ICICI Bank IFSC Code and MICR Code

ICICI Bank IFSC Code and MICR Code

Find ICICI Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

ICICI Bank IFSC Code and MICR Code

ICICI Bank IFSC Code and MICR CodeFind ICICI Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

ICICI Bank IFSC Code Finder - Select Your State

ICICI Bank IFSC Code Finder - Select Your StateDigital banking has made our lives easier. Let's say you want to transfer money to any bank's customer. Thanks to digital banking, you'll just need internet and basic information like account number and ICICI bank IFSC code to do it instantly!

But don't worry. Cheque payments are still very much valid - and thanks to the MICR code, they are much safer than before. Then again, there's the SWIFT code that you'll need for international transactions.

Let's find out more about the ICICI bank IFSC code, SWIFT code, and MICR, and how to find these codes.

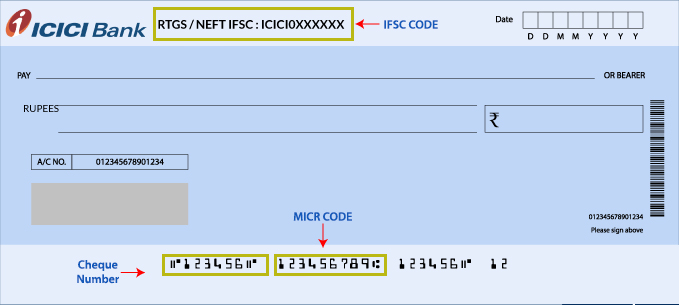

For online money transfers from one account to the other, IFSC is indispensable. But what is this code? IFSC, or Indian Financial System Code, is a unique combination of 11 alphabets and numbers. It helps to identify a particular branch of a bank.

By that rule, IFSC of ICICI Bank, too, includes 11 digits. The first four alphabets represent the bank. This is followed by a 0, and then comes six numbers representing a particular branch of the bank. Let's understand this with an example.

Suppose you have to transfer money to an ICICI account in the Tirupati Air Bypass Road branch, Andhra Pradesh. The ICICI bank Tirupati Air Bypass Road branch IFSC Code is ICIC0002537. This can be broken up as ICIC-0-002537. Here, ICIC is the bank code, while 002537 is the branch code.

Every branch of every bank has a distinct IFSC Code, as given by the Reserve Bank of India. IFSC is required for fund transfers via NEFT, RTGS, and IMPS. In fact, you cannot complete the fund transfer process without the IFSC Code.

Another code that you will come across while making transactions is the MICR Code of a bank. This is different from the IFSC because the MICR Code is used for the processing of cheques. The code contains nine digits that recognize a bank and its branch.

You can find the Magnetic Ink Character Recognition code, i.e., the MICR Code, on each cheque leaf. When a cheque needs to be cleared, a magnetic reading machine reads this code and recognizes the bank and branch to which the check belongs.

Earlier, the process of sorting cheques used to be manual. Now, the MICR technology has made it faster. If you look at an ICICI cheque, you'll find that the MICR Code has only numbers. For instance, the ICICI MICR Code of the Gariahat branch is 700229008.

The third type of code that you'll come across for banking is the SWIFT Code. This code is also used for digital money transfers. But you'll need this code if you want to make an international money transfer. It is also referred to as the BIC or Bank Identification Code.

The code can contain between 8 and 11 digits. Here's where things get interesting. If you look at ICICI Swift codes, you will see that SWIFT Codes change in accordance with the currency and the correspondent bank. It is common for all branches of the bank.

ICICI is associated with many correspondent banks. So, if you live abroad and want to send money to a friend or family in India, you can use the SWIFT Code to send the amount to any branch in India. Use the right code to complete a transaction smoothly.

If you want to transfer money, you will need one of the three codes, i.e., IFSC code, MICR code, and SWIFT code. It depends on the type and mode of transaction. But it is not possible to by-heart all codes, right? Thankfully, you don't have to, either.

