Federal Bank IFSC Code and MICR Code

Federal Bank IFSC Code and MICR Code

Find Federal Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Federal Bank IFSC Code and MICR Code

Federal Bank IFSC Code and MICR CodeFind Federal Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Federal Bank IFSC Code Finder - Select Your State

Federal Bank IFSC Code Finder - Select Your StateYou cannot deny that online banking has made our life easier in several ways. It saves you from standing in long queues in the bank. Net banking offers banking services at our convenience. Customers can utilize the Federal Bank IFSC code for net banking transactions.

Online banking allows you immediate access to bank accounts. You can view statements, pay bills, and access other banking services. Imagine you do not have to chase the manager or cashier multiple times for your banking needs.

Net banking provides a safer way to carry out transactions. All you need is to conduct online banking with precautions. There is a requirement to have complete information on the bank codes you need for fund transfer and other banking needs. Here is a complete blog that puts together all you need to know about net banking.

Do you know what an IFSC code is? If you do online banking regularly, you must have come across this code. Haven't you? But are you aware of its significance? The IFSC code is different for each bank branch. No two branches belonging to the same bank have the same IFSC code. RBI assigns the code to each bank branch that participates in the online payment system.

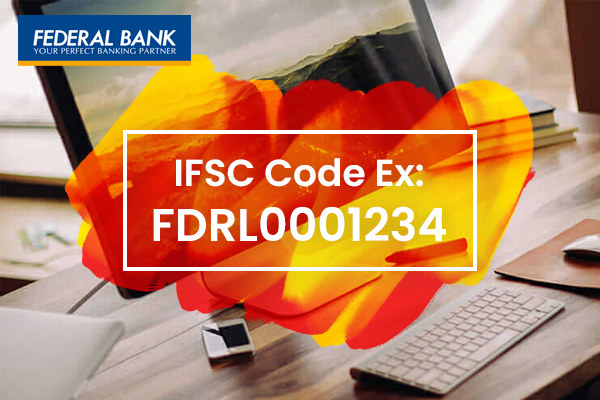

Federal Bank IFSC Code is an exclusive 11-digit code having a combination of letters and numbers. For example, The Federal Bank New Delhi Kirti Nagar Branch iFSC Code is FDRL0001820.

Here, the first 4 letters are the bank name followed by a common zero. The last 6 digits indicate the bank branch that is unique to each branch. IFSC code ensures that maximum accuracy is attained during online transactions through NEFT, IMPS, and RTGS. The code recognizes the source and destination bank involved in online funds transfer.

Magnetic Ink Character Recognition reveals many things about a bank and branch. The code is set up in such a way that only authorized banking professionals can use it to authenticate themselves.. The MICR code ensures quick cheque processing and safe monetary transactions.

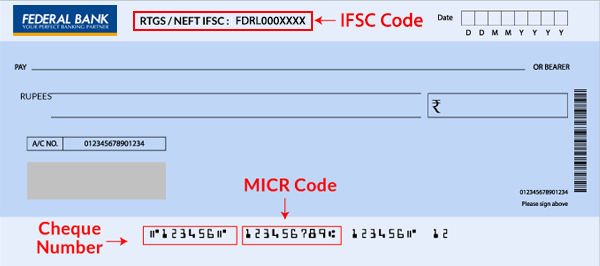

MICR contains a 9-digit code situated at a cheque's bottom. The first 3 digits indicate the city code in which the bank branch is located. It is aligned with the city's PIN code. The following 3 digits signify the bank code, while the last 3 digits show the branch code.

For example, the MICR code of Hiran Magri Sector 14 branch, Udaipur, is 313049002.

RBI has assigned the MICR code to make the funds transfer through NEFT fast and flawless. Special magnetic ink is used to write the MICR code. The ink verifies the validity and authenticity of the cheque. It identifies the fraud cases with the magnetic scanner that reads the code.

SWIFT or Society for Worldwide International Financial Telecommunication is an alphanumeric code. It helps transfer money electronically from one country to another simpler and faster. It identifies the financial institutions or banks that participate in funds transfer.

The code is applied for only international money transfers. The ISO has developed the SWIFT code, and it is used by the banks to transfer messages related to the transaction to other banks.

It contains 11 characters, somewhat similar to the Federal Bank IFSC code. The initial four letters signify the bank code, while the following two letters indicate the country code. The subsequent 3 letters are the location code, and the last 3 letters denote the branch code. For example, Federal Bank Agra is FDRLINBBAGR.

You might now have understood the significance of all the bank codes in digital banking. But do you know the sources to find the correct code of the specific branch? There are multiple sources to access the codes for the specific branch. 'Find Your Bank' is a fantastic website that takes you to the correct code. The website also has an app that enables you to access the codes anytime.

Following are the steps to follow on the site –

Here is a list of other valid sources that can help you find the relevant bank codes.

A cheque has a specific branch's MICR, and IFSC mentioned on it. The IFSC code is located at the top corner, while MICR is at the bottom next to the cheque number.

