Central Bank Of India IFSC Code and MICR Code

Central Bank Of India IFSC Code and MICR Code

Find Central Bank Of India IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Central Bank Of India IFSC Code and MICR Code

Central Bank Of India IFSC Code and MICR CodeFind Central Bank Of India IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Central Bank Of India IFSC Code Finder - Select Your State

Central Bank Of India IFSC Code Finder - Select Your StateWe are surrounded by several facilities that have made our life easier. Be it electronic gadgets/online shopping, we have everything at our convenience. Similarly, online banking has helped us to avoid visiting the bank and stand in long queues. We all now rely on the Central Bank of India IFSC Code for our banking needs.

Online banking has changed the way we conduct banking activities. It is no more the way it used to be a long time back. It enables you to complete financial transactions in one go, whether you are stuck in a traffic jam or work.

Though digital marketing has enhanced convenience in our lives, you also need to utilize the services with precautions. It is essential to find the correct CBI IFSC code to do fund transfer appropriately. But you don't have to worry!

Here is the blog for you that has all details related to online banking.

If you are using net banking services often, I am sure you must have heard about IFSC. Your bank might have requested you for details like the account holder's name, account number, and IFSC Code. But do you know what the IFSC code is?

IFSC is an alphanumeric code with 11 characters. It is broken down into three parts. Initial 4 characters denote the bank's name, and the fifth character is zero reserved for the future. The last six characters are mostly numbers but can also be alphanumeric. These signify the specific branch's bank.

For example, the CBI Udupi branch Karnataka IFSC code is CBIN0283152.

RBI assigns the Indian Financial System Code to recognize each bank participating in the electronic payment system. Central Bank of India IFSC Code enables you to make electronic payments like NEFT and RTGS.

It allows customers to transfer funds between bank's other branches or different banks. IFSC helps regulate the funds by identifying destination and source bank for transactions. The code ensures zero chances of discrepancy in the transactions.

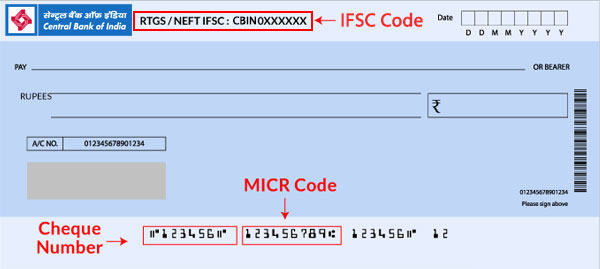

Have you noticed a cheque carefully? There are specific codes at the bottom. One of them is the cheque number, but do you know what the other one is? The MICR or Central Bank of India MICR Code plays a critical role in monetary transactions. It is a 9-digit unique code that allows quick processing of the bank's cheque.

The first three digits denote the city code aligned with the PIN code for India's postal address. The next three digits are the specific bank code, while the last digits are the branch code. MICR code of Anand Vihar Branch, Delhi is 110016122.

MICR validates the authority and validity of paper-based documents in the bank. The code verifies cheques for clearance and is required to fill up different financial forms like SIP.

A SWIFT code or BIC code is an exclusive code that recognizes non-financial and financial institutions. It is chiefly conducted wire transfers between banks internationally. It helps to identify the country, bank, and branch held by your receiver.

SWIFT code is almost similar to the Central Bank of India IFSC Code as it enables the bank to transfer funds to the correct destination. Several banks also use it to exchange messages between them.

A SWIFT code has 8 or 11 numbers or letters. While the 11-digit code indicates the bank's branch, the 8-digit code refers to the head office.

The first four characters indicate the bank code letters, while the subsequent two letters are the country code. The following two characters are the location code, and the last three characters are the branch code.

For example, the CBI SWIFT code of Mumbai, International Division is CBININBBXXX.

Now that you know about the dates, you might agree that the CBI IFSC code, MICR, and SWIFT code are critical to a digital banking transaction. But only information is not sufficient to transfer funds. You should also know the way to locate the codes correctly.

There are several sources to search the correct codes, like multiple third-party websites and bank websites. However, there are other options. One of them is "Find Your Bank'' is an online search tool. '‘Find Your Ban'’ is both an app and a website where you can access your bank details anytime you want. It works in the following manner.

Apart from this, there are additional sources to find the appropriate branch codes. Here are the details of the sources.

Your bank cheque book has IFSC and MICR codes. Central Bank of India IFSC Code is at the cheque's top corner, while MICR is located at the cheque's bottom next to the cheque number.

The bank passbook has the IFSC and MICR Code of the particular branch you have your account.

RBI has an official website https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx. You can access the website to locate the codes of the specific bank's branch quickly.

The Central Bank of India's digital platform enables you to locate the specific branch codes. It will add to your convenience in finding the codes.

