Punjab National Bank IFSC Code and MICR Code

Punjab National Bank IFSC Code and MICR Code

Find Punjab National Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Punjab National Bank IFSC Code and MICR Code

Punjab National Bank IFSC Code and MICR CodeFind Punjab National Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Punjab National Bank IFSC Code Finder - Select Your State

Punjab National Bank IFSC Code Finder - Select Your StateOnline Banking has transformed everyone's lives today. To ensure secure transactions can take place through net banking, banking codes play an important role. Punjab National Bank IFSC code, MICR, and SWIFT codes are required in Internet and traditional banking depending upon the type of online transaction you are going to make.

In this article, you will read about different banking codes and modes on net banking that can secure a transaction through your Punjab National Bank branch. You will also explore the composition of IFSC code, MICR code, and SWIFT code and how to check their validity. Let's start with the one we use the most for everyday transfers- the IFSC code.

IFSC Code is a unique code used to represent a bank and is distinct for different branches, even for the same bank. You can transfer funds online only if you provide the correct IFSC code and account number. The use of IFSC code is for making easy fund transfers via RTGS and NEFT.

IFSC code is an alphanumeric 11 digit code that the R.B.I. assigns to every bank branch for unique authentication. The format of the IFSC code is split into two primary parts. The first four characters represent the Punjab National Bank (P.N.B.) code. The last six digits represent the specific branch code. The 5th digit is set to 0.

For instance, the Punjab National Bank Gurgaon Mehrauli Road Branch IFSC Code is UTBI0GMR735 and set as PUNB0454200 . The first four letters PUNB are initials for Punjab National Bank (PNB). The fifth digit is 0. The ending six digits 454200 represent the branch code.

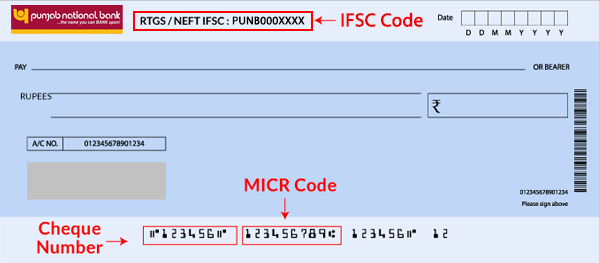

The MICR code enables faster processing of payments. The PNB MICR code is present on cheques. It is printed using Magnetic Ink Character Recognition Technology. It is a unique code that authenticates cheques as well as bank and branch names involved in ECS transactions.

One requires the MICR code to fill in financial transactional forms or slips for transferring funds. The MICR code is present at the bottom of the cheques, right next to the cheque number. You can even find the MICR code printed on the first page of your savings account passbook.

Punjab National Bank MICR code contains nine digits. The format of the MICR code is split into three parts. The MICR code begins with three digits representing the city code. This is followed by three digits referring to the bank code. The ending three digits refer to the bank branch code.

For instance, the Punjab National Bank MICR code for the branch Gurgaon, M.G. road district Gurgaon is set as 110024413. The first three digits, 110, depict the city code. The next three digits, 024, represent the bank code. The last three digits, 413, depict the branch code.

A SWIFT code enables secured and standardized transactions globally. Usually, banks use the SWIFT code to send and receive money anywhere across the globe. SWIFT code is also known as Business Identifier Code(BIC). For initiating an international money transaction, your branch SWIFT code is a must. A SWIFT code identifies the bank account while also verifying the international transactions.

Punjab National Bank SWIFT code is different from Punjab National Bank IFSC Code. A SWIFT code is a set of either eight digits or 11 digits. While making international transfers, these digits identify your bank branch. The number of digits in the SWIFT code varies from bank to bank.

A SWIFT code contains the bank code, the country code, the location code, and the branch code. For instance, the Punjab National Bank SWIFT code for Ahmedabad is PUNBINBBAVB. The first four letters PUNB denote the bank code. The next two letters IN denote the country code BB denotes the location code. The ending three letters AVB denote the branch code.

Now, let's have a look at where you can actually find these banking codes easily. While multiple sources might exist, it is always important that your Punjab National Bank IFSC code or other codes are accurate and updated. Here are some ways in which you can find your desired codes easily and quickly.

IFSC code is an alphanumeric 11 digit code that the R.B.I. assigns to every bank branch for unique authentication. The format of the IFSC code is split into two primary parts. The first four characters represent the Punjab National Bank (P.N.B.) code. The last six digits represent the specific branch code. The 5th digit is set to 0.

