Jio Payments Bank IFSC Code and MICR Code

Jio Payments Bank IFSC Code and MICR Code

Find Jio Payments Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Jio Payments Bank IFSC Code and MICR Code

Jio Payments Bank IFSC Code and MICR CodeFind Jio Payments Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Jio Payments Bank IFSC Code Finder - Select Your State

Jio Payments Bank IFSC Code Finder - Select Your StateOnline banking has become the latest trend these days. People do not like to visit banks unnecessarily as they can do most bank work with their mobiles. Jio Payments Bank IFSC code has changed the way banking used to be earlier.

IFSC and MICR codes enable the users to conduct online transactions the way they want. IFSC code identifies the bank and specific branch that is participating in the online transaction. The code is unique for each bank branch assigned by RBI.

MICR verifies the validity of cheques for transactions through a unique code for each bank branch. It makes the processing of cheques quick.

Having information on IFSC and MICR codes is not enough. You need to know how to find the IFSC and MICR codes. The article explains the ways to find the correct code.

Jio Payments Bank IFSC code allows you to conduct the funds' transfer quickly. The code ensures that the transactions through NEFT, IMPS, RTGS, and money transfer bank to bank. IFSC (Indian Financial System Code) code identifies the source and destination bank and regulates online funds transfer.

RBI assigns each bank branch a unique code different from others. It helps in recognizing the bank quickly. RBI ensures zero chances of inconsistency during online transactions through IFSC code.

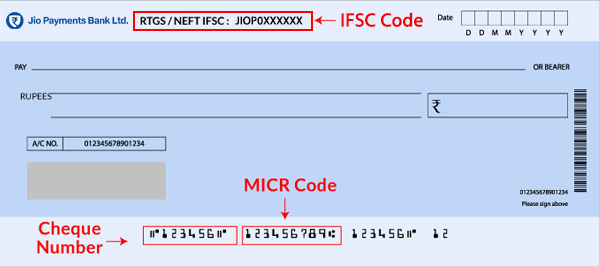

Jio Payments Bank IFSC code is a unique code that has 11 numbers and alphabets. For example, Jio Payments Bank, Ghansoli Navi Mumbai, Rtgs-ho branch IFSC code is JIOP0000001.

Here, the first four letters denote the bank name. The last six digits signify the branch's unique address. The fifth letter is a universal zero.

MICR or Magnetic Ink Character Recognition is significant in monetary transactions that enable quick processing of cheques. The code has a special ink that prints character sensitive to magnetic fields on banks' original documents.

Jio Payments Bank MICR Code verifies the documents and cheques in the bank. It authenticates cheques before clearing them from the bank.

MICR is a 9 -digit code. The initial three digits are the city code in alignment with the postal address pin code in India. The following three digits are the bank code, while the last digit is the branch code.

Jio Payments bank currently is not making the MICR code available.

Jio Payments Bank IFSC code and MICR codes are a must in funds transfer digitally and other online banking operations. But how and where to find the codes?

'Find Your Bank' is a unique website from where you can access the bank codes. It is a website as well as an app. Follow the steps below –

Apart from this, there are multiple third-party websites from where you can get the correct code. The additional reliable sources from where you find the bank codes are –

Your Jio Payments Bank passbook contains the IFSC code of the specific branch you have an account in.

You can find the Jio Payments Bank IFSC code in the cheque's top corner. You can locate the bank's MICR code at the cheque's bottom next to the cheque number.

You can visit Jio Payments Bank's online banking website. Here, you can find specific branch codes easily.

RBI is the supreme bank that controls the working of other banks. It has an official website https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx from where you can find the bank codes.

NEFT allows carrying online funds transfer in batches. It is suitable for making transactions from one branch to another and another bank. National Electronic Funds Transfer is apt for making transactions above Rs 2 lakh.

You will require a savings or current account with Jio Payments Bank for carrying transactions through NEFT. Jio Payments bank does not have any limit for NEFT transactions from Jio Payments bank to another bank through the mobile app.

You will be needing Jio Payments bank IFSC code of payee and sender for transferring funds through NEFT. You will require the beneficiary's name and address, account number, and type.

RTGS is a fast mode to transfer funds in real-time. RBI has created a robust system of payment that conducts transactions with a more rapid settlement cycle.

Various banks and financial institutions use Real Time Gross Settlement for inter-bank transactions and funds transfer.

IMPS is a quick and convenient option for online money transfer services. It allows you to complete the transaction instantly from one account to another. It is available for customers 24*7 even on bank holidays and Sundays.

Immediate Payment Service is inexpensive and accessible that allows you to use mobile instruments to use bank accounts and transfer funds. Jio Payments Bank IMPS minimum limit is Re one, and the maximum limit is Rs 2 lakhs.

Jio Payments Bank charges Rs 5 per transaction for funds transfer of up to Rs 1,00,000. It charges Rs 15 per transaction for Rs 1 lakh – Rs 2 lakh of transaction.

You can transfer money through IMPS using a mobile number & MMID (P2P) and Jio Payments Bank IFSC code and account number (P2A).

Jio Payments Bank is a payments bank in India. Reliance Industries own the bank that started in 2018. RBI approved Reliance Industries to create a new payments bank under the principle of the Banking Regulation Act, 1949.

Jio Payments Bank Limited is in a 70:30 partnership between Reliance Industries and State Bank of India. It offers simple and affordable banking solutions for digitizing payments and progress towards a cashless society.

Jio Payments Bank has one branch in Mumbai, Maharashtra of India. It has 184 banking outlets across India.

You can open a Jio Payments Bank savings account instantly online. It is a zero-balance account. You require an Aadhar card and a PAN card for opening the account. It is free of cost.

The bank offers funds transfer, receiving money, and making merchant payments. Jio Payments Bank offers Query Service to help you know your Aadhar status with the bank account.

Jio Payments Bank offers a 3.5% per annum interest rate payable quarterly on the savings account.

You can file an IMPS transaction complaint with Jio Payments Bank. You have to give all details related to the IMPS transaction like Beneficiary's Account Number, bank name, funds transfer amount, and funds transfer timing.

No, there are no debit cards for the Jio Payments bank customers.