online banking registration, and logging in and transferring funds. It also discusses how to add beneficiaries, reset net banking passwords, and online banking charges of the bank.

KVB Net Banking

Karur Vysya Bank offers various online banking services. It is a convenient channel through which customers can do banking work from any location. KVB online banking service is a safe and convenient option for managing your financial assets.

A KVB account holder can complete banking and non-banking transactions online with internet banking. You can do several tasks like viewing bank accounts, transferring cash, paying bills, and activating/ blocking ATMs with KVB net banking.

You can apply for a debit/credit card, book tickets online, and open an FD/RD account. KVB also offers retail and corporate banking. It was one of the first banks to deploy ATMs, check deposit stands and fully automated passbook printers in the country.

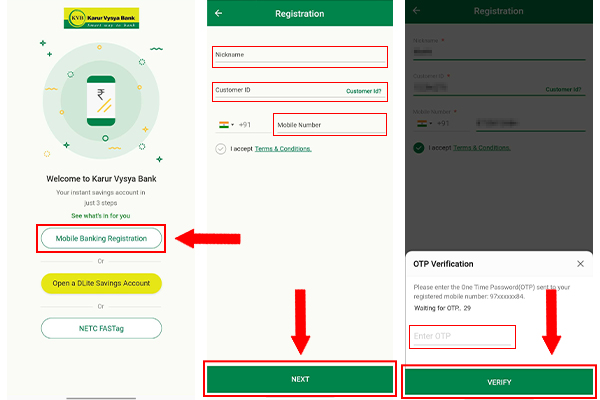

KVB internet and mobile banking services are an excellent step towards self-service banking in the industry. Karur Vysya Bank has introduced the new DLite app.

It is an easy mobile banking app that enables you to manage your KVB bank account anytime you want. It is an all-in-one app that allows you to carry out all financial and non-financial banking transactions.

The bank has a customer care facility available 24*7 to answer all your queries. You can call anytime at 1860 258 1916 to avail of the service.

Eligibility Requirements for KVB Net Banking

Here is a list of eligibility requirements for KVB account holders to use online banking services.

- Resident Indians

- NRIs

- Corporates

- Partnership firms

- Hindu Undivided Families (HUFs)

KVB Net Banking Guidelines

- You can log in to the KVB online banking account by following Double Factor Authentication. It has a 4-digit PIN and a random number generated by the RSA token.

- Only the primary KVB account holder will access net banking in joint accounts.

- All account holders will get a TPIN to conduct a financial transaction.

- Customers should change TPIN and password periodically for security reasons.

How to Register for KVB Net Banking?

You will get net banking registration by default on opening a banking account with Karur Vysya Bank. If you get the online banking registration, you can follow the below-listed methods.

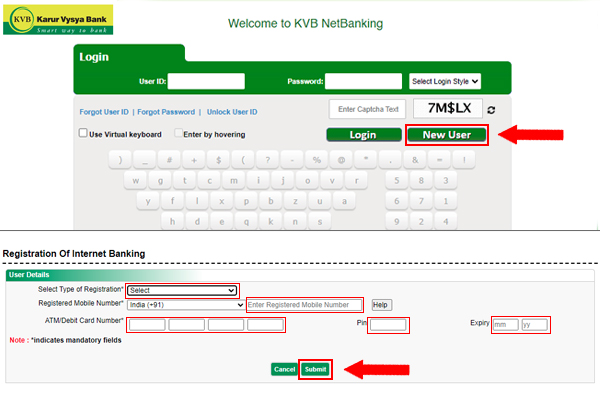

How to Register for KVB Net Banking Online?

An Indian resident and an NRI with a domestic mobile number can follow the steps to register for KVB internet banking online.

Step 1: Visit Karur Vysya Bank’s Official Website.

Step 2: Click on ‘Online services’ on the website’s right side.

Step 3: Click on ‘Register’ and choose ‘Retail Banking’ from the dropdown menu.

Step 4: Then click on ‘Self User Registration/ Register online link’. A registration page will appear. Accept T&C to proceed.

Step 5: Enter the required details and select facility type. Set Login and Transaction Password. Click on ‘Submit’.

Step 6: Next, the screen will display your user or login ID and reference number.

The bank will send you an SMS on activation of net banking login. And you can again log in to your KVB net banking and start a transaction.

Register KVB Net Banking through Phone Banking

Step 1: Call 1860 258 1916. It is the KVB customer care number for phone banking.

Step 2: Give the customer care your Customer ID and TIN (Telephone Identification Number). Verify your KVB account details.

Step 3: The customer care personnel will book your request for net banking registration.

Step 4: The bank will send your KVB net banking ID and password to your mailing address.

Register KVB Net Banking at a Bank Branch

- Visit the nearby KVB branch. Take a form for net banking registration.

- Fill in the details. Then, submit the form.

