Shinhan Bank IFSC Code and MICR Code

Shinhan Bank IFSC Code and MICR Code

Find Shinhan Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Shinhan Bank IFSC Code and MICR Code

Shinhan Bank IFSC Code and MICR CodeFind Shinhan Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Shinhan Bank IFSC Code Finder - Select Your State

Shinhan Bank IFSC Code Finder - Select Your StateIFSC code is among the most vital bank credentials you must have come across multiple times. The Indian Financial System Code or the IFSC is a unique code that is provided to your branch. Your Shinhan Bank IFSC Code is an identification number issued under the guidance of RBI.

The prime role of the code is the identification of your branch. At the same time, this code is necessary to make transactions through electronic transaction systems like NEFT, RTGS, and IMPS. The RBI requires it to track transactions and ensure that they are completed safely.

MICR code is another specific credential you need to be aware of. Your MICR code is present on the cheque leaf, and your bank uses it to process and verify cheque payments. Keep reading to get acquainted with these codes, how to find them, and use them in transactions.

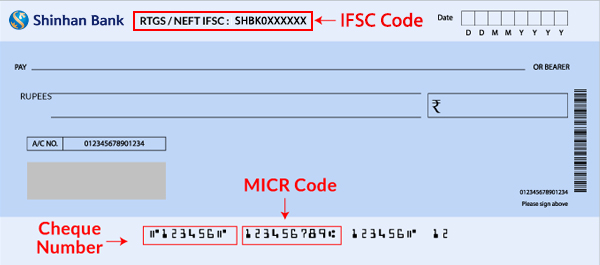

Your Shinhan Bank IFSC Code is an alphanumeric code made up of 11 digits. You can find your IFSC code on the bank passbook and other bank documents. It is a vital detail that you must enter when you initiate online transactions.

This code lets you make safe and easy digital transactions. The format for the IFSC code is CDEF0123456. The bank uses the information in these codes to identify the payment sources and destinations. It also helps in interbank communication.

For instance, the Shinhan Bank Mumbai branch IFSC Code is SHBK0000003. You can break this code down into three parts: the first four digits (SHBK) represent your bank’s name, the fifth digit is mandatorily a zero, and the last six digits (000003) represent the branch code.

Your Shinhan Bank MICR Code is a distinct nine-digit code, but it has an entirely different function. You can obtain this code from your cheque leaf. The MICR or the Magnetic Ink Character Recognition technology is used to print this code and is used for identifying and clearing cheque payments. The nine-digit code can be segmented into three parts.

Here, the MICR code of the Mumbai branch is 400659002. The first three digits (400) indicate the city name, and they are aligned with the PIN code used for postal addresses. The next three digits (659) represent your bank, and the last three digits (002) represent the branch of your bank.

The Shinhan Bank IFSC code and MICR code are mandatory to complete payments, so it is essential that you are familiar with these credentials. There are many different ways you can obtain these codes. They are elaborated below:

Find Your Bank is a website that serves a range of banking services. It is among the most feasible ways to get access to your bank credentials. You need to go to their website and enter the following details to find the IFSC and MICR code:

Once you enter all these details, you need to click enter to find the required codes in the results. Find Your Bank has also come up with an innovative mobile application that is accessible anywhere at all times. The mobile app enables you to find these codes in a seamless manner just in a matter of time.

You can easily find your bank credentials through your bank documents. The IFSC and MICR codes can be spotted on your bank passbook as well as the cheque book. You can find these codes printed on the first page of the passbook. On the cheque book, you can look for the details mentioned on the cheque leaf.

Your Shinhan Bank IFSC code and MICR code can be obtained from the official website of the Reserve Bank of India. RBI has an inventory that stores the IFSC and MICR codes for all the branches of several banks present in India.

You could also use the Net Banking or Mobile banking portal of your bank to find your codes. Just log in to the portal using the username and password provided to you. Once you are logged in, explore the available options and select the appropriate one to get the desired code.

In case any of these above-mentioned methods fail to work out for you, you can choose to approach the customer care unit of your respective bank branch, and they will guide you accordingly with further details.

Electronic transaction methods like NEFT, RTGS & IMPS are popularly used as they are more convenient and quick compared to conventional methods. You can even make these transactions from the comfort of your own space just by using a few details.

Along with the Shinhan Bank IFSC code, you will need the following data:

These details will always be useful to you when you carry out various payments via electronic systems.

The National Electronic Fund Transfer or the NEFT method is an electronic transaction method that was developed by the Reserve Bank of India and is among the most opted methods to send money.

