IDFC First Bank IFSC Code and MICR Code

IDFC First Bank IFSC Code and MICR Code

Find IDFC First Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

IDFC First Bank IFSC Code and MICR Code

IDFC First Bank IFSC Code and MICR CodeFind IDFC First Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

IDFC First Bank IFSC Code Finder - Select Your State

IDFC First Bank IFSC Code Finder - Select Your StateDo you want to transfer funds to an account in IDFC First Bank? You can do it without going to the bank - thanks to net banking. Whether or not you have an account with the bank will not affect your transaction, as long as you have the IDFC First Bank IFSC code.

The IFSC or Indian Financial System Code is essential for completing all fund transfers quickly through digital means. In addition, fund transfers may require you to use the IDFC First Bank MICR Code or SWIFT code, depending on the type of transaction at hand. Find out how to find the IDFC First Bank IFSC code, MICR code, and SWIFT code.

If you know anything about online money transfer methods, you have probably heard of the term "IFSC." Every branch of all banks has a unique Indian Financial System Code. This code helps to identify the bank and its branch of the recipient account.

Every branch of IDFC First Bank has an IFSC code assigned by the Reserve Bank of India, i.e., RBI. If you want to transfer an amount of money to any account in this bank, you'll need the IDFC First Bank IFSC code for NEFT, RTGS, and IMPS.

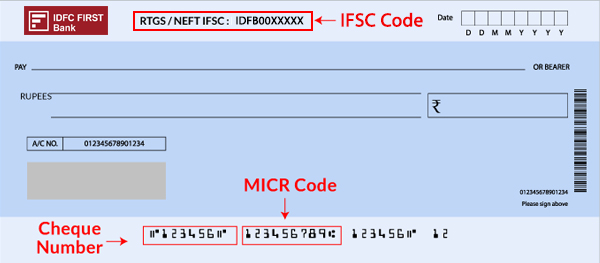

The IDFC First Bank IFSC code has 11 characters, just like the IFSC of any bank. These 11 characters include alphabets and numbers. The first four digits stand for the bank and are common for all branches. The last six characters stand for a branch of the bank.

Let's consider two Kolkata branches of IDFC First Bank to understand this. The IDFC First Bank KolKata City Salt Lake Branch IFSC Code is IDFB0060102, and that of the Park Street branch is IDFB0060101. Take a look at these two examples closely to understand the pattern.

The first four letters, IDFB, are common for both branches as the bank is the same. The difference is in the last six letters, which indicate the two separate branches. The "0", occupying the fifth position, is a control character, reserved for utilization in the future.

Just like IFSC, the MICR or Magnetic Ink Character Recognition Code is another set of characters used for cheque-based transactions. The IDFC First Bank MICR code has nine characters, just like any other bank. It is necessary for cheque clearance.

Magnetic Ink Character Recognition code helps identify the bank and the branch that participates in an ECS. This code, printed in magnetic ink on a cheque leaf, helps to track the cheque to the bank and branch issuing this cheque before the clearance.

The MICR code makes cheque clearance much faster. That's because it can easily be identified using a particular magnetic reader, thus speeding up the sorting process, especially when compared to manual sorting. So MICR codes make the entire system efficient.

Banks use SWIFT codes for global transactions. Not all banks have SWIFT codes, but IDFC First Bank does. This bank is a Society for Worldwide Interbank Financial Telecommunications member, which makes it eligible to have this code.

The IDFC First Bank SWIFT code is necessary to receive an international fund transfer or a SEPA payment in an account in this bank. SWIFT codes usually have 8-11 characters. Let's break down the IDFC First Bank SWIFT code, IDFBINBBMUM, with 11 characters.

The first four characters of the code, IDFB, represent the bank. The following letters, IN, indicate the country, i.e., India. The following two characters, BB, represent the location, i.e., Bandra-Kurla, and the last three letters, MUM, stand for the branch in Mumbai city.

You now understand that it is essential to know the IDFC First Indian Bank IFSC, MICR code, and SWIFT code for different types and modes of transactions to this bank. Now the question is, how will you find the correct code for your transactions?

There are various ways of finding these codes. Let's take a look.

