IndusInd Bank IFSC Code and MICR Code

IndusInd Bank IFSC Code and MICR Code

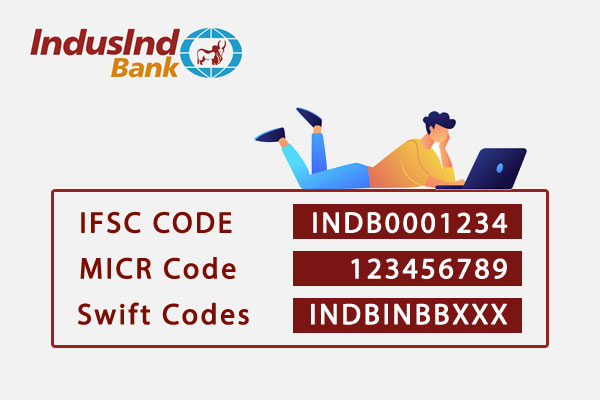

Find IndusInd Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

IndusInd Bank IFSC Code and MICR Code

IndusInd Bank IFSC Code and MICR CodeFind IndusInd Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

IndusInd Bank IFSC Code Finder - Select Your State

IndusInd Bank IFSC Code Finder - Select Your StateBanking codes have made it easy to initiate secure and correct transfers. For all online money transfers, an IFSC code is a prerequisite for making transfer to desired bank branch. They are assigned by the RBI and are required for wire transfers or online payments. To initiate a transfer to IndusInd Bank, you'd need the IndusInd Bank IFSC code of receiver's bank account branch.

Other codes like MICR and SWIFT codes serve to solve other security and international connectivity issues. You can find the desired IndusInd Bank IFSC code, MICR, and SWIFT code in multiple banking documents or at your bank's online portal.

Before we can discuss the best ways to find your desired IFSC, MICR, and SWIFT codes, let's try to understand the way each of these codes works, their character components as well as their specific use cases.

This article will help you understand the validity of banking codes, why they are important, and where you can find the right one. Read along to understand each of the following banking codes:

The IndusInd Bank IFSC code is a unique alphanumeric code spanning over 11 characters. The first four characters indicate the code of the bank, followed by '0'. The next six digits are specific to a particular bank branch.

For instance, IndusInd Bank Andheri-Kurla Road Mumbai branch IFSC code is INDB0000018. Here, "INDB" is the bank code, and "000018" is the branch code. Such an IFSC code is needed for all NEFT, RTGS, and IMPS transfers. Why is the IndusInd Bank IFSC code needed? It ensures that any transfer can be made to the right bank and branch only.

The MICR or Magnetic Ink Character Recognition code is for the unique identification and authentication of official documents. These are typically found at the bottom of cheques and printed using MICR technology to detect possible fraudulent cheques and duplications.

The MICR code is a 9-digit code. The first three represent the city, the next three the bank, and the branch is indicated by the last three digits. For instance, 110234109 is the IndusInd Bank MICR code for the Darya Ganj, Delhi branch.

The IndusInd Bank SWIFT code, contrary to the other two, is for the international identification of a unique bank branch. It is an 8–11-digit alphanumeric code that is assigned by the Society for Worldwide Interbank Financial Telecommunication or SWIFT.

The IndusInd Bank SWIFT code can be used for international money transfers or even communications between international banks. INDBINBBNDH is the swift code for IndusInd Bank Delhi. Here, "INDB" is the bank code, followed by "IN", the country code, "BB", and the location code "NDH".

Once you've read up on how to uniquely identify these banking codes, where and why they are used, the next struggle is to find valid codes promptly for all your transfers. While IndusInd Bank IFSC code, MICR code, and SWIFT code can be found in various places, let's talk about some easy and accurate ways to obtain the code you're looking for:

While you could check out the IndusInd Bank IFSC code that you're looking for in various ways, the easiest and one-place solution for all banking codes is a reliable search tool like Find Your Bank. Find Your Bank is a well-known IFSC search tool that can help find the desired IFSC, MICR, or SWIFT code as well as other bank details of all IndusInd bank branches pretty quickly.

All you need to do is:

That's it! The page will be redirected to the bank details with the official address, IFSC, and other banking codes, as well as other important details, all in one place. If you commonly end up looking for IFSC codes for transfers and want to make the process even faster, Find Your Bank also provides a mobile app that can be downloaded to make your search easier.

Some other places where you can spot the desired IFSC, MICR, and SWIFT codes are listed as follows:

Both the IFSC and MICR codes can be found on each cheque leaf of your IndusInd Bank cheque book. The MICR code is at the bottom of the cheque, while the IFSC code can be spotted at the top.