- You will receive a user/login ID via SMS from the bank.

- The bank will send your login and transaction password to your address within 7-10 working days.

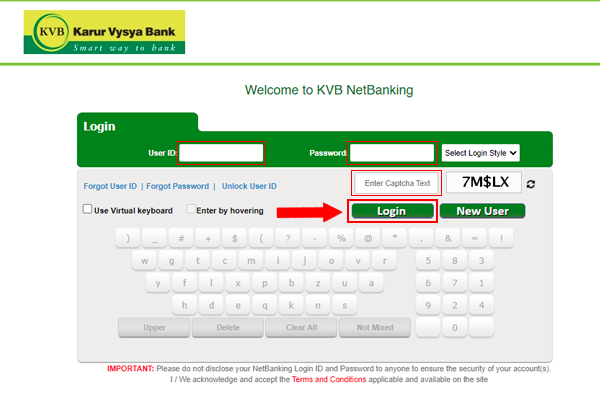

How to Login in KVB Internet Banking?

Step 1: Visit Karur Vysya Bank Official website

Step 2: Click on ‘Login’ on the website’s right side.

Step 3: Choose ‘Internet Banking’ services from the dropdown menu option.

Step 4: On the next page, click here to log in for the Registered User.

Step 5: Enter the User ID/Customer ID. Enter the Captcha.

Step 6: Fill in the password and click ‘Login’.

You are now logged in to your KVB net banking account.

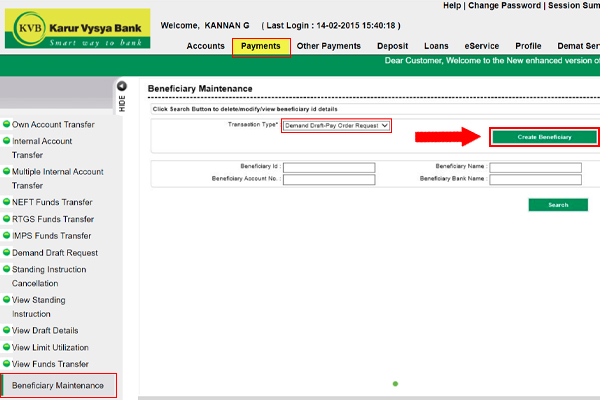

How to Add a Beneficiary Account in KVB Internet Banking?

Step 1: Visit the KVB official page and Log In to your net banking.

Step 2: Select the ‘Payments Section’.

Step 3: Click on ‘Beneficiary Maintenance’.

Step 4: Next, select ‘Create a Beneficiary’.

Step 5: Enter details like Beneficiary ID, Name, Account Number, and IFSC Code. Beneficiary ID can be the receiver’s name or nickname.

Step 6: Once you finish entering all details, click on the ‘Add Button’.

Step 7: Verify the details and click on ‘Confirm’.

Your beneficiary is added.

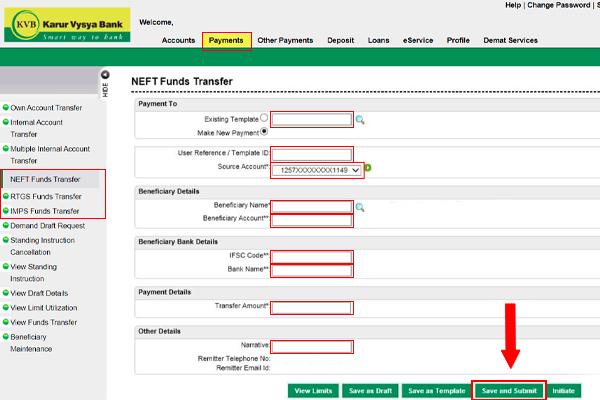

How to Transfer Money in KVB Net Banking?

Different transaction types available in KVB net banking are listed below –

NEFT

NEFT allows funds to transfer from one account to another. RBI has initiated the National Electronic Funds Transfer that enables online transactions. The transaction settles in half-hourly batches through NEFT.

KVB offers NEFT services in its online banking. NEFT is a hassle-free option for funds transfer from one branch to another KVB branch or any other bank. It is a safe and convenient transaction method that prevents fraud through cheques.

You will need details like the beneficiary’s name, account number, bank name, and IFSC code for the NEFT transaction in KVB. You will also be required to mention the amount to transfer to complete the process.

RTGS

RTGS is a quick funds transfer method that takes place in real-time on an order basis. Real-Time Gross Settlement is a secure way of transaction that is apt for high cash value. It saves a lot of time with minimum chances of fraud.

RTGS is available 24*7. KVB offers RTGS services for online funds transfer. You will have to provide the amount to debit, beneficiary’s name, bank name, account number, and IFSC code for completing funds transfer through RTGS.

Process of Funds Transfer

Step 1: Login into your KVB Net Banking account.

