Andhra Bank IFSC Code and MICR Code

Andhra Bank IFSC Code and MICR Code

Find Andhra Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Andhra Bank IFSC Code and MICR Code

Andhra Bank IFSC Code and MICR CodeFind Andhra Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Andhra Bank IFSC Code Finder - Select Your State

Andhra Bank IFSC Code Finder - Select Your StateToday, we all are surrounded by several facilities at our doorstep. Be it online shopping or electronic gadgets, and everything is made available to us conveniently. Likewise, online banking has made banking accessible. We depend on Andhra Bank IFSC Code for our banking needs. Online banking has changed the way we used to do banking a decade ago. It gives you a way to conduct financial transactions, manage bank accounts, and view bank statements easily. You do not need to stand in the bank's long queues.

Internet banking has enabled you to complete all your banking needs from anywhere and at any time. However, you need to conduct online banking carefully. You should have complete information on the various codes required for online transactions. But you do not have to worry! Here is a blog that has all detailed information on online banking.

Do you have a net banking account, or do you do online banking? If yes, then you must have heard of the IFSC code. But do you know what the IFSC code is and why it is essential in online transactions? Andhra Bank IFSC Code facilitates quick funds transfer. Each bank has a unique IFSC code that is different from the other. The code identifies the specific bank branch that participates in the online fund settlement processes.

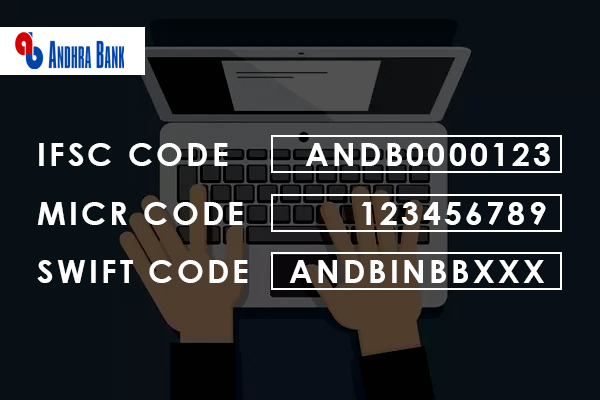

The IFSC code ensures secured transactions through NEFT, RTGS, IMPS, CFMS, and bank-to-bank instant money transfer. IFSC or Indian Financial System Code is an 11-digit code with a combination of numbers and alphabets. For example, The Andhra Bank New Delhi Connaught Circus Branch IFSC code is ANDB0000084.

Here, the first four letters signify the bank name; the following is zero, which is universal. The last six digits indicate the address of a specific bank branch that is always unique. RBI has assigned IFSC to identify each bank and allow zero possibility of discrepancy during the online transactions. Andhra Bank IFSC Code helps in regulating online funds transfer by identifying the source and destination bank.

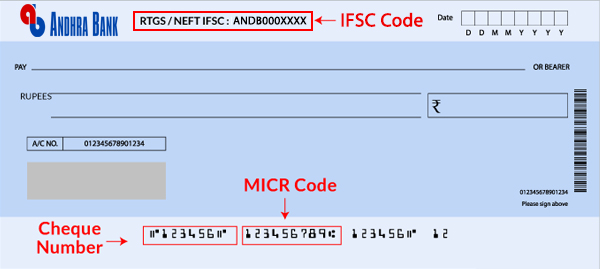

Have you ever noticed that there are specific codes at the bottom of a cheque? One of them is a cheque number, but have you ever wondered what the other one is?

It is the MICR Code, which is a unique 9-digit code. Magnetic Ink Character Recognition plays a significant role in monetary transactions and helps in the quick processing of Andhra Bank's cheques.

For example, the MICR Code of Andhra Bank, Coimbatore Tamil Nadu is 641011002. The initial three digits indicate the city code aligned with the PIN code of the postal address in India. The following three digits are the bank code, while the last digit is the branch's code.

The special ink is used to print certain characters on the original documents that are sensitive to magnetic fields. MICR specifically verifies the originality of paper documents in the bank. The code authenticates cheques for clearance and is required to fill forms like SIP.

SWIFT or BIC code identifies specific banks and branches in international money transfers. It is a combination of letters that recognizes the branch codes. Various banks use the SWIFT code to transfer other bank and transaction-related messages. The code identifies the bank, country, branch, and location. SWIFT and BIC (Bank Identifier Code) are used interchangeably and are the same. Society for Worldwide Interbank Financial Telecommunication handles the SWIFT code registrations.

A SWIFT code is almost similar to Andhra Bank IFSC Code as it also ensures that the bank transfers funds to the correct destination. A SWIFT code has 11 letters. The initial four letters are bank code, while the next two represent the country code. The following three letters are location code, followed by the last three letters that are the branch code.

The SWIFT code of Andhra Bank Jaipur is ANDBINBBJAI.

You will now agree that Andhra Bank IFSC code, SWIFT, and MICR code are essential in internet banking operations and online funds transfer. But having only information is not sufficient. Right? You also require knowledge on the way to locate the correct branch codes. There are multiple sources like bank's websites and third-party websites that can help you find the correct code. One of the websites is 'Find Your Bank.' It is both a website and app from where you can access the bank codes anytime.

Following are the steps to follow on the website.

The additional sources through which you can find the codes are mentioned below –

Your Andhra Bank passbook has the IFSC and MICR code of the specific branch you hold an account.

You will find the Andhra Bank IFSC code on the top corner of your cheque. MICR code is located at the bottom next to the cheque number.