Your IndusInd Bank passbook also contains the IFSC code next to the account holder's information, contact, and other details. It is also mentioned under the label Branch Code for some banks.

If all else fails, RBI's official website: https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx is a reliable place to find the IndusInd Bank IFSC code for your desired branch. You can select the bank's name and search to get the relevant banking codes and bank details.

Any bank's net banking portal also presents all valid and updated banking codes. You can find your IndusInd Bank code at https://www.indusind.com/in/en/personal/login.html by simply logging into your account and checking the recent statements where you made your previous transfers to the same branch.

One of the best ways to find the SWIFT code for an IndusInd Bank branch is directly contacting the IndusInd Bank Customer Care for the same. You can also check recent bank statements by logging into your account, where the relevant code will be shown in the recent transfers.

The primary modes of online money transfer through IndusInd Bank include NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service). The different regulations and specifics regarding these modes are as follows:

The NEFT or National Electronic Fund Transfer mode is available 24/7 and makes transfers in batches based on the DNS system. The minimum amount that can be transferred is as low as Re. 1 with no maximum transfer limit on NEFT.

For IndusInd Bank, the NEFT transaction charges range from Rs. 2.5 for a transfer of Rs. 10,000 up to Rs. 50 for a transfer of over 5 Lakh rupees (with the addition of GST). You can initiate NEFT transfer from your IndusInd bank branch between 8 AM to 7 PM from Monday to Friday, including odd Saturdays.

If your NEFT transaction doesn't occur in the current batch, it will proceed in the next batch, which is why NEFT transfers are sometimes cleared on the next day.

The following details are needed for an NEFT transfer:

RTGS or Real Time Gross Settlement through your IndusInd Bank is proposed for real-time transfers of high amounts of money starting at Rs. 2 lakh and above. You can access RTGS transfers from 8 AM to 4:30 PM from Monday to Friday, as well as odd Saturdays.

RTGS offers a more urgent cash transfer method, and hence levy higher charges for the transfer. IndusInd Bank RTGS charges start from Rs. 25 for transfer between Rs. 2-5 Lakh up to Rs. 50 for transfers over Rs. 5 Lakh (plus GST).

Your as well as the receiver's bank details, listed as follows, are needed for an RTGS transfer:

IndusInd Bank IMPS or Immediate Payment Service allows immediate transfer at any time of the day, every day. It is accessible 24/7 and relays money almost instantly. The minimum transfer amount is Re.1, with a maximum transfer of Rs. 2 lakh possible.

IMPS allows you to make multiple instant transfers and is an efficient mode used for instant transfers. The IndusInd Bank IMPS rates are Rs. 2.5 for transfers up to Rs. 10,000 ranging to Rs. 15 for transfers between Rs. 1-2 lakh (plus additional GST).

You need to have the following details to get started with an IMPS transfer:

IndusInd Bank was found by former Union Finance Minister Dr. Manmohan Singh in 1994 and is headquartered in Pune. With over 1558 bank branches and 2453 ATMs spanning across the country, it offers various banking, financial, and cash management services. You can open savings, salary, business, and various other kinds of accounts at IndusInd Bank.

The IndusInd Bank interest rates for general and senior citizens are as follows as per the official website since 30th December 2020:

| Tenure | Interest Rates p.a. (%) | Senior Citizen Rates p.a. (%) |

| 09 Months | 5.75 | 6.25 |

| 12 Months | 6.50 | 7.00 |

| 15 Months | 6.50 | 7.00 |

| 18 Months | 6.50 | 7.00 |

| 21 Months | 6.50 | 7.00 |

| 24 Months | 6.50 | 7.00 |

| 27 Months | 6.50 | 7.00 |

| 30 Months | 6.50 | 7.00 |

| 33 Months | 6.50 | 7.00 |

| 3 Years to below 61 month | 6.50 | 7.00 |

| 6 month and above | 6.25 | 6.75 |

The following prerequisites must be checked before you can open an account in IndusInd Bank:

The upper limit for the amount transferred in a single transfer via IndusInd Bank IMPS is Rs. 2 Lakh. However, you can make multiple IMPS transfers anytime for the amount required.

The CIF or Customer Information File number can be found by simply calling the IndusInd Bank Customer Care Number 1860 267 7777, and requesting the customer ID.

No, the IndusInd bank credit or debit cards do not hold the IFSC code. These can be accessed and used only for online payment methods such as NEFT, RTGS, and IMPS.

The branch code is indicated by the last six digits of the IndusInd Bank IFSC code. For instance, INDB0000018; here, '000018' is the branch code.