Assam Gramin Vikash Bank IFSC Code and MICR Code

Assam Gramin Vikash Bank IFSC Code and MICR Code

Find Assam Gramin Vikash Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Assam Gramin Vikash Bank IFSC Code and MICR Code

Assam Gramin Vikash Bank IFSC Code and MICR CodeFind Assam Gramin Vikash Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Assam Gramin Vikash Bank IFSC Code Finder - Select Your State

Assam Gramin Vikash Bank IFSC Code Finder - Select Your StatePeople often question the importance of specific bank credentials like the IFSC code. The Indian Financial System Code or IFSC is a necessary credential required in several banking operations, and the bank provides it. Likewise, your Assam Gramin Vikash Bank IFSC Code is a unique code that represents your bank branch.

IFSC code denotes the respective branch of a bank, and this code is issued under the guidance of the RBI. At the very same time, it is also required to make transactions through electronic fund transfer systems. The RBI uses it to keep track of the transactions made to ensure that all of them are safely completed.

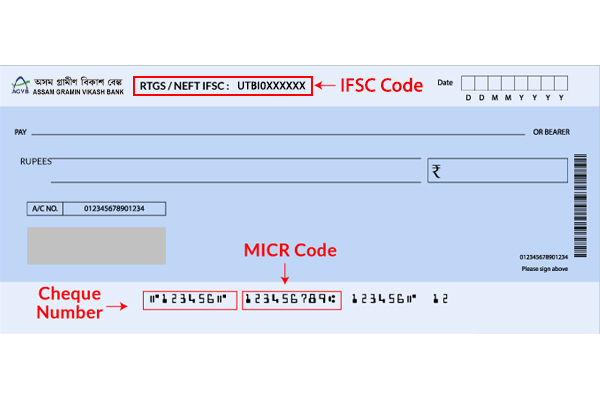

MICR, another unique credential, is crucial as well. You can locate the MICR code on your cheque leaf, and it is needed by the bank to process and verify cheque payments. To get further familiar with all the aspects of these codes and how to use them to make electronic transactions, refer to our detailed guide.

Your Assam Gramin Vikash Bank IFSC Code is a distinct alphanumeric code made up of 11 digits. You can obtain it from the bank passbook as well as other bank documents. It is among the most crucial details needed while completing several online transactions.

This code helps complete easy and secure paperless transactions. The IFSC code has a specific layout, and it is in the format CDEF0123456. For instance, the Assam Gramin Vikash Bank Head Office branch IFSC code is UTBI0RRBAGB.

You can break this code down into three parts, where the first four digits (PUNB) represent the name of your bank, the fifth digit is always a zero (0), and the last six digits (RRBAGB) represent the branch code.

There are numerous benefits of this code. Your bank uses this coded information to identify the payment source and destination. It is also used to facilitate interbank communication.

Your Assam Gramin Vikash Bank MICR Code is a special nine-digit code. However, it has an entirely different function altogether. You can spot this code on your cheque leaf. This code is printed using the MICR or Magnetic Ink Character Recognition technology.

It is mandatorily required for the identification and verification of cheque payments. The MICR code is made up of nine characters, and it is in the format 123456789.

The first three digits (123) indicate the city name and are aligned with the PIN code that is used for postal addresses. The following three digits (456) represent your bank, and the last three digits (789) indicate your bank branch.

The Assam Gramin Vikash Bank IFSC code and MICR code are essential credentials that you should always be aware of. They are required to complete payments through various methods. You can obtain these codes in several different ways. These are explained ahead:

Find Your Bank, an online website, is among the top options to redeem your IFSC and MICR codes. It offers several other banking-related information that you can refer to. To get the IFSC and MICR code of your branch, you need to simply visit their official website and enter the given data:

Once you enter all of the above information, click enter, and you will find all the necessary codes in the search results. Find My Bank has also developed an innovative mobile application that makes getting codes even easier. The mobile app lets you enjoy several other services as well without any hassle in a matter of a few clicks.

The bank documents provided to you by your bank always contain important credentials. You can locate your Assam Gramin Vikash Bank IFSC and MICR codes on the bank passbook and cheque book. In the passbook, you can find the codes printed on the first page, and in the cheque book, you can find these mentioned on the cheque leaf.

You can acquire your Assam Gramin Vikash Bank IFSC code and MICR code from the official website of the Reserve Bank of India. RBI has an inventory that stores all the IFSC and MICR codes for the branches of several banks located in India.

The Netbanking or Mobile portal of your bank is another way to get a hold of these codes. You need to first log in using your credentials. Once you are logged in, you can surf the given options and select the most suitable one to obtain the desired codes.

If none of the above-mentioned methods work, don’t worry. You can simply reach out to the customer care unit of your respective bank branch, and they will accordingly guide you with the required procedure.

