Commonwealth Bank Of Australia IFSC Code and MICR Code

Commonwealth Bank Of Australia IFSC Code and MICR Code

Find Commonwealth Bank Of Australia IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Commonwealth Bank Of Australia IFSC Code and MICR Code

Commonwealth Bank Of Australia IFSC Code and MICR CodeFind Commonwealth Bank Of Australia IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Commonwealth Bank Of Australia IFSC Code Finder - Select Your State

Commonwealth Bank Of Australia IFSC Code Finder - Select Your StateInternet banking has brought many changes in financial transactions between people and entities. Sending money online is simple, easy, and effective when you have the IFSC code of the bank. With the Commonwealth Bank of Australia IFSC code, you can send money to any account in the Indian branch of the bank.

It takes less time and effort to transfer money using the internet and mobile banking services. The IFSC code and MICR code play a vital role in facilitating thousands of online cash and cheque transactions every day. Both codes are provided by the RBI (Reserve Bank of India) and have special purposes.

In this article, we'll learn more about the IFSC and MICR codes of the Commonwealth Bank of Australia, why we need them, and how to find the codes easily (online and offline). Let's also read more about CBA and its presence in India.

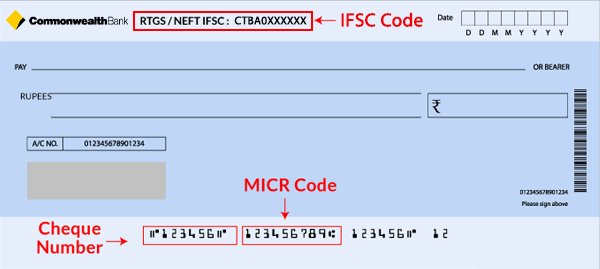

The Indian Financial System Code (IFSC) is an 11-character code used by the RBI to identify the branches of every bank in India. Every bank's branch has a unique identification code that makes it easy to transfer money online to the accounts with the branch. For example, if you know the IFSC code of CBA in Mumbai, you can send money to any account in that bank.

The 11-character IFSC code is divided into three sections:

For Instance, The Commonwealth Bank of Australia Mumbai branch IFSC code is CTBA0000001.

CBA has only one branch in India, located in Mumbai, Maharashtra.

Knowing the IFSC code of the bank branch is convenient in making NEFT, RTGS, IMPS, and other online payments. You need the IFSC code to make or receive payments (you have to share the IFSC code with the sender to transfer the money to your account).

Entering the wrong IFSC code will result in an unsuccessful transaction. It'll take 2-3 business days for the debited amount to be credited back to your account. The IFSC code is used to easily identify the bank's branch and deposit the money in the right account.

MICR code is printed using Magnetic Ink Character Recognition technology and is found on the cheque leaves and chequebook of the bank. The account holder can apply for a chequebook when opening the bank account (or afterward).

The MICR code is a 9-digit identification number used to authenticate and validate the cheque deposited by a person. Cheques are cleared faster through the Electronic Clearing System (ECS). ECS used the MICR code to determine that the cheque is legal and belongs to the bank.

The MICR code is divided into city, bank, and branch codes. For Commonwealth Bank of Australia, Mumbai branch, the MICR code is 400240268.

The MICR code is found at the bottom of the cheque and printed beside the number. You can also find the Commonwealth Bank of Australia IFSC code printed at the top of the cheque. The IFSC and MICR codes are printed on the first page of the chequebook for easy identification.

Online banking has made it easy to send and receive money anytime. You can send money to local, national, and international accounts using the internet and mobile banking services. However, certain details are important to complete the transaction.

The IFSC code is one vital detail without which you cannot send or receive money online. The IFSC code is also known as SWIFT code or BIC (Bank Identifier Code), depending on the country. Since CBA has a branch in India, you can send money to users with an account in that branch. But how can you find the Commonwealth Bank of Australia IFSC code?

There are different ways to find the IFSC code of CBA. The first method is to go to https://findyourbank.in/.

Find Your Bank is a free website where you can find the IFSC code, MICR code, address, phone number, and email id of any bank's branch located in India.

