Bank Of India IFSC Code and MICR Code

Bank Of India IFSC Code and MICR Code

Find Bank Of India IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Bank Of India IFSC Code and MICR Code

Bank Of India IFSC Code and MICR CodeFind Bank Of India IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Bank Of India IFSC Code Finder - Select Your State

Bank Of India IFSC Code Finder - Select Your StateDo you agree that each one of us is racing against time in our daily lives? We are trying hard to save time everywhere possible. When it comes to banking, online banking has made it possible to make our bank visits a rare occurrence. We all rely on the Bank of India IFSC Code to accomplish our banking needs.

Online banking has completely transformed the way of conducting banking activities. You can complete all your financial transactions on the go, whether you are in the midst of work or stuck in a traffic jam.

It is essential to find the correct Bank of India IFSC Code to complete the transactions appropriately. However, I would like to tell you that though digital marketing enhances convenience, you also need to use it with caution. But, do not worry! The article is all about the basics of digital banking.

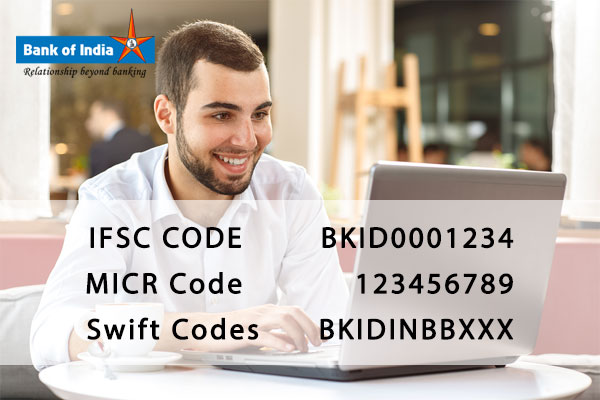

You must have heard the term IFSC Code several times if you use net banking often. Your bank might have asked you for details like account number, account holder's name, and IFSC Code. Ever wondered what IFSC Code is? RBI assigns unique IFSC (The Indian Financial System Code) to identify each bank that participates in the payment system. It is an alphanumeric code with 11 digits that is mandatory to transfer funds from one bank to another.

The initial four characters of the code signify the bank name, and the next character is zero. The last six characters are numbers that indicate the branch code. The last characters of the IFSC Code make it unique. For example, Bank of India Azadpur New delhi Branch IFSC code is BKID0006020.

Electronic payment systems like NEFT and RTGS use BOI IFSC Code. It enables you to transfer funds from your bank to another branch of the same or another bank. The code makes sure that no discrepancy occurs in the transactions.

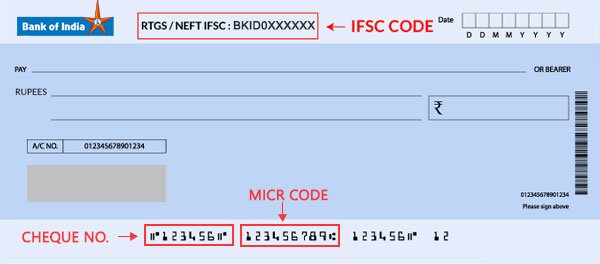

Have you ever analyzed a cheque carefully? Do you know that a code is printed at the bottom of the cheque adjacent to the cheque number? It is MICR or Magnetic Ink Character Recognition technology code. A MICR code is a unique 9-digit code that identifies banks and branches that participate in ECS.

The initial three digits are the city code aligned with the PIN code for postal addresses in India. The next three digits signify the bank code. The last digits are the branch code.

For example, the MICR Code of new Sabzi Mandi, Azadpur, New Delhi is 11001302.

MICR uses Character Recognition Technology that validates the legality and authority of paper-based documents in the bank. Bank of India MICR Code utilizes the code to verify cheques for clearance. It is explicitly required when you are filling up different financial forms like SIP.

SWIFT Code is almost similar to the Bank of India IFSC Code. SWIFT Code is used explicitly during international bank wire transfers. It identifies the country, branch, and bank that is held by your receiver's account.

SWIFT Code, also known as Bank Identifier Code (BIC), enables your bank transfer to reach the correct destination. Several banks utilize the code to exchange messages between them. ISO or International Standard Organization accepts the SWIFT Code, making it valid for financial and non-financial institutions.

A SWIFT code is 8 or 11 letters and numbers. The 11-digit code signifies the bank branch, while the 8-digit code indicates the head office.

The first four characters represent bank code letters; the next two contain only letters that are the country code. The next two characters are the character location code. The last three characters are the branch code.

Bank of India SWIFT Code of Ahmedabad Large Corporate Branch is BKIDINBBACB.

You would now agree that BOI IFSC Code, MICR, and SWIFT Code are critical to an online banking transaction. But, having enough information about the codes is not sufficient. You also need to know the way to locate these. Don't you? There are several sources to find the codes, like bank websites and third-party search engines. However, there is another alternative too. You can make use of 'Find Your Bank,' which is an online search tool.

