Maharashtra Gramin Bank IFSC Code and MICR Code

Maharashtra Gramin Bank IFSC Code and MICR Code

Find Maharashtra Gramin Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Maharashtra Gramin Bank IFSC Code and MICR Code

Maharashtra Gramin Bank IFSC Code and MICR CodeFind Maharashtra Gramin Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Maharashtra Gramin Bank IFSC Code Finder - Select Your State

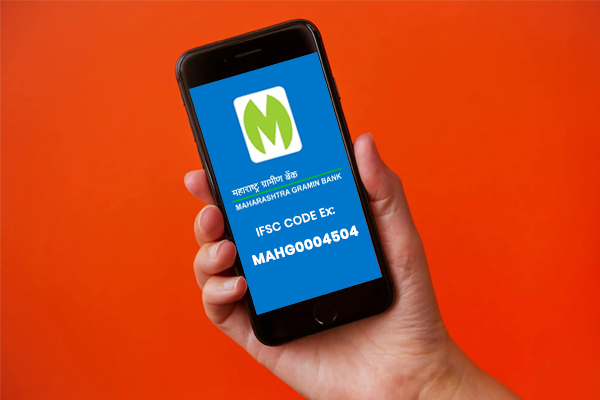

Maharashtra Gramin Bank IFSC Code Finder - Select Your StateThe Indian Financial System Code (IFSC) is an eleven-character code introduced by the Reserve Bank of India. IFSC was introduced for seamless online transactions, and the code comprises both letters and numbers. The Maharashtra Gramin Bank IFSC code is one among RBI's allotted codes with the same purpose.

On the other hand, the MICR or the Magnetic Ink Character Recognition code is used in the faster clearing of cheques. It is a nine-digit code that is printed using magnetic ink technology. The MICR code helps in locating bank branches just like the IFSC codes.

Both the IFSC and MICR codes are crucial for making instant fund transfers. Throughout this article, you'll find all the information regarding the IFSC and MICR codes. You will get to know where to find these codes and when to use them.

The Maharashtra Gramin Bank IFSC code has eleven characters, including both letters and numbers. As per the standard RBI rule, the first four characters in the IFSC code stand for the bank's name, the fifth character is zero, and the last six numbers symbolize the branch code.

The Maharashtra Gramin Bank IFSC code too follows the same pattern. For example, the Maharashtra Gramin Bank's Bahul branch's IFSC code is MAHG0004610.

The IFSC code has numerous important usages. For instance, you won't be able to make digital fund transfers via NEFT or RTGS without knowing the IFSC code. Therefore, the first thing to do while making an online fund transfer is to find out the receiver's bank's IFSC code.

Ensure that you collect the correct IFSC code, as even the wrong placement of a single number can lead to discrepancies.

Like the IFSC code, the MICR code also plays a crucial role in fund transfers all across Indian banks. The full form of MICR code is the "Magnetic Ink Character Recognition Code." The difference between the IFSC code and the MICR code is that the former is required during online payments, and the latter is required for cheque clearance.

When it comes to the functionality of MICR code, it also identifies bank branches that have the facility of Electronic Clearing System (ECS). The MICR code has three parts. The first part represents the city code, the middle part stands for the bank code, and the last part corresponds to the bank routing number.

The MICR code has only numbers and no alphabets, and it is a nine-numbered code. For example, the MICR code of the Maharashtra Gramin Bank Bahul branch is 411570505. The MICR code is needed while processing any cheques.

The MICR code is required to clear cheques through a scanning system. The MICR codes are printed with a unique font combined with magnetic ink. It helps prevent fraud during cheque clearance.

You can find the Maharashtra Gramin Bank IFSC code and MICR code through the find your bank website and mobile app. The find your bank site contains information of all Indian bank's branches, including Maharashtra Gramin bank; therefore, it's one of the most reliable sites to refer to.

To find these codes from the find your bank site, follow these below mentioned steps-

Apart from the find your bank site, there are other means to find these codes. Let's have a look at them as well-

The bank passbook and cheque book is another source where you will find the Maharashtra Gramin Bank IFSC code and MICR codes. The IFSC code is usually printed in the middle of the passbook, and the MICR code is found at the bottom of the chequebook.

The Reserve Bank of India website has information regarding the IFSC and MICR codes of all Indian bank branches, including the Maharashtra Gramin bank. Therefore, you can visit the site to find them.

Currently, every bank has its digital platforms like its website and mobile app. These are yet another authentic source of finding these codes.

Apart from all the sources mentioned above, there is another easy way of sourcing these codes. You can directly call the Maharashtra Gramin Bank customer care service to inquire about the IFSC and MICR code of any branch.

Various online fund transfer methods like NEFT, RTGS, and IMPS have made sending money quite easy. Let's learn about all these three different means, about their charges and limitations-

NEFT or National Electronic Fund Transfer is a DNS-based system meaning money is sent in different batches. To send money using NEFT, you will need the following information-

The NEFT service of Maharashtra Gramin Bank is available 365 days a year, including holidays.

| Amount | Charges |

| Upto Rs. 1 lakh | No charges |

| Rs. 1 lakh to Rs. 2 Lakhs | Rs.15 per transaction |

| Rs.2 lakhs and above | Rs. 25 per transaction |

The RTGS payment method is used when you make high-value fund transfers. The details required for RTGS fund transfer is the same as NEFT. The charges of RTGS is as follows-

| Amount | Charges |

| From Rs. 2 lakhs to less than 5 lakhs |

Rs. 25 per transaction made between 9 am and 12 pm Rs. 26 per transaction made between 12 pm to 3 pm Rs. 30 per transaction made between 3 pm to 5.30 pm and after |

| Above Rs.5 lakhs |

Rs. 50 per transaction made between 9 am to 12 pm Rs. 51 per transaction made between 12 pm to 3 pm Rs. 55 per transaction made between 3 pm to 5.30 pm and after |

IMPS is mainly used to make instant fund transfers. The Maharashtra Gramin Bank IMPS services are available twenty-four hours all around the year. To send money via IMPS, you will need-

| Amount | Charges |

| Upto Rs. 1 lakh | Rs. 5 per transaction |

| From Rs. 100001 to Rs. 2 Lakhs | Rs. 15 per transaction |

Maharashtra Gramin Bank has its head office in Aurangabad, Maharashtra. It is a regional bank in India, and currently, the bank has 413 fully CBS branches. The Maharashtra Gramin Bank was formed on March 25, 2008, and the bank was formed, combining both Thane Gramin Bank and Maharashtra Godavari Gramin Bank.

The Maharashtra Gramin Bank offers an interest rate of 2.75% p.a for savings bank deposits. The documents needed for opening a savings account in Maharashtra Gramin Bank are-

You can check the Maharashtra Gramin Bank account balance by calling 18002332133. You can also check the CGGB balance in the ATM or by updating your bank passbook.

To activate Gramin net banking at the Maharashtra Gramin Bank, you have to visit your nearest branch and submit a form with all required details related to net banking.

No, the Maharashtra Gramin Bank is a regional bank of the state of Maharashtra, and it is a part of 56 Gramin Regional Rural Bank in India.

The financial services offered by the Maharashtra Gramin Bank are as follows-