DCB Bank IFSC Code and MICR Code

DCB Bank IFSC Code and MICR Code

Find DCB Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

DCB Bank IFSC Code and MICR Code

DCB Bank IFSC Code and MICR CodeFind DCB Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

DCB Bank IFSC Code Finder - Select Your State

DCB Bank IFSC Code Finder - Select Your StateIFSC codes, along with other banking codes, have become a mandate for unique banking transactions. For NEFT and RTGS transactions, you have to input the receiver bank's IFSC code. The DCB Bank IFSC code for every bank branch is uniquely allotted by the RBI to every bank branch. For making any transfers to a DCB Bank branch, you will need to put in the branch IFSC code during the transfer.

You must have used an IFSC code often to transfer money to someone's bank account. There are many other banking and bank-related codes that have specific purposes for unique branch identification or document validation. In this article, you can explore the use and structure of other banking codes, such as the MICR and SWIFT codes.

Keep reading to understand the purpose, benefits, composition, and difference between DCB Bank IFSC code, MICR code, and SWIFT codes. You will also read about where you can use these codes along with distinct modes of online money transfer.

Starting with the most popular on the list, let's understand what exactly an IFSC code is, what it indicates, and how you can recognize the meaning of its components.

Surely, you must have filled in an IFSC code for a bank transaction at some point. Now, let's have a look at what it does and how it is different for each bank branch. Here is all about banking codes!

The Indian Financial System Code is the IFSC code needed for online banking. It is an 11-digit alphanumeric code that is assigned to each Indian bank branch by the RBI. The beginning four characters in the DCB Bank IFSC code is the bank code. The last six digits indicate the branch code, with the fifth one is set to 0.

For instance, let's consider the Mumbai Kurla DCB bank's branch in Maharashtra. The DCB Bank Mumbai City Kurla Branch IFSC Code is DCBL0000011. The initial four letters (DCBL) signify the bank's code. Following this, the fifth one is 0, and the ending six digits (000011) signify the branch code.

Why is an IFSC code necessary during any online transaction? Because no online fund transfers through RTGS, NEFT, and IMPS are possible without IFSC code. For smoother financial transactions and to receive funds without any errors, IFSC code is a must.

What is the result of providing incorrect IFSC code? Well, there are two possibilities. The first one, for the same bank, the fund transfers might be recurring. This might happen on providing the correct account number but different bank's IFSC code. This is the reason you should know the valid IFSC code. You can find and keep the DCB Bank IFSC code for your bank's branch handy for this.

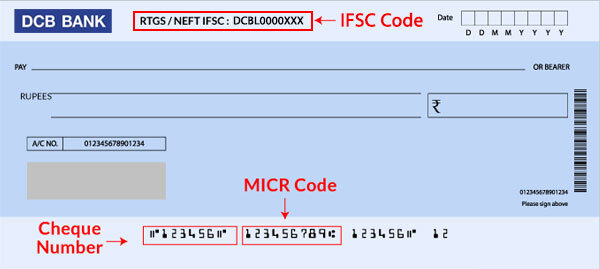

Through the MICR code, banks verify and authenticate banking documents like pay slip, cheques, etc. MICR is a short form for Magnetic Ink Character Recognition. The unique code is printed on these documents with MICR technology. You can find this code at the bottom of the cheque available beside the cheque number.

The format of DCB Bank's MICR code is as a nine-digit code. The first three digits represent the city code. The following three digits are the bank code. The last three digits are the branch code. Usually, you can refer to the MICR code on the front page of the passbook or bottom of cheques.

It processes the Electronic Cheque System (ECS) transaction faster and correctly. Unlike the MICR code, the IFSC code contributes to online fund transfers within all banks in India. The SWIFT code, which we will discuss next, is for transactions taking place globally. So, these banking codes have their distinct uses.

For example, the MICR code for DCB Bank's Mumbai Kurla branch is 400072011. The first three digits, "400," are the city code. The next three consecutive digits, "072", are the bank code. The ending three digits, "011," represent the branch code.

For performing any international transactions, the SWIFT code is essential. SWIFT is short for Society for Worldwide Interbank Financial Telecommunication. The code is a unique method to identify banks globally. SWIFT code is even called the Bank Identifier Code.