It is both an app and website from where you can access the details at anytime you want. Let us see the way it works.

'Find Your Bank' is a user-friendly tool that enables you to find the correct bank branch codes. And yes! You will also be able to trace the address from a known Bank of India IFSC Code for a branch.

Let me tell you that there are other sources to find the codes. Here are the details of the additional sources.

Your bank passbook contains the IFSC and MICR Code of the specific branch you hold your account.

Your bank cheque book contains IFSC and MICR code. Bank of India IFSC Code is located on the cheque's top corner, while the MICR code is at the bottom.

RBI has an official website https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx from where you can locate the bank's codes in a fraction of seconds.

Bank of India's digital platform will help you locate the codes, adding to your convenience.

Do not worry if you cannot trace the correct bank codes to carry national and international transactions. The solution to your problem is BOI customer care, which will help you get the valid SWIFT code.

There is another more straightforward way to get the code. You can sign in to your BOI account and view the bank statements. It will help you get the correct required code.

NEFT

If you use online banking for your banking needs, then you must have heard of NEFT. National Electronic Funds Transfers are used the most to transfer money online. RBI has introduced NEFT to facilitate seamless transfer of funds between banks all across India.

NEFT is a safe platform that does not require a demand draft or cheque to carry the transactions. RBI allows to carry NEFT transactions any time, but credits to be beneficiary account shall either occur on the same day or immediately next working day. It is dependent on the payment time and beneficiary bank.

RBI does not state any limitation on the amount to transfer through NEFT. Setting the limit is dependent on the specific bank.BOI levies additional charges of Rs. 2.50 per transaction on up to Rs.10,000 and Rs.5.00 Rs 10,000-1 lakh per transaction through NEFT online.

BOI NEFT requires the following:

RTGS facilitates the transfer of funds from one bank account to another in 'real time.'It means that the beneficiary will receive the amount immediately within 30 minutes as soon as you make payment. All in all, RTGS or Real-time Gross Settlement is the fastest possible money transfer facility between banks.

RTGS is a secure channel across all the banks in India. Indeed, you can conduct funds transfer through RTGS to anyone globally.

Bank of India levies Rs.2.50 per transaction for transaction pf up to Rs.10,000 through RTGS while Rs.5.00 for Rs.10,000-1lakh. It is Rs. 15 for 1 lakh -2 lakh and Rs.25 above two lakhs.

You need to have the following details to transfer funds through RTGS.

Immediate Payment Service or IMPS is introduced by NPCI and empowers bank customers to transfer funds immediately within any IMPS-enabled bank across India. What is so unique about IMPS? IMPS is available 24*7 and is accessible through ATM channel, net, and ATM banking. It also provides simplicity in transactions.

Bank of India allows a maximum limit of Rs. 2 lakh per transaction per day. The bank levies Rs.2.50 per transaction up to Rs.10,000 and Rs.5 per transaction above Rs.10,000.

The customer needs to be a retail internet banking customer to utilize BOI IMPS. You will also require the recipient's account number of IFSC.

Bank of India was founded and initiated in 1906. It has its headquarters in Bandra Kurla Complex, Mumbai. The bank was under private ownership till 1969, when it got nationalized with 13 other banks.

Bank of India has around 5000 branches in India spread across states and union territories. It has 500 zonal offices and 8 NBG offices that control the branches. The bank is the first among nationalized banks to establish ATM and fully computerized branch way back. The bank has 3328 ATMs on-site and 4095 off-site ATMsas of April 2018 issued by RBI.

You can open a Bank of India Savings Account by submitting the following documents–

Bank of India savings account types include –

|

Account types |

Minimum balance requirement |

Rate of interest |

|

BOI Savings Account Balance |

Zero balance savings account |

2.90% p.a. |

|

BOI Savings Plus Scheme |

Rs.25000 in a savings account Rs.5000 in a term deposit |

Nil |

|

BOI Star MahilaAccount |

Rs.5000 |

2.90%p.a. |

In case you have wrongly entered the beneficiary details and made the incorrect transaction, immediately inform the bank—Call BOI customer helpline number. In case the account number you mentioned does not exist, your money will be transferred automatically. However, if the account number exists, take immediate help from the bank. Provide bank details to prove that you have transferred to the wrong account.

Yes, a person with no bank account can transfer funds through NEFT. Transfer can be done to a beneficiary having a bank account with another NEFT member bank. You can transfer funds by depositing cash at the nearest NEFT-enabled bank's branch. You need to provide additional details like a complete address and telephone number. The payment is restricted to a maximum of Rs.5000 per transaction.

Yes, you can use NEFT to transfer funds from/to NRI/NRO accounts in the country. However, the transaction will be subject to the mentioned provisions.

No, you do need registration for receiving money using the Aadhaar number or bank account details. However, mobile registration is mandatory if you receive money through mobile no. or MMID (Money Mobile Identifier).

No, IMPS involves immediate fund transfer. So, you cannot stop or cancel the payment after initiating it.