Bank Of Baroda IFSC Code and MICR Code

Bank Of Baroda IFSC Code and MICR Code

Find Bank Of Baroda IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Bank Of Baroda IFSC Code and MICR Code

Bank Of Baroda IFSC Code and MICR CodeFind Bank Of Baroda IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Bank Of Baroda IFSC Code Finder - Select Your State

Bank Of Baroda IFSC Code Finder - Select Your StateFinding the right IFSC and MICR codes for secure banking transactions can be a bit of a task, especially if you make different wire transfers often through your Bank of Baroda account. For any NEFT, FTGS, or any other kind of online transfer, you will need the Bank of Baroda IFSC code of the receiver to be able to initiate the transfer.

An IFSC code is a unique identification for any bank branch throughout the country as assigned by the RBI. There are other banking codes like the MICR and SWIFT codes which are used for different authentication and security reasons. In this article, you will read about the different uses of banking codes, what they indicate, and you also learn about where you can find them.

Read along to understand how your Bank of Baroda IFSC code, MICR, and SWIFT codes work, how you can verify a valid code, and find your desired banking code in the most efficient way.

The Bank of Baroda IFSC code is an 11-digit alphanumeric code that uniquely identifies a BOB bank branch. Within the IFSC code, the bank code is indicated by the first four digits, and the last six digits are indicative of the specific bank branch. A “0” separates these two segments of the IFSC code.

The BOB Uttar Pradesh Faizabad Vishnu Market Branch IFSC Code is BARB0FAIZAB. Here “FAIZAB” is the specific branch code, while “BARB” is the general BOB code. You need to enter the IFSC code BOB for all net banking transfers that you initiate to a Bank of Baroda Branch.

A valid IFSC code ensures that your online transfer is directed only to the correct bank branch, and any erroneous attempts can be stopped before the transfer.

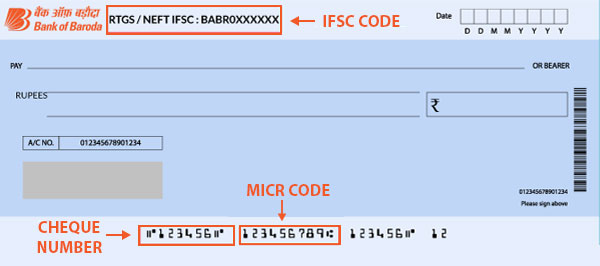

The Bank of Baroda MICR code is the one you’d spot at the button of bank cheques. Printed in Magnetic Ink, the MICR code is for the unique authentication and identification of valid bank cheques as well as several other formal documents. The unique ink used and the unique number itself allow to detection of fake cheques or duplicates.

For example, “110012118” is the MICR code for the Bank of Baroda Delhi Vikaspuri Branch. The BOB MICR code is a nine-digit code where the first three digits, “110,” indicate the city, the middle three digits “012” are indicative of the bank, and finally, the last three digits reflect the unique bank branch itself.

The Bank of Baroda SWIFT code is another banking code that you’d be familiar with if you have many any international bank transfers or even received money internationally. A SWIFT code, as assigned by the Society for Worldwide Interbank Financial Telecommunication, identifies your BOB branch internationally through an 8-11 character alphanumeric code.

BARBINBBBHI, for example, is the Bank of Baroda SWIFT code for the Bhilai branch. Here the first four characters, “BARB” is bank code, “IN” is the country code, followed by “BB,” and “BHI,” which is the location code. For all international online transfers or even international banking communications, you’d need your Bank of Baroda SWIFT code for any transfers to be initiated.

Now that you’re familiar with the different banking codes, their uses, and code structures, you are surely wondering about where you can find the right code when you need it. You might have tried to look for your Bank of Baroda IFSC code through various means; here are some secure ways of finding the valid IFSC, MICR, or SWIFT code that you want to acquire:

Find Your Bank - IFSC Search Tool

Finding and confirming your Bank of Baroda IFSC code can be cumbersome, and you end up with an invalid code. You may have to look for the MICR and SWIFT codes of the same branch separately. Advanced IFSC search tools like Find Your Bank can be a one-stop destination to find any banking code and even additional information for the BOB branch that you need.

Follow these steps to get your banking code in no time:

With these details, the page will be directed to bank IFSC, MICR, and SWIFT codes, as well as the branch address and other bank details. To make your search even faster, you can simply download the Find Your Bank mobile app and find your desired banking codes quickly, anywhere, and anytime.

You can also find the IFSC and MICR codes in your Bank of Baroda cheque leaf at the top and bottom of the cheque, respectively. The bank passbook also mentions the concerned branch IFSC code next to the account holder’s information.

The official RBI website is another reliable source to find your Bank of Baroda IFSC code. Visit https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx and fill in your bank details to find the desired code. BOB’s banking portal https://www.bankofbaroda.in/ also consists of all updated banking codes, which you can view by logging in.

Your BOB SWIFT code can be found by logging in and clicking on ‘View Statement’ for checking your recent bank statements. However, the best way to confirm the valid SWIFT code for your bank branch is by simply calling BOB Customer Care at their customer service number - 1800 102 4455.