The SWIFT code format consists of 8 or 11 digits. The initial four letters indicate the bank code. The subsequent two consecutive letters indicate the country code. The following two letters specify the location code. The ending three characters are optional, which represent the branch code.

For instance, the DCB Bank SWIFT code for the Mumbai Mohamed Ali branch is DCBLINBB043. The first four letters, DCBL, signify the bank code. The following two letters, IN, represent the country code. The next two letters, BB, indicate the location code. The last three digits, 043, indicate the branch code.

Are you searching for your bank's IFSC Code or MICR Code, or maybe SWIFT Code for international transactions? You must know these codes for domestic or international fund transfers. For any online transaction or offline transaction, you need these codes. There are various ways to locate DCB Bank IFSC Code, MICR Code, and SWIFT Code. Check more details below that can help out:

The easiest way to locate the DCB Bank IFSC code is to approach IFSC search tools. One such efficient IFSC Code tool is Find Your Bank. You can find DCB Bank IFSC Code, MICR code, and SWIFT code without any complexity.

Just follow these steps to find your expected code:

1. Head over to this website.

2. The homepage opens. Over the homepage, you will get to see four boxes.

3. To find your desired IFSC Code, you need to select the bank of your choice from the drop-down menu.

4. After selecting the bank, select the state, district, and city.

5. In the end, select the branch for which you are trying to find the IFSC code.

After following the above steps, you will get your desired details. You can also easily obtain other information like MICR code and SWIFT code along with the requested query.

Instead of using a website application, Find Your Bank serves the flexibility of using smartphone applications to make your search quicker. You can get this mobile app on Playstore and get started searching all the codes whenever needed.

You can quickly locate the IFSC code on the cheque book's front page or on the top of the cheque leaf. To locate the MICR code, you need to look at the bottom of the cheque leaf beside the cheque number.

As you are a DCB Bank account holder, you can find the IFSC Code and MICR code on the passbook's front page.

Online banking platforms like Internet Banking and Mobile Banking have made the procedure of fund transfers easier. You can even find the IFSC code and MICR Code on DCB mobile banking applications or other internet banking options.

Are you still struggling to find your IFSC code? Just make a call to your bank branch. If you fail to try all the above-listed methods, opt to call your branch and ask for the relevant bank code. You can find the accurate DCB Bank IFSC Code, MICR code, and SWIFT code via calling your nearest bank branch.

| IFSC code | MICR code | SWIFT code |

| Indian Financial System Code is abbreviated as IFSC. | Magnetic Ink Character Recognition is abbreviated as MICR. | Society for Worldwide Interbank Financial Telecommunication code is abbreviated as SWIFT. |

| It is used to identify the bank branch that participates in electronic fund transfers. | It makes the processing of cheques faster due to the Magnetic Ink Character Technology code. | It is used for international fund transfers between two banks. SWIFT code is even used for the exchange of messages within banks. |

| IFSC code is an alphanumeric code containing 11 characters. | MICR code is a 9- digit code. | Swift code is 8 or 11 alphanumeric characters. |

| Implemented by RBI | Implemented by RBI | Implemented by ISO |

|

DCB Bank Vashi, Navi Mumbai’s IFSC code is DCBL0000030 |

Example: DCB Bank Vashi Navi Mumbai’s MICR code is 40072030 | Example: DCB Bank Vashi Navi Mumbai’s Swift code is DCBLINBB030 |

Transferring funds online has become more accessible due to flexible online payment modes like National Electronic Funds Transfer (NEFT), Immediate Payment Service (IMPS), and Real-Time Gross Settlement (RTGS).

National Electronic Fund Transfer, abbreviated as NEFT, is an online transaction process that you can use for transferring funds from one bank to another or within the same bank. It follows a batch settlement process if done offline.

You can initiate NEFT transactions offline by visiting the nearest bank branches and online through DCB net banking or mobile banking applications. You are open to do NEFT transactions 24 by 7 all 365 days.

There are certain limits applicable for NEFT transactions. The minimum fund transfer amount is Rs. 25,000/- whereas the maximum fund transfer amount is Rs. 5,00,000/-. A total of 12 batch settlements are done on weekdays within certain time intervals. On weekends, a total of 6 batch settlements are done.