To find the IDFC First Indian Bank IFSC, you can check the following

The first page in the passbook of the recipient's bank account should contain all details, including the IFSC. You can ask the beneficiary to check the passbook.​

Every leaf of a cheque book belonging to the recipient account contains the IFSC. The IFSC is usually mentioned at the top of the leaf, along with other details.

While using a net banking platform for fund transfers, you can use the beneficiary account details for the IFSC. The bank's site also contains the code.

Since RBI is responsible for assigning the IFSC, it maintains a database of the same. You can visit the RBI website to find the IFSC of a branch.

Pay a visit to a branch of the IDFC First Bank and request for the IFSC code at the customer care desk. You can also call the bank to find the code.

Finding the MICR code of an IDFC First Indian Bank branch is very similar to finding the IFSC. To find the MICR code, you can refer to the following -

a) Passbook

b) Cheque leaf

c) RBI website

d) Customer care

To find the SWIFT code of IDFC First Bank, you can use the following methods -

a) Bank website

b) Customer care

c) Bank statement (available online and offline)

Find Your Bank is a trusted platform for finding the IFSC or MICR code of any IDFC First Indian Bank branch. You can also find the bank's SWIFT code on this platform. The process of finding the desired code for any bank in India is easy on Find Your Bank.

That's just about all you need to do to find the IFSC code. The MICR code of a branch, as well as the SWIFT code of the bank, will also be available on the Find Your Bank website and phone app in the same way - with the help of the correct details.

Find out how to use NEFT, RTGS & IMPS modes of money transfer in IDFC First Bank!

This fund transfer method is conducted through a batch system, and the remittance reflects within 2 hours. However, transactions above ₹10,000 in non-banking hours reflect the following day. NEFT is available for a maximum of ₹20,00,000.

A fund transfer method for ₹2,00,000 - ₹20,00,000, RTGS is available 24/7, even on bank holidays. The amount reflects in the recipient account within 30 min, through transactions above ₹10,000 in non-banking hours are completed the next working day.

For instant transfer for an amount up to ₹2,00,000, IMPS is a method of real-time fund transfer. It is available 24/7, and the transaction takes place instantaneously. It is a reliable fund transfer mode that you can depend on during an emergency.

At IDFC First Bank, all methods of fund transfer are free of cost. You can carry out the transaction at the branch or through net banking channels - without paying any charges. You'll need the beneficiary details, including IFSC, for these transactions.

IDFC First Bank is one of the trusted private banks in India. It started operating in October 2015. At that time, it had only 23 branches around the country. Today, it has 100 branches and is known for its excellent services to rural and semi-urban customers.

IDFC First Bank offers various types of bank accounts. The details are as follows:

| Account Type | Avg. Monthly Balance (₹) |

| Savings |

25,000 |

| Corporate Salary |

NIL (Monthly salary transaction) |

|

Senior Citizen Savings |

25,000 |

| Future First |

NIL |

| Pratham Savings |

NIL |

|

FIRST Power |

25,000 |

| Zero Balance Savings |

NIL (250 Initial payment) |

| Honour FIRST Defence |

NIL (Monthly salary transaction) |

The interest rate offered by this bank ranges from 3% to 5%, depending on the amount available in the account. To open the account, you will need to provide basic KYC documents. You'll need to provide documents to support your eligibility for special accounts.

1. Is IDFC First Bank safe?

IDFC First Bank has earned the AAA rating from CRISIL, which indicates the highest safety level. In addition, the bank has managed to increase its profits even during the pandemic, when most other banks are struggling. These aspects show that it is a safe bank.

2. Is IDFC First Bank good?

IDFC First Bank is a trusted financial institution operating in the private banking sector of the country. It has the universal banking license issued by the RBI in 2015 - the same year it started operating. It caters to corporate and private customers all over the country.

3. What is the Full Form of IDFC in IDFC First Bank?

The IDFC First Bank was established as IDFC Bank. "IDFC" stands for "Infrastructure Development Finance Company." It justifies the organization's services for infrastructure projects. Its merger with Erstwhile Capital First added the "First" in the new name of the bank.

4. Should I buy IDFC First Bank shares?

IDFC First Bank is one of the trusted banks in the country - not only among customers but also among investors. Its management and track record contributes to this. Experts recommend that you invest in the shares of this bank, and the trading prices are rising.