It works in settlements of batches, and it works on a Deferred Net Settling or a DNS system. The details of the NEFT service provided by Shinhan Bank are mentioned ahead:

| Timings | Available at all Times |

| Charges Applicable |

Rs 2.5 up to Rs 10,000/- Rs 5 above 10,000/- and up to 1 Lakh Rs 15 above 1 Lakh and up NIL to 2 Lakh Rs 25 above 2 Lakh |

| Settlement | Batches |

| Maximum and Minimum limits | No limits on NEFT |

GST applicable

To complete an NEFT transaction using the Netbanking or Mobile banking service of Shinhan Bank, just log in to the desired platform using your username and password, then select the NEFT option and enter the required details. Ensure that you thoroughly read the terms and conditions and, after review, complete the NEFT transaction.GST applicable.

RTGS or Real-Time Gross Settlement is another online transaction method, and it works in settlements in a real-time manner. Real-time refers to the transactions being completed at the time of receipt itself and are based on an individual or a gross system.

Payments made through RTGS are not revocable and hence used chiefly for higher amounts.

| Timings | Bank working hours |

| Charges applicable |

Rs. 25 on 2 Lakhs to 5 Lakhs Rs. 50 above Rs. 5 Lakh |

| Settlement | Real-time |

| Minimum and maximum limit |

The minimum limit is Rs. 2 lakhs No maximum limit |

To send money through the RTGS service of Shinhan Bank, you need to log in to the online banking service. Then, fill in the Shinhan Bank IFSC code and the other credentials that are mentioned above.

Select the RTGS fund transfer option and enter all the information. Before you complete the entire transaction, read all terms and conditions carefully.

IMPS is an instant electronic transaction system, and it is available all around the year, even on the holidays. It is a smart choice as the settlements are instant, and the method is considered quite convenient.

To utilize the IMPS service, go to the net or mobile banking portal of Shinhan Bank. For an IMPS transaction, you will require:

| Timings | Available all times |

| Settlement | Instant |

| Charges |

Up to Rs. 1 Lakh - Rs. 5 Rs. 1 Lakh to Rs. 2 Lakhs - Rs. 15 |

| Minimum limit | Rs. 1 |

| Maximum limit | Rs. 2 Lakhs |

Firstly, log in to the mobile application of Shinhan Bank with your bank credentials. Then, select the ‘IMPS’ option from the different fund transfer options available and enter all the details required, as explained above.

The bank provides a passcode that you need to fill in to complete the transaction. Then you need to verify the transaction using the passcode. After that, you will receive an affirmation text message along with a transaction number on your respective mobile number.

This indicates that the transaction was completed successfully. The transaction number provided to you can be used to monitor the transaction. It will also help to raise concerns in the future in case of inconveniences.

You can receive money through these electronic transfer methods in the same way by simply providing the remitter required details of your bank account and branch.

Shinhan Bank is headquartered in the South Korean capital, Seoul, and it is famed as the first lender in Korea. It was established near the end of the 19th century, and then it went by the name of the moniker Hanseong Bank until it was reestablished in 1982.

It merged with the Shinhan Financial Group, which gave it the current name, and now they are partnered with Chohung Bank and Jeju Bank. Shinhan has emerged as a solid international bank with a presence in around 20 countries along with a global network of over 150 branches and offices located around the world.

Shinhan Bank India came to India in 1996 at Nariman Point, Mumbai. It has six networks at Mumbai, Pune, New Delhi, Kancheepuram, Ahmedabad, and Ranga Reddy and provides various banking services.

You can find your IFSC code from bank documents like the bank passbook and cheque book. You can also obtain it through internet banking services of your bank or through online websites like Find Your Bank. Read our guide thoroughly to explore everything in detail.

The Shinhan Bank IFSC code is mandatory for the identification of the branch, and it is also required to complete various online transactions like NEFT, RTGS, and IMPS.

Shinhan Bank India came into existence in India in 1996 at Nariman Point, Mumbai. Currently, it is operating at six different locations, namely, Mumbai, Pune, New Delhi, Kancheepuram, Ahmedabad, and Ranga Reddy.

Yes, Shinhan Bank is entirely safe and secure. It is a prestigious bank with an international presence, and it provides reliable and authentic services.

Shinhan is a trusted choice among people around the world, and all your payments and funds are carefully managed. In case any inconvenience occurs, you can approach the bank branch directly or make a call to the customer care number.

RTGS payments have a gross or individual settlement process, and they operate throughout the RTGS working hours on a real-time basis. On the other hand, NEFT payments are processed in timely batches. Both of these methods are popular transaction systems, and they let you send money anywhere, at any time.