Do not worry if you cannot find the correct SWIFT code of your bank with all the other methods. You can rely on CBI customer care that is available 24*7. The customer care team will help you get the valid SWIFT code of the bank.

Another straightforward way of finding the bank codes is through your bank statements. You can sign in to your CBI bank account and analyze your bank statements. It will enable you to get the correct bank codes.

NEFTenables are transferring funds from the remitter's account in one bank to the beneficiary account either in the same bank or another bank in India. NEFT is utilized by either individuals, firms, and corporates to transfer money online.

NEFT is available for current and savings bank account. It is suitable to make transactions above Rs 2lakh. NEFT transfers funds in batches, and there are nearly 12 hourly settlements in a day.

Central Bank of India has not set any minimum or maximum limit for individual customers. However, for walk-in customers who deposit cash, the NEFT amount cannot exceed Rs.50,000 per transaction.

CBI levies Rs.2.50 for transaction up to Rs10,000 while Rs.5.00 for Rs.10,000-Rs.1lakh. The charges exceed Rs.15 for transactions between Rs. 1lakh to Rs. 2lakh, while you have to pay Rs. 25 for transactions above Rs. 2lakh.

You will need CBI ISFC Code for both the sender and payee to make a transaction through NEFT. You will also need beneficiary name and address and beneficiary account number and type.

RTGS involves transferring funds in real-time. It is one of the fastest and safe methods to transfer funds through a banking channel. RBI has developed a continuous, robust, and integrated payment system.

Banks and financial institutions use RTGS to transfer funds for customers and inter-bank transactions on an irrevocable and immediate basis. CBI has set a floor or minimum limit of Rs. 2 lakh for RTGS transactions, while there is no maximum limit.

However, there is a maximum limit for internet banking users. The maximum limit is Rs. 5 lakhs per transaction for the individual customer while it is Rs. 100 crore per day for corporate customers.

Central Bank of India levies Rs.25 for Rs. 2lakhs -Rs 5 lakhs per quarter while Rs 50 for above Rs 5 lakhs.

You need to have the beneficiary's name and account number and Central Bank of India IFSC code to transfer funds through RTGS.

IMPS or Immediate Payment Service is a tool to transfer money instantly within banks across India through the internet, mobile, and ATM. It is safe and economical in financial and non-financial perspectives available 24*7.

IMPS is simple and easy to use, accessible, and inexpensive. It enables bank customers to use mobile instruments to access their bank accounts and remit funds.

CBI sets Rs. 1lakh as a maximum amount per transaction through IMPS, while Rs. 2lakh is the maximum amount per day. The number of transactions per day has no limit. The bank charges Rs 5 for the amount up to Rs 2 lakhs.

You will be able to utilize CBI IMPS if you are using retail internet banking. You will also need the recipient's account number and IFSC.

The Central Bank of India was established in 1911. It is the first Indian commercial bank that is wholly owned and managed by Indians. During the past 106 years, the bank has successfully launched several innovative and unique banking activities.

CBI has a massive distribution network in 29 states and 6 out of 7 UTs in India. It holds a prominent position among the public sector banks on account of 4659 branches in the country. It has one extension counter with ten satellite offices at various centers (as of February 2019).

The bank offers a suite of financial services and products that include deposits, agri-banking, loans, cards, and NRI banking.

Central Bank of India account types include –

|

Account types |

Rates of interest (%) |

|

Home Savings Safe Accounts – Up to Rs 10 lakh Above Rs 10 lakh (linked with repo rate) |

2.90 2.75 |

|

Fixed deposit |

3.25% (for 60 to 90 days) |

Customer Information File is a document that contains every detail of the account holder (account number, address, name, and transactions). You can find your CIF number in the bank passbook and cheque book. You can also find it by logging in to your CBI internet banking account and by visiting your home branch.

NEFT is a safe, secure, economical, and error-free way to transfer funds from CBI's branch to another branch or a different bank branch. Another benefit is its organized nature and batch-wise settlement. It is paperless and has no minimum and maximum transaction. You can also make payment to a corporate or firm through NEFT.

You will need the beneficiary's MMID to transfer funds through IMPS. You can initiate IMPS once you have received the MMID. You can conduct IMPS through mobile banking applications, internet banking, and SMS. IMPS transactions will also require the Central Bank of India IMPS code to transfer funds to any CBI branch.

You need to provide the correct IFSC code to conduct a valid online funds transfer. In case you submit the wrong code, the funds are rerouted to the transferor's account after getting debited first. In some instances, if funds are transferred to the wrong account, you should contact and seek the CBI branch immediately.

No. Online funds transfer is not possible without providing IFSC Code. However, if you are transferring money through digital wallets, you don't have to mention the recipient's IFSC code.