You will find IFSC and MICR code in the Federal Bank passbook.

RBI is the chief bank that manages the working of other banks. You can visit the official website https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx to find the specific bank branch codes.

You can go through the bank's website to find the appropriate codes. You have to log in to your online account and find the Federal Bank IFSC code and MICR code.

Federal Bank fulfills all its commitments and promises to help the customers at all times. You can call the bank's customer care 24*7 and get the specific branch SWIFT code whenever required.

Once you login into your Federal Bank online account, you will find your bank statements. Here, you can also locate the correct branch codes.

National Electronic Funds Transfer is a reliable method to transfer funds. NEFT works on a secure platform INFINET that RBI has initiated. The process allows the customers to conduct online transactions smoothly and flawlessly.

NEFT does not take place in real-time; instead, it takes place in batches. Individuals, corporates, and small firms maintaining an account with the Federal Bank can transfer funds using NEFT. NEFT is also helpful in carrying out multiple transactions that include paying credit card bills and loan EMI.

Federal Bank has no maximum or minimum transaction limit through NEFT. However, the maximum amount per transaction is up to Rs 50,000 for cash-based remittances. You require a Federal Bank IFSC code to carry NEFT transactions.

Federal Bank charges Rs 2 per transaction up to Rs 10,000 while Rs 4 for Rs 10001 – Rs 1,00,000. The bank charges Rs 14 for transactions of Rs 1,00,001 lakh -Rs 2 lakh, while Rs 20 is charged for Rs 2,00,001 and above.

Do you need to transfer large amounts instantly? Federal Bank allows the customer to transfer funds on a 'real-time' and 'gross' basis. RTGS is possibly the fastest money transfer service through banking channels.

The settlement request takes place on an instruction basis instead of batch-wise. It ensures that the customers receive funds instantly without any delay. RTGS replaces the payment by demand drafts and pay orders.

Real-Time Gross Settlement is mainly helpful to carry out large value transactions. The minimum amount that Federal Bank allows through RTGS is Rs 2 lakh, while there is no upper limit. Federal Bank charges Rs 20 per transaction for Rs 2 lakhs – Rs 5 lakhs, while Rs 45 per transaction is charged for funds transfer above Rs 5 lakhs.

IMPS enables the customers to transfer funds immediately without a second delay. It is a quick and easy funds transfer service. It is accessible to the customers anytime and from anywhere. Customers can transfer funds from one bank branch to another branch of the same bank or another bank.

Indian Payment Service demands customers to register their mobile numbers with the Federal Bank for mobile banking. There is also an option to transfer funds using P2A (person to account number).

You can also choose P2P (person to person), in which you can send money by beneficiary's mobile number and MMID. Federal Bank allows a transaction limit of Rs 2 lakhs between own accounts while Rs 30,000 for another Federal Bank account.

Federal Bank charges Rs 5 per transaction for funds transfer between Rs 1000 to Rs 1 lakh and Rs 10 for Rs 1 lakh – Rs 2 lakh.

Federal Bank is an Indian commercial bank in the private sector with headquarters in Aluva, Kochi. It was founded in 1931. The bank has around 1263 branches across the country. The bank is a pioneer banking firm among traditional banks in India.

Federal Bank is among the first banks that use technology to computerize the branches. The bank offers multiple services like mobile or internet banking, depository services, online bill payment, merchant banking, and transaction banking services.

The savings bank accounts offered by Federal Bank are listed in the table below –

|

Account name |

Interest |

Average monthly Minimum Balance |

Eligibility |

| FedFirst |

1.50% less than RBI’s repo rate |

Rs 1000 |

Children up to 18 years (Indian and NRI) |

|

Bespoke savings account |

4.25% |

Rs 2 lakh |

Any individual holding account with Federal Bank |

|

FedSmart |

1.50% less than RBI’s repo rate |

Rs 1 lakh |

Residents having a sole or joint account |

| Mahilamitra |

1.50% less than RBI’s repo rate |

Rs 5000 |

Resident women above 18 years |

Documents that you require to open a Federal Bank savings account are –

Both IFSC and MICR are safe in their respective ways. IFSC is used for online funds transfer, while MICR is useful in cheque remittances. MICR is an old process that involves the protection of negotiable instruments. However, IFSC does not involve the physical dispatch of cheques between the bank and clearinghouse. IFSC and MICR follow high-security standards for transferring funds safely.

CIF or Customer Information File contains an account holders' valuable banking information in a digital format. Every file is allotted a unique number that belongs to each bank customer. It holds customer information like name, address, occupation, and account statements. It is an 11-digit number that Federal Bank generates digitally for the customers.

No, there is no option to conduct online transactions without mentioning the IFSC code.

No, IFSC and SWIFT codes are different. IFSC code helps to transfer funds within the country, while SWIFT code is needed to carry transactions online.

All the options like NEFT and IMPS can be used for transactions 24*7. RTGS is subject to timings assigned by the RBI.