Kotak Mahindra Bank IFSC Code and MICR Code

Kotak Mahindra Bank IFSC Code and MICR Code

Find Kotak Mahindra Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Kotak Mahindra Bank IFSC Code and MICR Code

Kotak Mahindra Bank IFSC Code and MICR CodeFind Kotak Mahindra Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Kotak Mahindra Bank IFSC Code Finder - Select Your State

Kotak Mahindra Bank IFSC Code Finder - Select Your StateUnique banking codes have changed the online banking mechanism adding an element of security and unique identification to any transfer you make. For initiating net banking with different branches of Kotak Mahindra Bank, a specific Kotak Mahindra Bank IFSC code would be needed for each branch that starts an online transfer through NEFT, RTGS, or IMPS.

While using a credit card might be convenient and handy for quick shopping, net banking can assist in different kinds of transfers even beyond the upper limits of credit cards. Other than IFSC codes, MICR and SWIFT codes serve distinct purposes to make banking secure and efficient.

In this article, you will read about how IFSC, MICR, and SWIFT codes function and their unique composition, along with what each digit indicates. You will also read about how you can identify a valid banking code as well as easily find the IFSC or other code that you’re looking for.

Let’s start with understand the distinct composition and uses of Kotak Mahindra Bank IFSC code, MICR code, and SWIFT code. We have also described what the different characters indicate to help you verify the validity of a code for your desired branch.

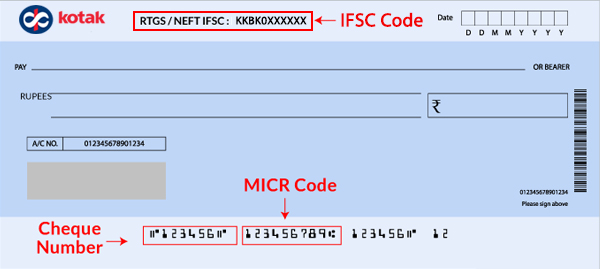

The Kotak Mahindra Bank IFSC code is a unique code assigned to each KMB bank branch by the RBI. As an 11-character code, it has distinct segments that indicate the bank, branch, and code. The first four characters typically indicate the KMB bank code. This sequence is followed by a “0”, which is then followed by six digits that stand for the bank branch in consideration.

For instance, the Kotak Mahindra Bank Indore M.G. Road Branch IFSC code is “KKBK0000751”, the first four digits indicate the KMB bank code, a “0” separates the last six digits “000751” that specify the M.G. Road Kotak Mahindra Bank branch.

The Kotak Mahindra Bank IFSC code of your bank branch needs to be entered by the sender to initiate a bank transfer. The role of a valid IFSC code is to confirm that the transfer is made only to the right bank branch of the receiver.

The MICR code, in contrast to the IFSC and other banking codes, is not used as a pre-requisite of a banking transfer. The Kotak Mahindra Bank MICR code is, in fact, used for the unique identification of banking documents, and especially cheques.

Magnetic Ink Character Recognition works with a unique code or identification printed in magnetic ink on official documents and bank cheques. These are used to identify any fake cheques or unauthentic documents that do not contain a print in distinct magnetic ink.

The MICR code for Kotak Mahindra Bank Bangalore Ing Vysya House branch is “560485072”. This is a 9-digit code that consists of different segments. The last three digits, “072,” indicate the bank branch. The first three digits, “560,” are the city code, and the next three, “485,” indicate the bank, i.e., Kotak Mahindra Bank.

The Kotak Mahindra Bank SWIFT code’s purpose and structure are quite different from than Kotak Mahindra Bank IFSC code or MICR code. The SWIFT code is assigned by the Society for Worldwide Interbank Financial Telecommunication for the unique identification of your bank branch internationally. This is used for international online transfers to a distinct KMB branch as well as for communications between different international banks.

The Kotak Mahindra Bank SWIFT code for the Ahemdabad branch is “VYSAINBBAHD.” A SWIFT code is typically 8-11 characters wherein the first four characters “VYSA” are indicative of the bank, the next two “IN” is the country code, and this sequence is followed by “B.B..” The last three digits are the specific location code which is “AHD” in this case.

Having understood the working mechanisms of different banking codes, the next obvious requirement is to find the code. There are several official documents and other places where you can find the desired Kotak Mahindra Bank IFSC code, MICR, and SWIFT code. Described below are some easy and authentic ways to find a valid banking code for the Kotak Mahindra Bank branch.

While different official sources of finding the right Kotak Mahindra Bank IFSC code are available, these can often be confusing or difficult to verify. Advanced IFSC search tools like Find Your Bank can help you derive the right code, official branch address, and other details. The IFSC, MICR, and SWIFT codes can all be searched for with a single click for any KMB bank branch.

All you need to do to search on Find Your Bank’s search portal is follow these simple steps:

Once these details are filled in, the page will automatically be redirected to a search result listing the bank IFSC code, MICR, SWIFT code, and other details specific to that bank branch.

If you’re someone that is in need of valid banking codes very often, Find Your Bank also offers a mobile app that you can download and keep handy on your device to make a quick search for distinct IFSC or other codes as and when you need.

There are some other ways to find and check valid banking codes. For instance, on each Kotak Mahindra Bank cheque leaf, the IFSC code is present on the top, and the MICR code can be spotted at the very bottom in magnetic ink.

Your bank passbook also consists of the branch IFSC code mentioned along with the account holder’s information section.

The Kotak Mahindra Bank IFSC code can also be found on the KMB banking portal. Visit https://www.kotak.com/en/reach-us.html and fill in your bank branch details. If all else fails, you can visit RBI official site https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx. Fill in your KMB bank details to derive the valid banking code for your concerned branch.