If you want to find the codes of ICICI bank, you can visit the website of Find Your Bank and use their database to find what you are looking for. You have to provide information like the state, district, and location of the branch - and it will give you the details.

This platform also gives you the chance to find the branch's address and codes, using any one of the IFSC Code, MICR Code, SWIFT Code, or Zip Code. Find Your Banks is a user-friendly search tool that makes the job of finding bank codes easy.

Suppose you're looking for the codes of an ICICI branch. Start by entering the state, district, and branch location to get the ICICI Bank IFSC Code of a particular ICICI branch. Then, you can use it to get the MICR Code and the SWIFT Code (if applicable).

Find Your Bank also offers an App for your smartphone to make things easier and faster. All you have to do is find it on Google Playstore and install the App on your phone so that you can access such information anytime and anywhere.

In addition to Find Your Bank, you should be able to find the details you need using the information provided by the bank.

Every ICICI bank account holder has a passbook. This passbook contains the ICICI bank IFSC Code and MICR Code.

Each cheque leaf of the bank contains IFSC Code and MICR Code. While the IFSC Code sits at the top, you'll find the MICR Code at the bottom of the leaf.

ICICI's digital platforms are beneficial and laudable. You can find the IFSC and MICR Code by using their "Interbanking" and "iMobile".

If you call or visit an ICICI branch, you'll find the relevant information you need. This is the best way to find the SWIFT Code as this code may vary based on different transactions and locations.

Your bank statement contains the IFSC Code and MICR Code. The SWIFT code is usually on the statement, too. You can find your e-Statement by logging on to ICICI bank's website.

The central regulatory body of the banks in India, i.e., the Reserve Bank of India, has its own website. You can visit this site and find the codes you are looking for.

You now have the basic idea that to transfer funds online in ICICI; you need the ICICI bank IFSC code. But what is the exact process of transferring funds? There are three methods of sending money - a) NEFT, b) RTGS, and c) IMPS.

For these, you need -

a) Account holder's name

b) Account number

c) Bank name, branch, and IFSC Code.

The National Electronic Funds Transfer, or NEFT, is a popular digital fund transfer method. In this process, the bank clears funds in batches within a specific timing. It works on an hourly basis. There are different platforms for doing this, like net banking and mobile banking.

If the batch gets cleared within this specific time, the amount gets transferred to the receiver's account on the same day. Otherwise, the amount will reflect in the beneficiary's account on the next working day. Also, as per the change in government norms, NEFT is available for 24 hours throughout the year.

All banks charge small amounts as NEFT fees. For ICICI, they are as follows:

| Transaction Amount | NEFT Fees |

| Up to INR 10,000 | INR 2.25 |

| INR 10,000 to INR 1,00,000 | INR 4.75 |

| INR 1,00,000 to INR 2,00,000 | INR 14.75 |

| INR 2,00,000 to INR 10,00,000 | INR 24.75 |

In addition to these, GST will be issued as applicable. You cannot make an NEFT of more than INR 10 lakh.

RTGS, or Real Time Gross Settlement System, is a fund transfer method in which the transactions occur one after the other. This means that the funds get cleared individually. ICICI is known for settling an RTGS transaction within the same working day.

Clearly, it is one of the fastest money transfer methods. This method is also considered extremely secure. You can also plan an RTGS ahead of time. For that, you will have to maintain a time frame of 3 days or more.

ICICI also charges a fee for this service. Check out the RTGS fees at ICICI:

| Transaction Amount | RTGS Fees |

| INR 2,00,000 to INR 5,00,000 | INR 20 |

| INR 5,00,000 to INR 10,00,000 | INR 45 |

Again, GST is added to this fee as applicable. Remember that you can avail of RTGS only for transactions of between INR 2 lakh and INR 10 lakh.

If you are looking for an instant transfer of funds, IMPS is the easiest mode of transaction. ICICI is particularly noted for its secure and quick IMPS services. The IMPS, or Immediate Payment Service, allows you to make a transaction 24x7.