Bank of Baroda offers online money transfer methods for different priority cases. The most popular banking modes for BOB money transfer include NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service).

An NEFT transfer allows you to transfer money 24/7 in iterations of deferred settlement batches. Bank of Baroda makes NEFT available on all days of the week at any time. These payments, however, are not cleared in real-time. If your payment doesn’t go through in the current session, it will be cleared in the following half-hour session.

BOB permits a maximum limit of up to Rs. 5 Lakhs through NEFT with no minimum limit. The NEFT charges through online transfers and the branch are listed as follows:

| Transfer Amount |

Charges for Online Transfer |

Charges for Branch Transfer |

| Up to Rs. 10,000 | Rs. 2.25 + GST | Rs. 2.25 + GST |

| Rs.10,000 - Rs. 1 Lakh | Rs. 4.75 + GST | Rs. 4.75 + GST |

| Rs. 1 Lakh - Rs. 2 Lakh | Rs. 14.75 + GST | Rs. 14.75 + GST |

| Over Rs. 2 Lakhs | Rs. 24.75 + GST | Rs. 24.75 + GST |

The documents and details needed for an NEFT transfer include:

An RTGS transfer is used to carry out high-value transfers in real-time. It is typically used in cases of emergencies, and a minimum of Rs. 2 Lakh needs to be transferred. While many banks don’t apply an upper limit on RTGS, Rs. 5 Lakh is the upper limit per transaction for BOB.

BOB offers RTGS from 8 AM to 4:30 PM from Monday to Friday except for bank holidays. The RTGS payments occur in real-time and have the following charges depending upon the transfer amount:

| Transfer Amount |

Charges for Online Transfer |

Charges for Branch Transfer |

| Rs.2 Lakh - Rs. 5 Lakh | Rs. 24.5 + GST | Rs. 24.5 + GST |

| Over Rs. 5 Lakh | Rs. 49.5 + GST | Rs. 49.5 + GST |

Following sender’s and Beneficiary’s details are needed to get started with an RTGS transfer:

IMPS or Immediate Payment Service mode is an instant mode of money transfer that you can use on any day of the year and at any hour. BOB offers IMPS that can be carried out with the help of a 7-digit MMID that is linked to the receiver’s bank account.

The IMPS limit for BOB is Rs. 50,000 per day and Rs. 2,50,000 per month. The IMPS transfers are made almost instantly and are charged as follows depending upon the transfer amount:

| Transfer Amount |

Charges for Online Transfer |

Charges for Branch Transfer |

| Up to Rs. 1000 | Re. 1 + GST | Rs. 2 + GST |

| Rs.1000 - Rs. 25,000 | Rs. 1.5 + GST | Rs. 3 + GST |

| Rs. 25,000 - Rs. 2 Lakh | Rs. 5.5 + GST | Rs. 10 + GST |

The following details are required before you can initiate an IMPS transfer online:

Bank of Baroda is an Indian government-owned bank founded by Sayajirao Gaekwad III on 20th July 1908. Headquartered in Vadodara, Gujarat, BOB offers a variety of banking and financial services under the ownership of the Ministry of Finance, Govt. of India.

Bank of Baroda offers regular savings, basic savings, super savings, Champ account, Senior Citizen Privilege Savings, and several other types of accounts. With 9,482 branches and 13,193 ATMs, Bank of Baroda has over 132 million customers and 100 overseas offices.

The interest rates for Bank of Baroda for general and senior citizen’s savings accounts are as listed below as of 16th April 2021:

| Tenure Period | Interest Rates for General Citizens(%) | Interest Rates for senior Citizens(%) |

| 7 days to 14 days | 2.80 | 3.30 |

| 15 days to 45 days | 2.80 | 3.30 |

| 46 days to 90 days | 3.70 | 4.20 |

| 91 days to 180 days | 3.70 | 4.20 |

| 181 days to 270 days | 4.30 | 4.80 |

| 271 days & above and less than 1 year | 4.40 | 4.90 |

| 1 year | 5.00 | 5.50 |

| Above 1 year to 400 days | 5.10 | 5.60 |

| Above 400 days and upto 2 Years | 5.25 | 5.75 |

| Above 2 Years and upto 3 Years | 5.25 | 5.75 |

Following documents are required, and conditions need to be fulfilled to open an account in Bank of Baroda:

No, Bank of Baroda credit and debit cards do not have linked IFSC codes. IFSC codes are reserved only for net banking purposes such as NEFT, RTGS, etc.

In most cases, the wrong IFSC code forbids the transfer from going through. However, in the case of an identical account number from a different branch, a debit can occur, but it can be recovered through the bank internally.

The last six characters of your 11 digit Bank of Baroda IFSC code are indicative of the bank branch. For example, the IFSC code for Uttar Pradesh Faizabad Motibagh Branch is BARB0FAIZAB. Here “FAIZAB” is the branch code.

The Bank of Baroda IFSC code can be found at the top of each cheque in the cheque book and on the front page next to the account holder’s information in your BOB passbook.