Abu Dhabi Commercial Bank IFSC Code and MICR Code

Abu Dhabi Commercial Bank IFSC Code and MICR Code

Find Abu Dhabi Commercial Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Abu Dhabi Commercial Bank IFSC Code and MICR Code

Abu Dhabi Commercial Bank IFSC Code and MICR CodeFind Abu Dhabi Commercial Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Abu Dhabi Commercial Bank IFSC Code Finder - Select Your State

Abu Dhabi Commercial Bank IFSC Code Finder - Select Your StateThe Reserve Bank of India has introduced the Indian Financial System Code or IFSC code. It is a unique eleven-character alphanumeric code that is different for every bank branch. The Abu Dhabi Commercial Bank IFSC code is also different for every branch, and it falls under the RBI guidelines.

The IFSC code plays an important role in digital fund transfer modes like NEFT and RTGS. With the growth of online banking, people don't prefer to stand in the long bank queues anymore. A majority of the people in India are opting for seamless and faster online money transfers.

The IFSC code is irreplaceable in this regard. We cannot initiate a digital fund transfer without entering the mentioned code. Another banking code equally important is the MICR code. It is a Magnetic Ink Character Recognition code which banks use for cheque clearance.

We will talk about both the Abu Dhabi Commercial Bank IFSC code and MICR code throughout, so continue reading.

The IFSC code is an eleven-character code consisting of both letters and numbers. This is a standard format of the code which is the same for all banks. The Abu Dhabi Commercial Bank IFSC code too falls under the same category.

The IFSC code of Abu Dhabi bank has eleven alphanumeric characters. The first four letters of the code signify the bank name; the middle character is zero. It is reserved for future use. The last six numbers stand for the branch location or code.

For example, the Abu Dhabi commercial bank Bangalore branch IFSC code is ADCB0000002. Here the initial letters ADCB represent the Abu Dhabi bank; as per the standard format, the middle character is zero, and the final six digits 000002 is for the Bangalore branch.

The IFSC code is a must for digital fund transfer options like- NEFT, RTGS, and IMPS. It is mandatory to identify the bank name and branch locations where you are going to deposit the money.

The correct IFSC code also ensures that the money does not get deposited into the wrong bank account. Therefore, when you send money via any of the mentioned modes, make sure that you enter the correct IFSC code.

Each branch of the Abu Dhabi bank comes with different IFSC codes. There are a lot of sources to get this code. We will talk about them in the following sections. Using the IFSC code, you can send money to both intra and inter-bank accounts.

The initiation of the Indian Financial System Code (IFSC) by the Reserve Bank of India has made transferring funds a matter of seconds. You no longer need to go to the branch every time you have to transfer money.

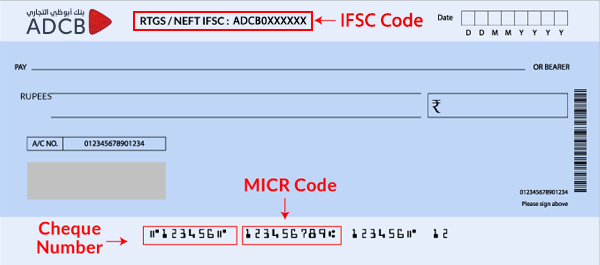

Another banking code that is also very important is the MICR code. The initials MICR stands for Magnetic Ink Character Recognition Code. The MICR code is also different for every bank branch. But unlike the IFSC, which is used for online fund transfers, MICR is used for cheque clearance.

The MICR code is a nine-digit code consisting of numbers only. There are no letters in the code. We can also divide the MICR code into three parts. The first part is for the city name, the following part is for the bank's name, and the third part is for the branch name.

Let's see an example from the Abu Dhabi Commercial Bank MICR code. 560269002 is the MICR code of Abu Dhabi bank Bangalore branch. The first three numbers, 560, correspond to the city, the next three numbers, 269, stand for the bank, and the last three numbers, 002, are for the branch location.

Likewise, all the other branches of Abu Dhabi bank have different MICR codes. The MICR code also helps in the identification of the bank branches.

The code is printed using magnetic ink, and banks use it for issuing cheques. The magnetic ink is used to detect and limit any fraudulent transactions.

You cannot proceed with any digital or cheque transfers without the IFSC and MICR code. So it's vital that you know the sources where you can get them. Here are some of the easiest and common ways to find the mentioned codes.

