Axis Bank IFSC Code and MICR Code

Axis Bank IFSC Code and MICR Code

Find Axis Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Axis Bank IFSC Code and MICR Code

Axis Bank IFSC Code and MICR CodeFind Axis Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Axis Bank IFSC Code Finder - Select Your State

Axis Bank IFSC Code Finder - Select Your StateThe banking system uses distinct IFSC codes to identify every single bank branch uniquely. These are often needed for online money transfers or even NEFT and other internet banking methods. Nationally assigned by RBI, these codes are allotted to every bank and specific branch. Any wire transfers to an Axis bank account will require the specific Axis Bank IFSC code that the receiver holds an account in.

IFSC code is popularly known as a required entity for money transfer. Many other codes are also used for unique identification. The article explores the scope of these banking codes, their purpose, and their benefits. You will even understand their indicative digits and how to find them.

Read along to explore a step-by-step guide on how to find your bank in relation to different banking codes such as Axis Bank IFSC code, MICR code, SWIFT code. Read through till the end to understand every detail about how these codes work.

Let us start out with the most well-known one. Whenever you make a wire transfer or send someone money online, you are required to fill in an IFSC code in addition to bank account details. For an Axis bank, there's a specific code for each branch, and here's how IFSC codes function.

IFSC or Indian Financial System Code is an 11-character alphanumeric code given by RBI to every bank branch in India. The first four letters in an Axis Bank IFSC code is UTIB, which represents the code of the bank. The six digits represent the branch's code. The fifth digit is 0.

Let's say the bank in concern is the Shrirampur Branch of Axis Bank in Ahmednagar. The Axis Bank Shrirampur Branch IFSC code is UTIB0001370. Here, the first four letters (UTIB) represent the bank's code. The fifth digit is 0. The last six numbers (001370) denote the branch's code.

So, why do you need an IFSC code? Without an IFSC code, you cannot initiate any internet banking transaction for transferring funds using NEFT, RTGS, and IMPS. Well, the simple reason being the elimination of any discrepancies in the fund transfer process.

What happens if you provide the wrong IFSC? Well, if it's the same bank, sometimes the transfer could still go through. This can happen if you use the correct account number but the code for a different branch. Thus, it is important to know the correct IFSC code and understand how to find it for any bank branch.

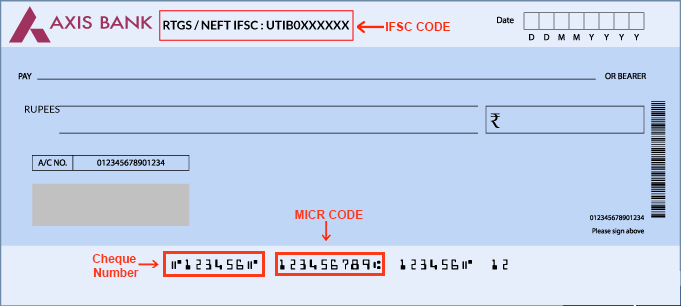

MICR (Magnetic Ink Character Recognition) code is the one you'd find at the bottom of cheques in a distinct black ink. It is printed using MICR technology. It verifies the legality and credibility of paper-based document/s in the banking database.

Axis Bank's MICR code is a nine-digit code found on cheque leaves, passbooks, and its digital banking platform. It helps the RBI to identify the bank branches and speed up the cheque clearing process.

While IFSC code helps electronic money transfer between banks within India, such as NEFT and IMPS, MICR is used to process cheques faster. Unlike these codes, the SWIFT code is used for international transactions between two banks.

For international money transfer, you'd need something called a SWIFT code. Society for Worldwide Interbank Financial Telecommunication or SWIFT is a universal way of identifying banks worldwide. It is an 8 or 11 alphanumeric code to identify a particular bank branch uniquely.

SWIFT code is also known as BIC (Bank Identifier Code). For international fund transfers between two banks, a SWIFT code is needed for corroboration. Banks are also known to use these codes for message exchange within them.

The first four letters represent the bank code. The next two letters represent the country code, followed by two alphanumeric characters, specifying the location code. The last three characters are optional. They represent the branch code.

For example, the Axis Bank Swift code for the Jaipur branch is AXISINBB010. It is the International Standard Organization (ISO) that gives approval to the standard format of Bank Identifier Codes (BIC).