Finding the SWIFT code can be a bit tricky, as it is not used frequently. The SWIFT code can easily be confirmed from a recent bank statement simply by clicking on “View Statement.” If you still have a doubt, calling the Kotak Mahindra Bank Customer Care number at 1860 266 2666 is a sure-shot way of pinning down the valid SWIFT code of your KMB bank branch.

There are several different ways in which online money transfers can be made with a Kotak Mahindra Bank account. These include the most commonly used online transfer methods, NEFT, RTGS, and IMPS. Listed below are the details of how and when you can make a transfer using Kotak Mahindra Bank NEFT, RTGS, and IMPS processes.

An NEFT or National Electronic Funds Transfer is a mode available every day 24/7 and is often used for regular money transfers. While money transfer through NEFT is available at all times, only requests made before 6 PM are processed on the same day. All consequent requests would be processed the next day.

NEFT payments occur in distinct batch cycles instead of taking place in real-time. Kotak Mahindra Bank allows up to Rs. 5 Lakhs under the NEFT process. There are no additional charges levied for NEFT transfers that are inward from savings and current accounts. The charges for outward charges are applied as follows:

|

Transfer Amount |

Charges for Online Transfer |

Charges for Branch Transfer |

|

Up to Rs. 10,000 |

Free |

Rs. 2.50 + GST |

|

Rs.10,000 -Rs.1 Lakh |

Free |

Rs. 5 + GST |

|

Rs. 1 Lakh - Rs. 2 Lakh |

Free |

Rs. 15 + GST |

|

Over Rs. 2 Lakhs |

Free |

Rs. 25 + GST |

The following documents and details need to be specified before an NEFT transfer can be made:

An RTGS or Real Time Gross Settlement is a transfer mode for easy online transfers in real-time. RTGS is popularly used for high amount transfers that need to be carried out instantly. For Kotak Mahindra Bank, a minimum of Rs. 2 Lakh is required to be transferred in order to make an RTGS payment.

A maximum of up to Rs. 5 Lakhs can be transferred using RTGS from 8 AM to 4 PM for weekdays and 8 AM to 12 PM for Saturdays. The following charges are levied for RTGS depending on the amount transferred and transfer channel:

|

Transfer Amount |

Charges for Online Transfer |

Charges for Branch Transfer |

|

Rs.2 Lakh - Rs. 5 Lakh |

Free |

Rs. 25 + GST |

|

Over Rs. 5 Lakh |

Free |

Rs. 50 + GST |

The documents and beneficiary details needed for KMB RTGS transfer is as follows:

IMPS or Immediate Payment Service is a mode for online money transfer that processes almost instantly and can be processed on any day of the year. The transaction limit for the beneficiary, as well as the daily transaction limit for IMPS with Kotak Mahindra, is Rs. 2 Lakhs.

The transaction timings range from 12:30 AM to 6:30 PM for all amounts, and up to 3 Lakhs can be transferred in general after 6:30 PM. The following charges are levied for IMPS transfers made with Kotak Mahindra Bank:

|

Transfer Amount |

Charges for Online Transfer |

Charges for Branch Transfer |

|

Up to Rs. 10,000 |

Rs. 5 + GST |

Rs. 5 + GST |

|

Rs.10.000 - Rs. 2,00,000 |

Rs. 15 + GST |

Rs. 15 + GST |

The details and documents needed for initiating an IMPS transfers are listed as follows:

Kotak Mahindra Bank is a flagship organization under the Kotak group and was founded in 2003 by Uday Kotak. Headquartered in Mumbai, KMB offers a variety of financial services for different retail and corporate customers, including personal finance and investment as well as insurance and finance management.

With 1600 branches and 2519 ATMs spread across the country, Kotak Mahindra Bank stands to be the third-largest private sector bank in India as of February 2021.

The interest rates accumulated for a KMB savings account are governed as follows:

|

Tenure Period |

Interest Rates for General Citizens (%) |

Interest Rates for Senior Citizens (%) |

|

7 to 14 days |

2.50 |

3.00 |

|

15 to 30 days |

2.50 |

3.00 |

|

31 to 45 days |

2.75 |

3.25 |

|

46 to 90 days |

2.75 |

3.25 |

|

91 to 120 days |

3.00 |

3.50 |

|

121 to 179 days |

3.25 |

3.75 |

|

180 days |

4.40 |

4.90 |

|

181 days to 269 days |

4.45 |

4.96 |

|

269 days to 364 days |

4.45 |

4.96 |

|

365 days to 389 days |

4.58 |

5.09 |

|

390 days |

4.89 |

5.41 |

|

391 days to under 23 Months |

4.89 |

5.41 |

|

23 Months |

5.09 |

5.61 |

|

23 months to under 2 years |

5.09 |

5.61 |

|

2 years to less than 3 years |

5.09 |

5.61 |

|

3 years + but under 4 years |

5.20 |

5.72 |

|

4 years + but under 5 years |

5.35 |

5.88 |

The following documents and eligibility criteria must be fulfilled in order to open a KMB account:

Your Kotak Mahindra Bank CIF number can be easily found by sending an SMS alert of the bank keyword to the official bank number. You can also confirm the CIF number by calling the nearest bank branch.

The Kotak Mahindra Bank BSR code is a seven-digit code that is used to identify a bank branch for tax purposes and income tax payments. It is the Basic Statistical Return code for your specific Kotak Mahindra bank branch and is provided by the RBI.

The Kotak Mahindra Bank IFSC code can be used for online NEFT, RTGS, and IMPS transfers for receiving payments from a KMB account or even a different account. The receiver’s valid bank branch IFSC code is needed for the transaction to go through.

The Kotak Mahindra Bank IFSC codes for two different branches will not be identical. While parts of the code, including the banking and country code, can be the same, the branch code will be distinct, hence making each code unique.