You might be knowing that RBI controls all the banks. It also has an official website https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx. Here, you can find all the codes of the specific bank branch.

You can navigate through Andhra Bank's digital banking website. Here, you will find the specific branch codes easily.

If you cannot find the correct SWIFT code of a specific branch, then there is another option for you. Andhra Bank's customer care is available 24*7. The team will give the correct SWIFT code of the branch.

If you have a digital banking account, then you will easily find the specific branch codes. You have to sign in to your Andhra Bank online account and analyze the bank statements. From here, you will get the correct bank codes.

NEFT enables hassle-free funds to transfer online from one bank to another of the same bank or any other bank. National Electronic Funds Transfer is available for the customers who have savings/current accounts with Andhra Bank. NEFT transfers funds in batches and is suitable to make transactions above Rs 2 lakh. An account holder can transfer the funds to another bank account by paying a minimal charge within a few hours.

Andhra Bank has a minimum limit of Rs 1 lakh, while there is no maximum limit to make an NEFT transaction. It has a time frame of nearly 2 hours to receive the funds. However, the fund transfer is time-bound and takes place batch-wise. Fund transfer does not take place in real-time.

Andhra Bank charges Rs 2.5 per transaction for transfer up to Rs 10,000 while Rs 5 per transaction for the transfer of up to Rs 1 lakh. The bank charges Rs 15 for transfer between Rs 1 lakh-Rs 2 lakh. It levies Rs 25 for Rs 2 lakh and above. You will need the Andhra Bank IFSC code of sender and payee to transfer funds through NEFT. You will also need the beneficiary's name and address, account type, and number.

RTGS is one of the fastest methods to transfer funds in real-time. RBI has developed Real Time Gross Settlement, an integrated, robust, and continuous payment system. The transactions are done with a faster settlement cycle. The banks and financial institutions use RTGS to transfer funds and make inter-bank transactions on an immediate and irrevocable basis. Andhra Bank has set the minimum limit of Rs 2 lakh for funds transfer, while there is no maximum limit.

Andhra Bank levies Rs 25 per transaction for fund transfer of Rs 2 lakh – Rs 5 lakhs between 9 am to 12 pm, while Rs 30 between 12 pm to 3:50 pm. The bank charges Rs 50 for above Rs 5 lakhs between 9 am to 12 pm, while Rs 55 between 12 pm to 3:50 pm.

It would be best to have the beneficiary's IFSC code, name, and account number for transferring funds through RTGS.

IMPS is a quick, online, and smooth fund transfer service that makes online banking convenient. It enables an account holder to make transactions from one account to another instantly. It even works on public or bank holidays and Sundays available 24*7. Immediate Payment Service is accessible and inexpensive. IMPS allows the customers to use mobile instruments for accessing their bank accounts and transfer funds. Andhra Bank allows transferring funds up to Rs 2 lakh per transaction.

Andhra Bank IMPS facility charges Rs 5 plus GST for every phone to phone and phone to account transaction. However, phone to merchant transfer is used to pay a bill, and online shopping payments are free of cost.

In order to use the IMPS facility, you need the beneficiary's name and account number. Besides this, phone to phone transaction requires beneficiary MMID, while phone to account requires beneficiary IFSC code.

Andhra Bank is a public sector bank that was founded in 1923. The headquarters are located in Hyderabad, Telangana. It has a vast customer base across the country. Andhra Bank has a network of around 2735 branches operating all over India. The bank offers a variety of products and services like loans, retail, and corporate banking, credit/debit cards, and insurance.

The bank has witnessed significant growth over the years. Andhra Bank also offers mobile, internet banking, and NRI banking. Different types of Andhra Bank savings account are listed in the table.

| Account Type | Interest | Minimum Balance | Eligibility |

| AB Kiddy Bank | 3.00% | Rs. 100 | Children up to 18 years |

| A.B. Gold Account | 4.00% | N.A. | Comes with partial or permanent disability or accidental insurance facility |

| Abhaya First Wealth Pack | 4% | Rs. 25,000 -Rs. 1,00,000 | Resident individuals for 18-59 years |

| AB Jeevan Abhaya Triple Plus |

4% | N.A. |

Resident individuals for 18-50 years |

You require the following documents to open a savings bank account in Andhra Bank-

If the sender has to initiate a transaction through a mobile channel, he has to complete mobile banking registration with Andhra Bank. There is no need to do mobile registration if the sender is doing transactions through the internet or ATM.

The receiver has to collect MMID from the bank and share it with the sender if it is through a mobile channel. Alternatively, the receiver can also send the account number, Aadhar number, and IFSC code for receiving money through IMPS.

MMID is Mobile Money Identifier, which is a 7-digit number. Your Andhra Bank branch will issue the number. MMID, when combined with a mobile number, helps in funds transfer. The combination is also linked with the account number to identify the beneficiary details.

It is essential to provide the correct IFSC code to complete a transaction. However, if you mistakenly submit the wrong IFSC code, the funds will reroute back to the transferrer's account. If the amount is transferred to the wrong account, you have to contact Andhra Bank's branch and seek support immediately.

Andhra Bank's NEFT service delays fund movements and settles transfers within 24 hours. NEFT does not require a physical cheque or demand draft. The bank sends an SMS or email to confirm the credit. The entire NEFT process is paperless, making it safe and cost-effective.

Yes, you cannot transfer funds online without mentioning the IFSC code. However, if you are using digital wallets, there is no need to provide the recipient's code.