What's more, the amount reflects in the beneficiary's account within the blink of an eye, even on non-working days. The transaction can be performed using the bank's website or App. Just remember to add the details of the beneficiary correctly.

It’s obvious that such a service comes at a price. Here’s a look at ICICI’s IMPS fees:

| Transaction Amount | IMPS Fees |

| Up to INR 10,000 | INR 5 |

| INR 10,000 to INR 1,00,000 | INR 5 |

| INR 1,00,000 to INR 2,00,000 | INR 15 |

GST is also added to the IMPS charges. IMPS services are only available for transactions up to INR 2 lakh, while the minimum amount stands to Re 1.

Requirements for IMPS transfer include MMID (Mobile Money Identifier), Mobile number and name of beneficiary and payee, Bank account number and Aadhar number of the beneficiary, IFSC code of the destination bank branch.

One of the biggest names in the private banking scenario in India, ICICI, was established in 1994 in Vadodara. Within a span of only 26 years, the bank has accumulated assets worth INR 14.76 trillion (as of 30 Sept. 2020).

The network of the banks spreads across the country, with 5000+ branches and 15,000+ ATMs. It is a trusted banker for both individual customers and corporates. Its catalog of banking services and financial tools makes every customer happy.

The bank offers attractive rates to its customers. They are as follows:

| Account Type (Savings) |

Rate of Interest (%) |

Minimum Balance |

| Titanium Privilege | 3-3.5 | INR 1,25,000 |

| Gold Privilege | 3-3.5 | INR 50,000 |

| Silver | 3-3 | INR 25,000 |

| Regular | 3-3 |

INR 10,000 (Metro/Urban); INR 5,000 (Semi Urban); INR 2,000 (Rural) |

| Advantage Woman | 3-3.5 | INR 10,000 |

| Life Plus Senior Citizens | 3-3.5 | INR 4,500 |

| Young Stars | 3-3.5 | INR 2,500 |

| Smart Star | 3-3.5 | INR 2,500 |

| Pockets | 3-3.5 | NA |

| Basic - Edge | 3-3.5 | NA |

To be eligible for holding a savings account in the ICICI bank, you must be -

If so, you can open a sole account or joint account at the bank. If you don't meet these two criteria, you can still open an account.

CIF number, or Customer Information File, refers to a code that contains the personal details of an account holder in any bank. The same applies to ICICI bank. It is an 11-digit unique code. If you open a new account, the code will remain the same.

This number encodes information about your loans, funds, Demat, and personal details. It is much like the Aadhar card number, though CIF numbers are only applicable in the case of banking details on a person. Your ICICI e-statement will display the CIF number.

BSR Number, or Basic Statistical Return number, is a code that RBI assigns to all Indian banks. This code contains seven digits, of which the first three digits represent the bank's unique identity, while the remaining four numbers help to recognize a branch of the bank.

For instance, the Gariahat branch of ICICI bank in Kolkata is 6390224. This code comes into play in the case of TDS and TCS returns. The bank maintains a distinct record of all tax payments. BSR appears on OLTAS challan, CIN, and TDS certificate.

Are you wondering what happens if you introduce an incorrect IFSC Code? The good news is, if you use the wrong code, you won't lose money. The amount will be refunded to your account. You'll have to go through the whole process again with the right code.

In some cases, when you attempt a transfer within the same bank, the fund transfer may be successful. In that case, all the other details like account number and account holder's name will have to be correct. But it's better to use the right code.

There are SWIFT Codes for different branches of ICICI banks, as well as the head office. They vary on the basis of currency and intermediary banks. Even the number of digits in a SWIFT Code will vary. You may have to use a different code for the type of transaction you choose.

It is essential to check the ICICI bank SWIFT Code at the time of making a transaction. This will help you to make sure that you are choosing the right code. If you don't, your money will be refunded, and the entire process can be delayed. All add corresponding details correctly, too.