The standard format of Bank Identifier Codes (BIC) is approved by the International Standard Organization (ISO).

How do you find the relevant IFSC code for your bank or a desired SWIFT or MICR code? These codes are needed for domestic or international money transfers, either online or offline. While there are several ways to find Axis bank IFSC code, MICR, and Swift code, here are some that can help you get started:

One of the easiest ways to find an IFSC code is with Online IFSC search tools. Find Your Bank is one such efficient IFSC search tool where you can find an Axis bank IFSC code, MICR code, and Swift code easily. Follow these simple steps to find your desired code:

1. Visit this website - https://findyourbank.in/.

2. On the home page, you will find four information cells to fill.

3. Select the bank of your choice from the drop-down menu.

4. Select the state where it is located.

5. Select the district from the menu.

6. Finally, select the branch you are looking for.

And you are good to go!. The IFSC code search result will show you IFSC, MICR, and Swift (if available) codes of that particular branch.

Find Your Bank also provides a smartphone application that makes the search even easier. You can find this app on the Playstore and be ready to search these codes as and when you need them.

One can easily find the IFSC and MICR codes on your bank's cheque leaves. Generally, IFSC codes are printed on the top, while MICR codes are printed at the cheque's bottom.

As an account holder at Axis Bank, you must have a passbook. You can look for the AXIS Bank MICR Code or IFSC code there.

Internet banking has indeed made fund transfer even smoother and faster. Your Axis Bank IFSC and MICR code can also be found on the Axis Bank Mobile Banking facility or the Axis Bank Interbanking facility.

If all else fails, then call your bank branch. When you're unable to find the codes through either of the above-mentioned methods, you can simply call your branch to find a relevant banking code. While you can easily find IFSC and MICR codes, the most accurate way to find the AxisBank SWIFT code is by calling the branch.

| IFSC code | MICR code | SWIFT code |

| IFSC code stands for ‘Indian Financial System Code. | MICR code stands for Magnetic Ink Character Recognition. | Swift code stands for Society for Worldwide Interbank Financial Telecommunication code |

| It is a code that identifies the bank of a branch that is involved in electronic fund transfer system. | It is a code that is based on character recognition technology that assists in faster check processing | It is a globally recognized identification code used during international credit transfers and also to exchange messages between banks. |

| IFSC is an 11 characters long alphanumeric code | MICR code is a 9-character code. | Swift code has 8 to 11 alphanumeric characters. |

| Developed by RBI | Developed by RBI | Developed by ISO |

| Example: Axis Bank ChandniChowk Delhi’s IFSC code is UTIB0000254 | Example: Axis Bank ChandniChowk Delhi’s MICR code is 110211028 | Example: Axis Bank ChandniChowk Delhi’s Swift code is AXISINBB254 |

The convenience of transferring funds online has undoubtedly made our lives much simpler. Axis Bank provides multiple payment options such as Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), Instant Money Transfer (IMT), Visa Money Transfer, ECS, etc.

National Electronic Fund Transfer or NEFT is one of the most popular methods of transferring funds from one bank to another online. It is based on a DNS system (Deferred Net Settlement), which means that it is transferred in different batches.

The RBI has imposed no limit on the minimum or maximum fund transfer through NEFT. Also, NEFT is available throughout the year (24x7x365 basis). Once the amount is transferred, it may take 2 hours from the batch settlement, during which the beneficiary's account gets credited.

For NEFT, your bank would charge any amount between Rs 2.50 to Rs 25 (+ service tax), as per the amount transferred to the beneficiary.

You would need to fill in some information about the beneficiary to transfer funds through NEFT. These include:

Real-Time Gross Settlement or RTGS is a countrywide real-time payment system. It is used to transfer high-value funds domestically. This is the one you'd use for an instant money transfer in case of emergencies or quick money needed to be wired.

There is a minimum amount cap of Rs. 2 lakh on RTGS transfer with no upper ceiling. "Real-time payment" means there is an instantaneous transfer of payment. But, once it is processed, it is irreversible.

