Punjab And Sind Bank IFSC Code and MICR Code

Punjab And Sind Bank IFSC Code and MICR Code

Find Punjab And Sind Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Punjab And Sind Bank IFSC Code and MICR Code

Punjab And Sind Bank IFSC Code and MICR CodeFind Punjab And Sind Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Punjab And Sind Bank IFSC Code Finder - Select Your State

Punjab And Sind Bank IFSC Code Finder - Select Your StateOnline banking has become one of the biggest boons in our lives. It helps us transfer money to any bank without stepping out during work hours. For instance, if you wish to make a transfer to PSIB Bank, you just need the Punjab and Sind Bank IFSC Code.

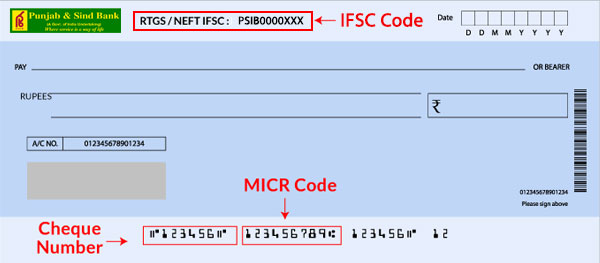

Every bank in India has an IFSC, i.e., the Indian Financial System Code. To transfer funds digitally, this code is a must. For other fund transfer methods, you will need the PISD Bank MICR code and SWIFT code. The type of code required depends on your transaction. Today you'll learn how to find the Punjab and Sind Bank IFSC code, MICR code, and SWIFT code.

If you have never made an online transfer before, the first thing you need to know about is the IFSC. The different branches of each bank in India have unique IFSCs or Indian Financial System Codes. It helps you find a particular branch and bank of the recipient account. If you wish to transfer money by NEFT, RTGS, or IMPS to an account in PSIB Bank, you'll need to find out the branch of the account. Accordingly, you'll need to find the specific Punjab and Sind Bank IFSC code. The RBI assigns the code to each bank.

Just like the IFSC codes of other banks, every Punjab and Sind Bank IFSC has 11 characters. The first four characters are the same for all branches on the same bank and will only change if you consider a different bank. For PSIB Bank, it is PSIB.

The last six spaces are filled by numbers or branch code. For every branch, this part of the code is different. This leaves us with the fifth character, which is occupied by "0". It is a control character for future use. All accounts of a single branch will have the same IFSC.

Let's consider PSIB accounts in Kolkata and Mumbai. The Kolkata's Chowringhee branch IFSC Code is PSIB0000625, while that of the Worli branch in Mumbai is PSIB0000646. You'll notice that the only difference is in the last six digits, i.e., branch code.

Another code required for fund transfers is the MICR code or the Magnetic Ink Character Recognition code. This code is required for transactions through cheques. Just like the MICR code of other banks, the Punjab and Sind Bank MICR code has nine characters.

The MICR code is required for the clearance of the cheque. If you have an account in PSIB and want to make a transfer by cheque, the recipient bank will use your MICR code to identify the bank and the branch that has issued this cheque before clearing it.

The MICR code helps to make the process of cheque clearance much faster. The code is printed on the cheque leaf, and a magnetic reader is used to read it. This helps speed up the sorting method, making the entire process of cheque clearance much more efficient.

Do you want to transfer funds to a PSIB account from an international bank? International fund transfers of SEPA payments become easy with the SWIFT code. It is given to banks that are Society for Worldwide Interbank Financial Telecommunications members.

PSIB also holds the membership, and so, it has a SWIFT code. For most banks, this alphanumeric code is about 8-11 characters. The SWIFT code of PSIB, i.e., PSIBINBB005, has 11 characters, and the letters have a special meaning. Let's find out.

The first four letters, PSIB, together with stand for the bank code. The next two letters, i.e., IN, together represent the country code for India. The following letters, BB, signify the location of the bank, i.e., Delhi. The last three digits, 055, indicate the Rajendra Place branch.

Now you know the importance of the Punjab and Sind Bank IFSC Code, MICR code, and SWIFT code. They are used for different types of fund transfers to PSIB. You must remember that for proper transactions and verification steps, you need the correct code.