The Find Your Bank website and mobile app are some of the easiest ways to find the MICR and IFSC codes of all banks, including Abu Dhabi Commercial Bank. To find the codes from the Find Your Bank website, you have to-

Download the Find Your Bank mobile app or visit the website, i.e., https://findyourbank.in/

Now you have to select details like-

After selecting each of the options, the Abu Dhabi Commercial Bank IFSC code and MICR code will appear on the screen. There are multiple other means to find these codes; let's have a look at them-

The bank cheque book provides the IFSC and MICR codes. Each cheque book leaf has these codes printed. The IFSC code is printed on the top of the cheque book, and the MICR code is printed on the bottom beside the cheque number.

Every account holder gets a passbook that contains all the information about the account holder. This information includes the IFSC code and MICR code as well. So it's an easy and reliable source to find these codes.

The RBI or Reserve Bank of India has started the system of IFSC codes, so it keeps the record of all Indian bank's IFSC codes and the MICR codes too. You can find the codes on the RBI website easily.

Each bank comes with their customer care service who are always ready to serve their customers. Therefore, you can contact the bank's customer care when you need the codes.

The Abu Dhabi Bank's own website also has the IFSC codes of all of their branches. Either search them into their website or download the mobile to search the IFSC and MICR codes.

Sending and receiving money in this digital age has become a crucial aid for people. It takes just a few seconds and saves you the trouble of visiting your branch. The very few requirements of sending funds online are a smartphone or a PC, internet connection, the IFSC code, and receiver's information.

NEFT, RTGS, and IMPS are three of the most popular fund transfer methods that have made transferring money quite easy. Let's learn about these methods-

NEFT or National Electronic Fund Transfer is a DNS system where money is sent in batches. NEFT is available 24*7, and it takes around two to three hours to reach the money to the beneficiary's account.

There is no minimum and upper limit for NEFT. The data you will need for sending money via NEFT are-

| Amount | Charge |

| Upto Rs. 10,000 | Rs. 2.50+ taxes |

| Rs. 10,000 to Rs. 1 lakh | Rs. 5.00+ taxes |

| Rs. 1 lakh to Rs. 2 lakh | Rs. 15.00+ taxes |

| Rs. 15.00+ taxes | Rs. 25.00+ taxes |

| Rs. 5 lakh to Rs. 10 lakh | Rs. 25.00+ taxes |

RTGS

RTGS is used for making large sum fund transfers instantly. The minimum amount for sending money via RTGS is two lakhs. The Abu Dhabi bank's RTGS system is available from 8 am to 6 pm from Monday to Saturday. The service is not available on 2nd and 4th Saturdays.

You need similar information for sending money via RTGS, which are-

| Amount | Charges |

| Rs. 2 lakhs to 5 lakhs | Rs. 25+ taxes |

| Above 5 lakh | Rs. 50+ taxes |

IMPS is a real-time instant fund transfer method. If you've to make an urgent money transfer, you should go for IMPS mode. IMPS is also available 24*7, So sending urgent funds any time of the day becomes easier. IMPS has an upper limit of 25,000.

The information required for IMPS is as follows-

Abu Dhabi Commercial Bank is a bank from the United Arab Emirates. The bank was formed in 1985 by merging three banks, namely- Federal Commercial Bank, Emirates Commercial Bank, and Khaleej Commercial Bank.

The ABCB bank is the third largest bank in the United Arab Emirates which provides a number of commercial and retail banking services to its customers. The bank has its headquarters in Abu Dhabi.

ABCB bank has only one foreign branch, which is in India. The first branch of Abu Dhabi Commercial bank was opened in Maharashtra. Another branch of ADCB bank was established in Bangalore.

Some of the primary services extended by the ADCB bank are- loans, deposits, corporate banking services, ATM services, etc. Apart from these, some of the additional services provided by the bank are- regular and premium NRI banking services.

You will need the SWIFT code while making international fund transfers. It is an 8 to 11 character code. The ADCB SWIFT code is ADCBAEAA.

It is a semi-government bank. The government of Abu Dhabi holds 65.52% shares of the bank.

You can use various digital fund transfer modes like NEFT, RTGS, and IMPS to send money from the ADCB bank. To send money using these methods, you will need- the beneficiary name, account number, IFSC code, MMID code, and lastly, enter the amount you want to send.

No, ADCB is not the largest bank in the UAE. It is the third-largest bank.