DCB bank imposes some charges on specific amounts that are transferred using NEFT. The costs vary from Rs 2 to Rs 50, depending upon the amount that is transferred. The bank timings for NEFT transactions are 8:00 AM to 7: 00 PM on weekdays, whereas, on Saturday, it is 8:00 AM to 1:00 PM.

Some mandatory data that you need to insert for transferring funds through NEFT:

Real-Time Gross Settlement, abbreviated as RTGS, is reliably preferred for quick online transactions from one bank to another bank or within the same bank. In comparison to NEFT, RTGS online money transfer is faster and feasible for urgent payments.

To make RTGS transactions, you can either visit the nearest bank branch or make RTGS fund transfers online through DCB mobile banking applications. It is done on a real-time basis, which means the amount gets credited within 30 minutes into the beneficiary's account.

There are certain limits applicable on per-day amount transactions. The minimum limit for the amount transferred is Rs. 50,000/- whereas the maximum limit for fund transfers is Rs. 2 lakh. There are some charges applicable on specific amounts during online fund transfers.

DCB bank charges a transaction fee of Rs. 25 to Rs. 50, depending upon the amount. These charges are applicable only on outward transactions. RTGS is one of the most secure real-time-based fund transfer methods. The preferred timings for RTGS fund transfers are Monday to Friday from 9:00 AM to 4:30 PM. On Saturdays, the timings are from 9:00 AM to 2:00 PM.

The documentation required for RTGS fund transfer is the same as NEFT:

Immediate Payment Service, abbreviated as IMPS, is the fastest mode of online money transfer that can be used for transferring funds from one bank to another bank or within the same bank account. You can perform IMPS fund transfers online only through a digital platform like internet banking, mobile banking applications, or ATMs. IMPS services are available 24 by 7 all 365 days, even on public holidays or bank holidays.

DCB Bank extends this service for online fund transfers only if you have your registered mobile number. You can get the MMID number from the bank and use it during any online transaction.

For IMPS transactions, the minimum fund transfers limit is Re.1, whereas the maximum fund transfers limit is Rs. 2 lakhs. DCB bank applies some charges on online fund transfers via IMPS. They are Rs. 5 for transactional amount Rs. 1 lakh and Rs. 15 for Rs. 2 lakhs.

For transferring funds via IMPS, you need following the data:

Development Credit Bank abbreviated as DCB, is a private bank headquartered in Mumbai, Maharashtra. It is under the guidance of the DCB government and has been scheduled as a commercial bank. It has 352 branches across India, along with 515 ATMs. The bank branches are located in 19 states and three territories. It was established in the year 1930 and gave rise to multiple facilities.

DCB Bank has built its presence due to its professional management, excellent infrastructure, and contemporary facilities. These facilities include personal loans and business loans, internet banking, and some other investment solutions. The bank facilitates its customers with all types of account opening schemes. It enables opening savings accounts, salary accounts, joint accounts as well as current accounts. DCB Bank savings account balance, along with their rate of interest, is present below and, as of 16th September 2020, is as follows:

| Balance | Rate of Interest |

| Up to Rs. 1 crore | 4% |

| From 1 crore to 5 crore | 6.25 % |

For opening DCB bank's savings account, you need to carry the following documents:

BSR is short for Basic Statistical Return. It is a seven-digit code usually used by the bank to identify tax deposits of various bank branches. It is easy to get the DCB bank BSR number. You need to visit the bank's website, select the district and state to find the BSR code.

Well, the DCB IFSC code uniquely identifies the bank branch for hassle-free fund transfers. IFSC code is reliably used for electronic fund transfers. For making any online fund transfers through RTGS, NEFT, and IMPS, IFSC code is used.

You can locate the IFSC code either on the front page of the cheque book or on a cheque leaf. It is present on either the top of the cheque leaf or in the middle of the leaf beside the account number.

The minimum balance required to open a savings account in DCB Bank is Rs. 10,000/-

There's no fear in sharing your IFSC code. Because it just specifies the bank's branch. In fact, you have to share it if someone wants to send you money. You can even find IFSC code online through multiple websites by selecting the state, district and branch. Hence, you can easily share your IFSC code.