Running into old IFSC codes or the non-updated versions of codes is a common problem. You'd use a code that you knew, but it is no longer your Punjab National Bank code. An advanced IFSC search tool like Find Your Bank can help solve this problem. Here, you can find the latest IFSC, MICR, and SWIFT codes of your bank branch, along with other branch details altogether.

To do a search on Find Your Bank, follow these simple steps:

1. Visit the official website at https://findyourbank.in/.

2. Select your Punjab National Bank in the code finder.

3. Select the state of your bank branch.

4. Now, select the branch district.

5. Finally, select your PNB bank branch.

With these details, your search page will be redirected to results with the bank's IFSC code, MICR code, SWIFT code, bank branch address, and several other details of the concerned Punjab National Bank branch. If finding different IFSC codes is a daily task for you, Find Your Bank's mobile app can be a good addition to your smartphone for quick and accurate searches.

Your IFSC and MICR codes can also be found in your Punjab National Bank passbook and chequebook. In your passbook, your Punjab National Bank IFSC code can be found alongside the account holder's information, typically on the first page. The MICR code is easily spotted on each cheque leaf at the bottom next to the bank code. Each leaf also has the IFSC code printed on the top.

A sure-shot way of checking for valid P.N.B. banking codes is simply logging on to your PNB bank portal. Log onto https://netpnb.mco/ and check your branch code. The official RBI website - https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx also offers a peek into all kinds of IFSC and other codes for different bank branches.

In the case of looking for your PNB branch SWIFT code, the search can be a bit more tricky. Your recent bank statements with the same SWIFT code can be saved for review at any time. Log in and click on "View Statement" to refer to old transactions. If you're in a hurry and can't be sure if you have the right code, just call Punjab National Bank's toll-free customer care number at 1800 180 2222 to check for the SWIFT code that you're looking for.

The process of transferring money has become hassle-free due to the availability of several fund transfer modes. The three standard methods that one can use for transferring funds from one account to another are: NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service).

NEFT is a secure and reliable mode of money transfer within two bank accounts in India. National Fund Transfer System, abbreviated as NEFT, provides flexibility to the customers for making payments easily. NEFT can be initiated in two ways. The first way is by using Internet banking through the portal. The second way is visiting the nearest bank branch and filling up the NEFT fund transfer form.

The availability of NEFT fund transfer is 24 by 7, on all 365 days; only if done via internet banking. For those who are willing to transfer by visiting the bank branch, the bank schedule needs to be followed.

RBI applies some charges for online fund transfer as well as offline fund transfer. Punjab National Bank NEFT charges are summarized in the table below :

| Transaction Amount via NEFT | Transaction Fees on the Amount |

| Till Rs.10000 | Rs. 2.50 |

| Over Rs.10000 to Rs.1 Lakh | Rs. 5.00 |

| Over Rs. 1 Lakh to Rs. 2 Lakh | Rs. 15.00 |

| Over Rs. 2 Lakh | Rs. 25.00 |

Note: The transaction fees apply only to transactions carried outwards. For all the Punjab National Bank Transactions, GST charges are applicable.

Customers who are willing to transfer NEFT funds visiting the bank branches can note these timings.

| Weekday | Timings |

| Monday to Friday | From 8:00 AM to 7:00 PM |

| Saturday | From 8:00 AM to 1:00 PM |

Note: The maximum limit set for NEFT fund transfers is Rs. 50,0000/-

Mandatory documents and information to carry for NEFT fund transfer :

RTGS is one of the fastest modes of fund transfer, where a customer can remit the amount to another bank account within seconds. Real-Time Gross Settlement, abbreviated as RTGS, is a nationwide payment transfer system. RTGS reduces restrictions and time for fund transfers. Punjab National Bank accepts RTGS service transactions so that the customers can initiate fund transfers one to one.

There are two ways in which the RTGS fund transfer can be done. The first way is using internet banking through the portal. The second way is to fill up the RTGS form by visiting the nearest bank branch. Through RTGS, the fund transfers can be done instantaneously with some nominal charges.

Punjab National Bank charges no fees for the RTGS transfer done online. However, some charges are applicable for RTGS transfers offline. The table below shows the transactional fees applicable on a certain amount:

| Amount Transfer via RTGS | Transaction fees on the amount |

| Above Rs. 2 Lakh to Rs. 5 Lakh | Rs. 20 + GST |

| Above Rs. 5 Lakh | Rs 40 + GST |

The RTGS fund transfers are available 24 by 7, on all 365 days only for online modes like internet banking or mobile banking. But for RTGS fund transfers through bank branches, you need to follow strict timings. The timings are Monday to Friday from 8:00 AM to 7:00 PM. The timing for Saturday is from 8:00 AM to 1:00 PM.