In this digital world, people mostly opt for electronic fund transfer methods like NEFT, RTGS & IMPS instead of offline banking as it is more convenient and faster comparatively. You can use these transactions from the comfort of your space using a few details.

Along with the Assam Gramin Vikash Bank IFSC code, you will need the following credentials:

These details will always be helpful to you when you carry out several payments via electronic transaction systems.

The National Electronic Fund Transfer or NEFT is an electronic payment system initiated by the Reserve Bank of India, and it is among the most opted methods to quickly transfer funds. It works in settlements of batches and works on the DNS or Deferred Net Settling system.

The details of the NEFT service provided by Assam Gramin Vikash Bank are mentioned ahead:

| Timings | Available at all times |

| Charges applicable |

Rs 3 up to Rs 10,000/- Rs 6 above 10,000/- and up to 1 Lakh Rs 18 above 1 Lakh and up NIL to 2 Lakh Rs 29 above 2 Lakh |

| Settlement | Half-hourly batches |

| Maximum and Minimum limits | No limits on NEFT |

GST applicable.

Payments through NEFT can be made using the Netbanking or Mobile banking service of 3/- per transaction. Firstly, log in to the respective platform and then select the NEFT option.

After that, add your beneficiary by entering the required information. Before you complete the NEFT transaction, make sure to thoroughly read the terms and conditions.

RTGS or Real-Time Gross Settlement is another electronic transaction method, and it works on a real-time settlement. By real-time, it means that transactions are completed at the time of receipt only and are based on an individual or gross system.

Payments that are made through RTGS are not revocable, and hence, it is usually used for higher amounts.

| Timings | Bank working hours |

| Charges applicable |

Rs. 24 on 2 Lakhs to 5 Lakhs Rs. 54 above Rs. 5 Lakh |

| Settlement | Real-time |

| Minimum and maximum limit |

The minimum limit is Rs. 2 lakhs There is no maximum limit |

To send money through the RTGS service, log in to the online or mobile banking service. Then, you will be required to select the option for RTGS fund transfer and fill in the Assam Gramin Vikash Bank IFSC code and the other credentials that were mentioned above.

IMPS is an instant or immediate electronic fund transfer method that is available around the clock and throughout the year, even on bank holidays. It is a popular choice when it comes to fund transfer methods as the settlement is instant, and the method has been found to be very convenient.

To use the IMPS service, you can use the net or mobile banking portal of Assam Gramin Vikash Bank IFSC code. To complete a successful IMPS transaction, you will need:

| Timings | Available all times |

| Settlement | Instant |

| Charges |

Up to Rs. 1 Lakh - Rs. 5 Rs. 1 Lakh to Rs. 2 Lakhs - Rs. 15 |

| Minimum limit | Rs. 10 |

| Maximum limit | Rs. 2 Lakhs |

To use the IMPS service, log in to the mobile application of Assam Gramin Vikash Bank with your credentials. Then, go for the ‘IMPS’ option from the fund transfer options available and then enter the details required, as mentioned earlier.

A passcode will be provided to you during the transaction, which you need to fill in in order to complete the transaction. Once you verify the payment using the passcode, an affirmation text message will be sent to you along with the transaction number on your respective mobile number.

This will indicate the successful completion of your transaction. You can use the transaction number provided to you to keep track of the transaction. It will also help you if any inconvenience occurs.

If you wish to receive money through the above electronic transfer methods, you need to provide the remitter required details of your bank account and branch.

Assam Gramin Vikash Bank (AGVB) is a regional rural bank with its headquarters in Guwahati. It came into existence on 1st April 2019, and it has a strong network of 473 branches spread across the state. As of 1st April 2020, the sponsorship of AGVB bank has been given to Punjab National Bank.

The AGVB bank is customer-centric, and it believes in the upliftment of the deprived sections, rural youth, and agriculture in Assam. They provide various financial services, from deposits to loan schemes, and all of their products are driven towards the development of rural Assam.

Yes, the Assam Gramin Vikash Bank IFSC code has changed recently. The new IFSC code is PUNB0RRBAGB, and it has been effective since 25/03/2021.

Yes, Assam Gramin Vikash Bank has merged with PNB, and as of 1st April 2020, the sponsorship of AGVB bank has gone to Punjab National Bank.

Assam Gramin Vikash Bank has recently merged with the Punjab National Bank.

You can check your Assam Gramin Vikash Bank account balance in many ways. You can give a missed call or send an SMS containing ‘BAL’ on the balance inquiry number- 9555244442. You can also get the account balance statement from the ATM service or by approaching the bank directly.

MMID is an abbreviation for the Mobile Money Identifier code. It is a seven-digit number that is issued by the bank for all the registered customers who are using the Mobile banking platform. MMID code is necessary to complete a successful IMPS transaction.