You can download the Find Your Bank mobile app on your phone and use the app to find the IFSC and MICR codes for all banks in India.

The passbook contains the account-related information of the account holder. The first page of the passbook is usually dedicated to details such as the bank's name, address, contact information, and account holder. The IFSC code, user ID, and account number are also provided on the same page.

Every chequebook has the IFSC code and MICR code printed on the front. Each leaf/ cheque has the IFSC code on the top and the MICR code at the bottom. You can apply for a chequebook when you open your account in the branch.

NetBank is the net banking facility provided by the Commonwealth Bank of Australia. You can find the Commonwealth Bank of Australia IFSC code from the net banking website.

CommBank app is the mobile app of CBA and is available on App Store for iPhones and Play Store for Android phones. The app provides the bank codes and allows you to access your account online. You can check the balance, past transactions and send money using the app.

Another easy way to find the IFSC code of CBA is by contacting customer care. Send them an email or call the toll-free numbers to ask for the necessary information. You'll get a faster reply when you call the bank.

Since you know how to get the IFSC code of a bank, it's time to see how to make online money transfers through different means. NEFT, RTGS, and IMPS are three commonly used methods to wire money between Indian banks.

The IFSC code is necessary for all three methods of online transfers. If CBA in India allows NEFT and RTGS transactions, it will follow the same rules (limits and service charges) as other Indian banks.

NEFT is used to send money from one bank account to another through the internet. There is no limit for the minimum or maximum amount to be sent using NEFT. The service charges are applicable based on the amount per transaction. You can conduct any number of NEFT transactions per day.

You need the following information to make an NEFT payment:

You can make NEFT payments using your NetBank facility, CommBank app, or visiting the branch. The NEFT transactions are cleared once every hour or two. It usually takes two hours for the money to be credited to the beneficiary's account. However, you can do NEFT transactions 24*7.

If you want to send larger amounts through NEFT, make sure to test by sending a minimum amount to the beneficiary. Confirm that the person has received the money before sending the actual amount.

Service charges for NEFT transactions are as follows:

RTGS is used to send huge amounts of money in real-time. Business and large financial transactions are done online through RTGS payments. The minimum amount that you can send using RTGS is Rs. 2,00,000/-

The money is transferred in real-time and is faster than NEFT. You need the following information to make RTGS payments:

Like NEFT, you can send money through RTGS either by logging into your NetBanking account, CommBank app, or visiting the branch. RTGS payments also have service charges based on the amount you send per transaction.

IMT is a facility to send money overseas through your CBA account. The IMT feature can be used by logging into a NetBank account or the CommBank mobile app. You can also visit the branch for an international money transfer.

The service charges depend on the amount and country you want to send money to. The transaction can be canceled before the money is sent to the beneficiary, which takes around 2-3 business days.

The Commonwealth Bank of Australia is also referred to as CommBank. It is a multinational bank with branches in various countries in Asia and the European Union and branches in New Zealand, North America, and the United Kingdom.

CBA was founded on 22nd December 1911 in Melbourne, Australia. The bank currently has its headquarters in Sidney. It is a locally-owned public bank that derives its revenue by offering financial services in different parts of the world.

CBA provides international financial services (IFS), banking, and insurance services and products in India, Indonesia, China, and Vietnam.

Commonwealth Bank of Australia offers the following services:

Yes, it is. Commonwealth Bank of Australia accepts online applications to open the standard savings and current accounts by anyone. Even if you are traveling on a visa, you can open an account. Non-residents are welcome to open an account with CBA.

Yes, it will. The CommBank mobile app will work in any location as long as your phone has an active internet connection and an international mobile number. You can access your account, check the balance, and make payments through the app. If you use an Australian phone, make sure to turn on the global roaming feature to connect to the internet.

BSB is a Bank State Branch identifier number similar to the IFSC code of each bank's branch in India. BSB is used for domestic transactions within Australia. The SWIFT code is the same as Business Identifier Code (BIC) and is used for international money transfers. The SWIFT code of CBA is CTBAAU2S.