Mandatory documents and information to carry for RTGS fund transfer :

Among other fund transfer methods, IMPS is one of the most reliable fund transfer methods. Immediate Payment Service is abbreviated as IMPS. It refers to transfer funds immediately without any restrictions like timings or holidays. IMPS fund transfer can be done using net banking or mobile banking via mobile applications. The customers can even remit the amount at ATMs.

Punjab National Bank enables this easiest and secure mode of fund transfer for the benefit of customers. The maximum limit Punjab National Bank set for IMPS transfer is Rs. 50,000 in a day. Customers with a Punjab National Bank account can avail of IMPS fund transfer service transactions.

For any IMPS fund transfer, one requires an MMID number and mobile number. The IMPS transfer can be done using a bank account number and the IFSC code.

IMPS transfers are available 24 by seven on all 365 days. One can get confirmation of the payment without any delays. Punjab National Bank IMPS transfers via internet banking or online banking have no charges applicable.

Mandatory pre-requisites for IMPS fund transfer :

Punjab National Bank is India's first Swadeshi Bank that started its operations from Lahore on 12th April 1985. Headquartered in New Delhi, it is a well-established bank that is ready to fulfill the varied banking needs of customers.

It was established and authorized with a mere capital of Rs. 2 Lakh. PNB is the first nationalized bank established to be managed by Indians. It has 12,248 branches, over 13,000 ATMs, and over 180 million customers.

PNB aims to fulfill the complex financial needs of its customers. It offers a wide range of financial benefits, investment solutions, loans at the lowest rate of interest, and numerous plans for savings. At the time of establishment, PNB had set a corporate vision and mission. P.N.B.'s vision was centered on being the most preferred bank for customers, being the best place to work for employees, and having excellent operations in the industry.

PNB's mission is to create value for investors, employees, and customers and be the first choice for its stakeholders.

The table below shows the interest rates for the Punjab National Bank savings account balance. It is calculated depending upon the balance maintained in the savings account. These rates are levied with effect from 1st July 2021:

| Savings Balance | Rate Of Interest (%p.a) |

| Below Rs. 100 Crore | 3.00 |

| Over Rs. 100 Crore | 3.00 |

Punjab National Bank's rate of interest applicable on term deposits of general and senior citizen's account are listed as follows W.E.F. July 2021 :

| Tenure Period(Days) | Interest Rates for General Citizens (%) | Interest Rates for Senior Citizens (%) |

| 7 days to 14 days | 3.00 | 3.50 |

| 15 days to 29 days | 3.00 | 3.50 |

| 31 days to 45 days | 3.00 | 3.50 |

| 46 days to 90 days | 3.25 | 3.75 |

| 91 days to 179 days | 4.00 | 4.50 |

| 180 days to 270 days | 4.40 | 4.90 |

| 271 days to 364 days | 4.50 | 5.00 |

| 365 days | 5.10 | 5.60 |

| 400 days to 2 years | 5.10 | 5.60 |

| 2 years 1 day to 3 years | 5.10 | 5.60 |

| 3 years 1 day to 5 years | 5.25 | 5.75 |

| 5 years 1 day to 10 years | 5.25 | 5.75 |

To open a savings account in Punjab National Bank, the following documents are required :

1. What is the difference between NEFT & RTGS?

NEFT involves net settlement, whereas RTGS operates on the basis of gross settlement. NEFT is typically used for regular fund transfers, whereas RTGS is used for high-value and quick fund transfers.

2. What is MMID?

MMID or the Mobile Money Identifier code is a 7-digit code allotted by banks for transfers through IMPS. The registered mobile number and account number are required to get an MMID code which can be used for receiving IMPS funds.

3. Is it possible for two PNB bank branches to have the same IFSC code?

Typically, all distinct bank branches have distinct codes. For similarly situated branches, a major part of the code can be identical, but the PNB branch code will be different to make it distinct.

4. Who all are eligible to make PNB NEFT transfers?

PNB NEFT transfers can be made by all individual account holders or those associated with business and corporate firms. Even non-account holders can initiate a PNB NEFT transfer with relevant details, including their name, mobile number, and address now.