Bank Of Maharashtra IFSC Code and MICR Code

Bank Of Maharashtra IFSC Code and MICR Code

Find Bank Of Maharashtra IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Bank Of Maharashtra IFSC Code and MICR Code

Bank Of Maharashtra IFSC Code and MICR CodeFind Bank Of Maharashtra IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Bank Of Maharashtra IFSC Code Finder - Select Your State

Bank Of Maharashtra IFSC Code Finder - Select Your StateDon't you agree that the world is running remotely effectively? Amidst this, online banking has been a boon for the banking industry and customers. Bank of Maharashtra IFSC Code supports in accomplishing net banking significantly.

Indeed, digital banking has reduced the in-person visits to the bank, adding convenience to the customers. It offers online features that make transactions easier. It enables you to carry banking activities at your convenience from anywhere at any time.

However, online banking demands finding the correct Bank of Maharashtra IFSC Code from reliable sources. You need to be cautious while doing transactions online. For this, you require complete information on the basics of digital banking.

Here is the article that will give you detailed insights into internet banking and bank codes.

If you have a Bank of Maharashtra net banking account, you must have given details like account number, name, and IFSC code. Isn't it? Let me tell you IFSC code is critical for funds transfer online.

RBI allots the Bank of Maharashtra IFSC Code that is unique for each of its branches. The code enables you to transfer funds digitally from one branch to another of the same or different bank. IFSC code correctly recognizes each bank participating in funds transfer through NEFT and IMPS.

IFSC code makes the transactions reliable and smoother ensuring zero inconsistency. It contains a combination of 11 alphabets and numbers. For example, the Bank of Maharashtra Mumbai Andheri Seepz Branch IFSC Code is MAHB0001756. The initial 4 alphabets signify the bank name, while the last six numbers are the unique branch code. The fifth character is a universal zero.

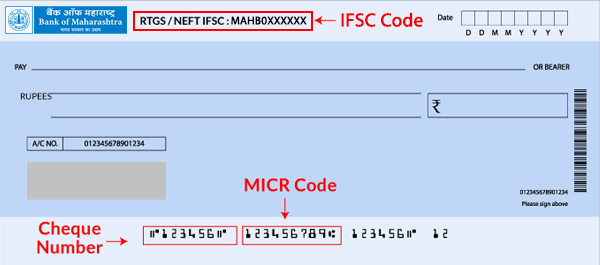

Have you ever noticed your cheque carefully? It has several codes located at the bottom. One of them is the cheque number, but do you know what the other code is?

The MICR code is an innovative technology that authorizes whether paper-based documents in the bank are legal. The Magnetic Ink Recognition Code applies CRT or Character Recognition Technology that the banks utilize to verify and clear cheques.

MICR code is a numeric code with nine numerals that identify branches participating in ECS. The code is mandatory for filling various financial forms like SIP to enable quick cheque processing.

For example, the MICR code of Bank of Maharashtra, Andheri Seepz branch, Mumbai is 400014165. Here, the first 3 numbers are the city code, the following three represent the bank code, while the last 3 signify the branch code.

But what about international transactions? IFSC code is used for making transactions within national bank accounts. SWIFT code is the one that enables conducting funds transfer internationally between two banks. SWIFT code has a slight similarity with the Bank of Maharashtra IFSC Code. International Standard Organization or ISO has accepted the validity of the SWIFT code for use in financial and non-financial institutions.

Some banks use SWIFT codes for exchanging messages with one another. SWIFT code is an 11-digit code in which the first four letters represent the bank code. The next two are only letters that signify the country code. The next set of 3 letters denotes the location code, while the last 3 are the branch code. For example, the SWIFT code of Overseas Branch, Mumbai, is MAHBINBBOVM.

The Bank of Maharashtra IFSC, SWIFT, and MICR codes are essential for conducting online banking transactions. Now that you have ample information on the bank codes, it is essential to know where to find the correct codes. Multiple sources are available to find the correct codes, like bank websites, mobile bank apps, and reliable third-party websites. You can get the codes from the 'Find Your Bank' website.

Follow the steps below to find the codes.

'Find Your Bank' also has a mobile app. It is a user-friendly app on your Android for searching the bank codes. The app will allow quick processing and generate the correct codes easily. The app is available for download from Google Playstore. The app will also help you trace the address from a known Bank of Maharashtra IFSC Code, SWIFT, and MICR code for a branch.

Let me tell you that there are other reliable sources from where you can locate the bank codes. Here are the details.

Your Bank of Maharashtrapassbook mentions the IFSC and MICR code for the specific branch you have an account with.

You will find the bank's IFSC and MICR code on the cheque book. IFSC is located at the cheque's top corner, while MICR is at the bottom.

RBI is the supreme bank that controls the functioning of all banks. It allots the IFSC and MICR codes to individual branches. RBI has an official website https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspxfrom where you can find the codes easily.

The bank has an official net banking website. Browse the website, and you can find the codes conveniently.

Log in to your digital banking Bank of Maharashtra account. Go to analyze statements. Here, you can find the codes of the specific branch with which you have an account. Having an online account will help you locate the codes online quickly.

If you cannot find the correct SWIFT code, there is another convenient option for you. You can call the Bank of Maharashtra customer care service to know the correct SWIFT code. The service is available 24*7.