But how will you find the different codes? Let's take a look. "Find Your Bank" for the Punjab and Sind Bank IFSC, MICR, and SWIFT Codes

A trusted site for finding the Punjab and Sind Bank IFSC, MICR, and SWIFT codes is Find Your Bank. It has a database for the IFSC and MICR codes of all banks and their branches, as well as SWIFT codes. The steps you should follow are simple and quick.

This simple method is to be followed to find the Punjab and Sind Bank IFSC, MICR, SWIFT codes. In addition, there are other ways to find these codes through other sources. Here's how you can do it.

You can find Punjab and Sind Bank IFSC using the following methods:

Each PSIB account holder has a passbook with all the details written on the first page. Among the details, you'll find the IFSC. So check the recipient's passbook for the code.

The leaves of the checkbook of the recipient's bank account contain the IFSC. This code is usually printed at the top of each leaf of the checkbook, among other details.

Whether you want to transfer funds from another PSIB account or another bank account - you can find the IFSC. You can also find the details on the PSIB website.

RBI assigns the IFSC to every bank - and hence, it maintains a database of the codes of all banks. So, you can find the IFSC of a particular PSIB branch on the RBI website.

The customer care executives at PSIB are ready to provide you with the IFSC you are looking for. You can reach them by calling the bank or visiting the nearest branch.

If you want to know the MICR code of a particular branch of PSIB, you can take similar steps as you would follow to know the Punjab and Sind Bank IFSC code. To find the Punjab and Sind Bank MICR code, you can refer to -

Finding the SWIFT code of Punjab and Sind Bank is not difficult at all. For the SWIFT code, you can refer to -

While there are plenty of trustworthy sources to find the codes you need, Find Your Bank is the go-to destination for all the codes in one place.

To transfer money to a Punjab and Sind Bank account online, you will need to use the following methods:

1. NEFT transactions do not have any upper or lower limits.

2. It is available 24x7, with 48 settlements at gaps of 30 minutes.

3. Charges for NEFT:

1. RTGS can be used for transactions above ₹2,00,000.

2. It is available 24x7, and settlements on a real-time basis.

3. Charges for RTGS:

a) ₹2,00,000-₹5,00,000

- 8am to 11am: ₹29 + GST

- 11am to 1pm: ₹27 + GST

- 1pm to 6pm: ₹24 + GST

- 6pm onward: ₹19 + GST

b) More than ₹5,00,000

- 8am to 11am: ₹53 + GST

- 11am to 1pm: ₹52 + GST

- 1pm to 6pm: ₹49 + GST

- 6pm onward: ₹44 + GST

1. IMPS transactions can be for amounts up to ₹2,00,000.

2. It is available 24x7, with a real-time settlement basis.

3. Charges if IMPS:

a) Less than ₹1,00,000: ₹5 + GST

b) ₹1,00,000-₹2,00,000: ₹15 + GST

For all these transactions, you will need to use the Punjab and Sind Bank IFSC code. Apart from this, you can also transfer funds by visiting the branch where you hold your account. Or you can use a cheque.

The Punjab and Sind Bank was established in 1908 and nationalized in 1960. It now has nearly 1500 branches, and it is one of the most trusted banks in the country. It offers different banking instruments and accounts. Let's look at the different PSIB accounts:

|

Account Type |

Charges |

| Savings |

₹500 (w/o cheque) ₹1000 (with cheque) ₹500 (rural) |

|

Premium Savings |

₹50,000 |

| Current |

Variable |

|

Premium Current |

₹1,00,000 |

To start your account at PSIB, you'll need to submit copies of your PAN card, Aadhar card, driving license, voter card, etc., to prove your identity and address. You'll also need to submit two passport-size photographs. If it is a current account, you will need to submit business-related details like a copy of the trade license.

The Income Tax Department uses the BSR code of a bank to track IT returns to the Reserve Bank of India. It has seven digits and is unique for every bank. The BSR code of Punjab and Sind Bank is 370002.

Just like any bank, PSIB has a unique IFSC for each branch. The last six digits are the branch code. To locate the PSIB branch using the IFSC code, you can visit Find Your Bank and enter the code - and the platform will generate the branch location.

It is not possible to find the IFSC code for a PSIB account just by using the account number. However, you can use a tool like Find Your Bank or the RBI website to find the IFSC code using the branch location.

The CIF number or Customer Information File number is a code given by a bank to its customers at the time of opening the account. PSIB does the same. It helps the bank to record information about the customer's account.