Karnataka Gramin Bank IFSC Code and MICR Code

Karnataka Gramin Bank IFSC Code and MICR Code

Find Karnataka Gramin Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Karnataka Gramin Bank IFSC Code and MICR Code

Karnataka Gramin Bank IFSC Code and MICR CodeFind Karnataka Gramin Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Karnataka Gramin Bank IFSC Code Finder - Select Your State

Karnataka Gramin Bank IFSC Code Finder - Select Your StateToday, all of us prefer to carry a majority of our tasks online - be it online shopping, online ticket booking, or online training. In this respect, online banking has gained much momentum in recent years. Karnataka Gramin Bank IFSC code is significant in carrying digital banking transactions.

IFSC is a unique code that is key in online funds transfer. It identifies the bank branches that participate in NEFT, RTGS, and CFMS. IFSC code ensures smooth and quick online money transfer. MICR is code printed on cheques for identifying and validating cheques.

But finding the bank code of a specific branch is essential. Incorrect IFSC code can lead to the wrong transaction. So, you have to be careful while doing transactions through online banking. So, how do you find the correct IFSC and MICR codes?

The article will tell you how to find the Karnataka Gramin Bank IFSC code and MICR code.

You might often be required to enter details like the account holder's name, account number, and IFSC code. But do you know what the IFSC code is?

RBI assigns an IFSC code to each bank branch to identify the branch involved in the money transfer. IFSC or Indian Financial System Code is a must for transferring funds from one branch to another of the same or different bank.

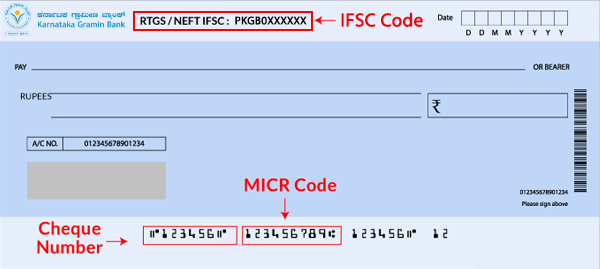

IFSC code has 11 characters. For example, the IFSC code of Karnataka Gramin Bank, Asset Recovery Management Branch, Karnataka is PKGB0012539. The first four letters are the bank name. The last six numbers are the branch code. The fifth letter is a zero that is universal.

Electronic payment processes like RTGS and NEFT require Karnataka Gramin Bank IFSC Code. The code ensures a smooth online transaction without any discrepancies.

Do you know a code is printed at the cheque's bottom? Ever noticed it? The code next to the cheque number is MICR or Magnetic Ink Character Recognition technology.

MICR is a unique code that checks a cheque's validity participating in the cash transfer and enables faster processing. It identifies the ink with which the code is written. MICR is required for filling up different financial transactions, such as the SIP form.

MICR has nine characters. The initial three digits signify the city code in alignment with the postal address PIN code in India. The following three digits demonstrate the bank code, and the last digits are the specific branch code.

Karnataka Gramin Bank does not make MICR code for any of its branches.

So, the Karnataka Gramin Bank IFSC code and MICR code are essential to carry funds transfer online. But you should know the valid sources from where you can find the correct code.

Sources like bank and third-party websites are valuable sources from where you can find the bank codes. However, another reliable source is the 'Find Your Bank' website. It is also an app. It is a user-friendly platform that enables you to find the correct code. It will also trace a branch address from the Karnataka Gramin Bank IFSC code.

Follow the below steps to access the website and app.

Let us look at the other sources from where you can find IFSC and MICR codes.

Your Karnataka Gramin Bank has IFSC and MICR mentioned in it. You will find the codes of the specific branch in which you have an account.

Your Karnataka Gramin Bank cheque leaf has MICR and IFSC code. IFSC code is at the cheque's top. MICR is at the cheque's bottom next to the cheque number.

RBI is the supreme bank. It has an official website https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx. From here, you can access the codes of a specific branch within seconds.

Karnataka Gramin Bank has an official website for net banking. The platform will help you locate the correct codes.

RBI introduces NEFT for facilitating funds transfer online seamlessly batch-wise. National Electronic Funds Transfer is safer and does not require a cheque or demand draft for doing transactions. RBI allows the banks to carry NEFT transactions at any time, but credits to the beneficiary account take some time.

NEFT takes place in batches, so transactions either take place the same after a while or the next day. Karnataka Gramin Bank has not set minimum and maximum limits for NEFT.

The bank charges Rs 2.25 per transaction for transactions up to Rs 10,000. It charges Rs 4.75 and Rs 14.75 for Rs 10,000-Rs 1 lakh and more than Rs 1 lakh – Rs 2 lakhs respectively. The bank charges Rs 24.75 for funds transfers above Rs 2 lakhs.

You require the beneficiary's name and address, account number and type, and bank branch IFSC for NEFT transactions.

RTGS enables funds to transfer from one branch to another in real-time. The beneficiary will get the credited amount within 30 minutes of the request. Real-Time Gross Settlement is a quick and secure way to conduct transactions online between banks.

Karnataka Gramin Bank has a minimum limit of Rs 2 lakhs, while there is a maximum limit for RTGS. The bank charges Rs 24.50 for Rs 2 lakhs – Rs 5 lakhs transactions between 8 hours – 11 hours. It charges Rs 49.50 for above Rs 5 lakhs transactions between 13 hours – 15 hours.

You will need the beneficiary's name, account number, and IFSC code for the RTGS transaction.

IMPS enables the transfer of money immediately within any IMPS-enabled bank. It is initiated by NCPI to access the transfer of funds quickly. IMPS or Immediate Payment Service is a safe, quick, and robust service available 24*7.

You can use IMPS on bank holidays and Sundays. Karnataka Gramin Bank has a daily limit of Rs 25,000 for IMPS and a cumulative monthly payment of Rs 50 lakhs. The bank charges Rs 2.50 for the transaction of up to Rs 10,000 and Rs 5 for above Rs 10,000.

You will need the beneficiary's IFSC code and account number for IMPS.

Karnataka Gramin Bank is an Indian RRB or Regional Rural Bank. It operates under the sponsorship of Canara Bank. The bank was established in 2005 with head office at Dharwad, Karnataka.

Karnataka Gramin Bank offers retail banking services to rural users in areas of Karnataka, around Western and North America. It provides savings accounts, deposit schemes, loan products, and online banking services. Karnataka Gramin Bank has 1134 branches and 24 networked ATMs.

No. Karnataka Gramin Bank is not a nationalized bank. It is an RRB. Canara bank, which is a nationalized bank, sponsors it.

You can use the DiGi-PKGB app of the Karnataka Gramin Bank. It will tell you your latest transaction updates and balance inquiry. The bank offers a missed call alert facility to know your account balance anytime from any place for free.

If you have entered the incorrect bank details, inform the bank immediately. If the account number you entered does not exist, the bank will transfer your money back to you. However, if an account number exists, provide all the details to the bank.

MICR code of the Karnataka Gramin Bank is printed in two fonts CMC-7 and E-138. It uses a magnetic toner or ink that usually contains iron oxide. The bank's MICR identifies the bank branch to which the cheque belongs. The cheque is passed within a MICR reader. Each character produces a uniform waveform that the reader identifies. MICR, thus, reduces manual efforts.

No, there is no need to register for receiving money through IMPS. There is a need for the bank account number and Adhar card. However, it is mandatory to make mobile registration for receiving money through a mobile number.