RTGS is a little costlier than NEFT. It would cost you Rs 24.50 for an outward transaction of Rs 2 to 5 lakh and Rs.49.50 for anything higher than 5 Lakhs. Since the RBI maintains it, transfer via RTGS is secured and hassle-free.

The documentation required for RTGS fund transfer is the same as NEFT.

IMPS or Immediate Payment Service is an instant fund transfer service that works 24x7, including on bank holidays. It is an interbank electronic fund transfer service that you can access through multiple channels like mobile, internet, ATM, and SMS.

National Payments Corporation of India first initiated the service in 2010. To avail of the service, you have to register your phone number and get the Mobile Money Identifier (MMID) from the bank. IMPS can be used in non-banking hours, too, without any lower limit compulsion.

The minimum transaction limit for IMPS is as low as Re 1, with a maximum transfer limit of Rs. 2 lakh per transaction. Your bank may permit you to do multiple transactions. The beneficiary receives the amount almost instantly in this process.

The individual banks decide the charges of IMPS. However, the cost for fund transfer up to Rs 1 lakh is usually Rs5, and Rs 15 for transfer between Rs 1 - 2 lakh and Rs 25 for amount 2 Lakh and above.

To initiate an IMPS transfer, you would require the following details.

IMT or Instant Money Transfer is an innovative, safe, and simple domestic money transfer service to send cash.

Once the IMT is initiated, the recipient will receive an SMS on his mobile phone with the IMT transaction details. The beneficiary can then withdraw the amount via a debit card or even make a cardless withdrawal without having a bank account.

Only a transfer of a maximum amount of Rs.10,000 can be made per transaction with a monthly cap of Rs 25,000. For every IMT transaction, the sender will be charged a nominal amount of Rs 25.

To initiate an IMT transfer, you would require:

Axis Bank's Visa enabled services to offer you to conveniently pay the bills of a Visa Credit Card issued by any bank. You can also send money to a beneficiary's bank account using his/her Visa Debit Card number.

The transfer limit is capped to Rs 49,999 in one transaction. For every successful transaction, you will be charged a transaction fee of Rs 5, along with taxes. Visa money transfer takes around 3-4 days for payment processing.

The following details are required to initiate Visa Money Transfer:

ECS or Electronic Clearance System facilitates paperless credit or debit transactions directly linked to your account. It helps to transfer funds from one bank account to another electronically.

It is a handy feature to make recurring transactions electronically, like paying your loan EMI, utility bills (electricity/telephone/mobile bills, credit cards, etc.), mutual fund SIP, insurance premium, etc. ECS transactions do not have any value limit.

ECS does not require any specific documents to initiate your payment transfer. It also does not charge any fee until you drop a scheduled payment day. However, the settlement takes around 3 to 4 days.

Axis Bank is India's third-largest private sector bank with around 4,528 domestic branches, 12,044 ATMs, and 5,433 cash recyclers in India, as per stats released on 31st March 2020. It started its journey in 1993 as UTI Bank, with one registered office in Ahmedabad and a corporate office in Mumbai. Axis Bank offers you almost all account types, including savings account, salary account, and current account.

Axis Bank savings account's rate of interest as of 20th October 2020 is:

| Balance | Rate of Interest |

| Less than Rs 50 Lakhs | 3.00% per annum |

| Rs 50 Lakhs to less than Rs 10 Crores | 3.50% per annum |

| Rs 10 Crores to less than 100 Crores |

Repo + (-0.65%) Floor rate of 3.60% applicable |

| Rs 10 Crores to less than 100 Crores | Repo + (-0.25%) |

| Rs 200 Crores to less than 2500 Crores | Repo + (0.00%) |

To open an Axis Bank Savings account, you have to be an adult Indian citizen. You would also require the following documents to proceed:

You can find the Axis Bank branch code on your passbook, chequebook, or the bank’s website. If you know the IFSC code, its last six digits are your bank’s branch code.

Axis Bank internet banking is a facility offered by Axis Bank that lets you transfer money online. You can also check the transaction history, balance and other related details here. To access Axis Bank internet banking, you have to visit the bank's website.

Axis Bank minimum balance requirement is 10,000/month.

IFSC Code specifies a branch of any bank. You would require this code to transfer money to anyone. Also, the codes are available online. Hence, it is safe to tell your branch’s IFSC code.