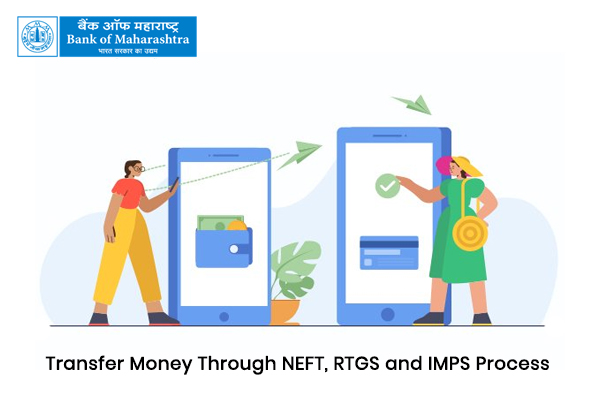

NEFT enables online funds to transfer from one branch to another or of a different bank without interruption. Those having the Bank of Maharashtra savings/current account can avail of National Electronic Funds Transfer. Transactions through NEFT take place in batches and are considered for funds transfer above Rs 2 lakh. You can transfer money through NEFT by paying a minimal fee.

Bank of Maharashtra has no minimum and maximum limit to make an NEFT transaction. The bank takes nearly one hour to settle NEFT deals. NEFT transactions up to Rs 10,000 accounts for Rs2.5 per transaction by the bank across the counter while it is free in digital mode. The bank charges Rs 2 in digital mode for Rs 10001 – Rs 1 lakh while Rs 5 at the branch.

Bank of Maharashtra charges Rs 3 for funds transfer of Rs 1 lakh -Rs 2 lakh digitally while Rs 15 across the counter. It charges Rs 5 for transactions above Rs 2 lakh in digital mode while Rs 25 offline.

You will need the Bank of Maharashtra IFSC code of sender and receiver. You will also require the receiver's account number and type and address.

RTGS is a faster method of funds transfer in real-time. Real-time Gross Settlement is a continuous and integrated payment system with a quick settlement cycle. The banks utilize RTGS for inter-bank funds transfer on an irrevocable and immediate basis. Bank of Maharashtra has set Rs 2 lakh as the minimum amount for RTGS while there is no maximum limit.

The bank levies Rs 25 across the counter and Rs 5 in digital mode for funds transfer through RTGS from 8: 00 -11:00. There is a charge of Rs 50 and Rs 10 in offline and digital mode simultaneously for Rs 5 and above. Bank of Maharashtra charges Rs 27 offline while Rs 5 in digital mode for transactions from Rs 2 lakh - Rs 5 lakh from 11:00- 13:00. It charges Rs 52 in offline mode and Rs 10 in digital mode.

After 13:00, the bank charges Rs 30 in offline mode while Rs 5 in digital mode for Rs 2 lakh -Rs 5 lakh. It charges Rs 55 offline and Rs 10 in online mode for Rs 5 lakh and above. You will need the receiver's IFSC code, account number, and name for transferring funds through RTGS.

IMPS is an intermediate interbank funds transfer service that enables accessing your online bank account and transfer money immediately and securely. NPCI offers a cost-effective IMPS service. It is available 24*7 even on public holidays and Sundays. Bank of Maharashtra has a minimum limit of Re1 and a maximum limit of Rs 2 for the IMPS facility. It charges Rs 5 per transaction for up to Rs 1,00,000 while Rs 15 for funds transfer from Rs 1,00,001 – Rs 2 lakhs.

Bank of Maharashtra uses two transfer modes for IMPS. One is P2P (phone to phone) that requires a mobile number and MMID, while the other is P2A using an account number and IFSC code. All savings and current account holders of Bank of Maharashtra who have registered for mobile or net banking or those having a valid MMID can utilize IMPS.

Initially, the Bank of Bombay was established in 1840. It was the first commercial Bank in Maharashtra. The Bank of Maharashtra was registered as a formal bank under the Indian Companies Act on 16th December 1935 in Pune. The bank has 1900 branches in India with 15 million customers. The bank is having the highest number of branches among nationalized banks in Maharashtra.

The bank offers multiple services to various customers, including businesses, corporates, retail, and SMEs. Bank of Maharashtra offers a 3.50% p.a. interest rate for savings deposits balance for up to Rs 25 lakhs while 4% p.a. above Rs 25 lakhs.

Those who fall under 18 years do not require having a minimum balance for opening a savings account. Anyone can open a savings account by visiting the branch with the required documents.

|

Saving account types |

Minimum balance requirement |

|

Mahabank Purple Savings account |

Rs 3,00,000 average balance monthly |

|

Mahabank Lok Bachat Yojana |

No balance for opening an account. It can be Re1. |

|

Mahabank Royal Savings Account |

Rs 1,00,000 monthly |

|

Mahabank Yuva Yojana |

Rs 10 |

|

Mahabank Savings Bank Scheme |

Maintain on average basis monthly |

Documents required for opening

BSR or Basic Statistical Return Code is given to the bank by RBI. You can use the code while filling TDS/TCS returns. BSR code is also used in deductee and challan details. It is unique to each of the Bank of Maharashtra branches.

Yes. You cannot transfer funds without giving the IFSC code details of the transferee.

The Bank of Maharashtra issues mobile Money Identifiers or MMID. It is a 7-digit number that helps in funds transfer by combining it with a mobile number. It is also linked with an account number for identifying the beneficiary's account details.