Step 2: Select the ‘Payments option’.

Step 3: Click on ‘Beneficiary Maintenance’.

Step 4: Select Payment Type.

Select internal transfer if you have to transfer funds from one KVB branch to another. For cash transfer from KVB to another bank, select NEFT/RTGS.

Step 5: Select the ‘Beneficiary’ to transfer the amount.

Step 6: All details of the beneficiary will appear.

Step 7: Cross-check the details.

Step 8: Enter the Amount to Transfer.

Step 9: Enter ‘T-pin’ and ‘OTP or RSA code/pin’ to finish the transfer.

Step 10: You will get an SMS that confirms the transaction.

KVB Net Banking Charges

Karur Vysya Bank Net Banking is free of cost for the customers. But they have to make specific charges for carrying transactions through NEFT or RTGS.

NEFT

| Transaction Amount | Charges |

| Up to Rs.10,000 | NIL |

| Rs.10,000 – Rs.1 lakhs | Rs.5 |

| Above Rs.1 lakhs | Rs.10 |

RTGS

| Transaction Amount | Charges |

| Rs.2 lakhs – Rs.5 lakhs | Rs.15 |

| Above Rs.5 lakhs | Rs.30 |

How to Reset KVB Net Banking Password?

Step 1: Open KVB’s Official Website.

Step 2: Click on ‘Forgot Password’.

Step 3: Enter ‘Login ID’ for KVB Net Banking.

Step 4: Select Reset Password using Debit Card/Security Question/ Aadhaar Number and Enter Details.

Step 5: Click on ‘Submit’.

Step 6: Provide ‘OTP’ and ‘Transaction PIN’ that you receive on your mobile number.

Step 7: Enter the ‘New Password’ and ‘Confirm’.

Step 8: Click ‘Submit’ to change the password successfully.

Services Can be Accessed Through KVB Net Banking

Services that customers can access at the Karur Vysya net banking portal are listed below –

Funds Transfer

KVB allows the account holders to transfer funds online from one KVB account to another through NEFT and RTGS.

My Account

You can view all current and savings accounts linked to a customer ID in the My Account section. You can get details like KVB account name, number, and current balance in the section.

Customer Service

You can avail various customer services in the section-

- Cheque status

- Cheque book status

- Forex rate details

- Pay bills

- Order new cheque books

- Stop cheque payment

- View Demat account details

- Shop online

- Book tickets

- Apply for IPO

Loans

Here, you can have all loan accounts associated with your KVB customer ID. You can check loan account details like loan type, EMI due date, and maturity date.

Term Deposits

You can view all term deposits like recurring and fixed deposits linked with your customer ID here. You will get details like deposit date, maturity amount, interest rate, and amount.

E-Statements

A KVB account holder can view the e-statements by logging into net banking. You can also apply to receive e-statements by email either weekly or monthly.

KVB Customer Care for Net Banking

Karur Vysya Bank has initiated various services to help users facing banking issues. You can reach the bank’s customer care representative at 1860 200 1916 (for those in India) and +91 44 30721916 (for account holders outside India).

If you want to lock/unlock your KVB net banking facility, send an SMS to 56161, +91 92447 70000 from the mobile number you have registered with the bank. The message should be KVBNET <Login ID> LOCK / UNLOCK.

Visit https://www.kvb.co.in/customer support/feedback.aspx to give feedback or register a complaint related to the KVB net banking. You can give a missed call at 088821 01234 to get your KVB customer ID if you have forgotten it.

Frequently Asked Questions

How to Activate Internet Banking after Receiving Passwords and TPIN?

To activate internet banking, you have to send an email to [email protected]. Please send from the same email ID registered with the bank. The bank will activate your customer ID within three working days. It will send you a confirmation mail.

How to Identify My Login Password and TPIN?

The KVB net banking login password has a pattern. It is alphanumeric with one numeric digit, one lowercase letter from a-z, and the remaining are uppercase letters for example, EDqTS1B.

TPIN is the transaction PIN which is a 4-digit PIN in numeric form. It is used for making transactions.

How to Reset My Internet Banking Transaction PIN (TPIN)?

You can change or reset your KVB Net Banking TPIN by the following methods.

- Using security questions on the net banking login page, click on Reset/Forgot Transaction PIN.

- Call KVB helpdesk number 1860 258 1916

- Submit a request form in your home branch to reset your TPIN.

- Send a request mail to [email protected] to change /reset your TPIN.

How to Check Karur Vysya Bank Balance Enquiry by Missed call?

You can check your KVB account balance by giving a missed call on +91 92662 92666.

How to Unlock User ID for KVB Internet Banking?

If you make three failed attempts to login into your net banking account, the bank will lock your account. If the account does not automatically unlock in 3 working days, you will have to send an email to [email protected]. The bank’s customer care team will help you unlock the user ID.

Leave a Reply