HSBC IFSC Code and MICR Code

HSBC IFSC Code and MICR Code

Find HSBC IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

HSBC IFSC Code and MICR Code

HSBC IFSC Code and MICR CodeFind HSBC IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

HSBC IFSC Code Finder - Select Your State

HSBC IFSC Code Finder - Select Your StateIndian Financial System Code or the IFSC code is a standard Indian system used for transferring online funds between different bank branches. All Indian banks come with unique IFSC codes, which vary from branch to branch. HSBC IFSC code is a part of this Indian banking system.

The IFSC code is a unique combination of alphanumeric characters, and it is required during any online transfer like NEFT, RTGS, and IMPS. This blog talks in detail about how you can find the IFSC codes of HSBC bank along with the MICR and SWIFT codes. You will also learn about the usage of these different codes, their purpose, and their benefits. Let's begin.

The HSBC IFSC code is an eleven-character code assigned by the Reserve Bank of India. The first four characters in this combination stand for the bank name, zero is the fifth character, and the last six characters correspond to the branch location or name.

The IFSC code for each branch of HSBC is different for each branch. Let's see this formation with examples- the HSBC Kolkata Gariahat branch IFSC code is- HSBC0700005, and the HSBC Mumbai Bandra branch IFSC code is HSBC0400004.

What is the importance of the IFSC code? The IFSC code is important to initiate any online money transfers. For example- if you are sending money to your friend via NEFT, you will need to know his/her bank's IFSC code in order to initiate a successful transaction.

The IFSC code is allotted to locate each branch of the bank. A correct IFSC code will locate each branch no matter where it is located and help in payment processing.

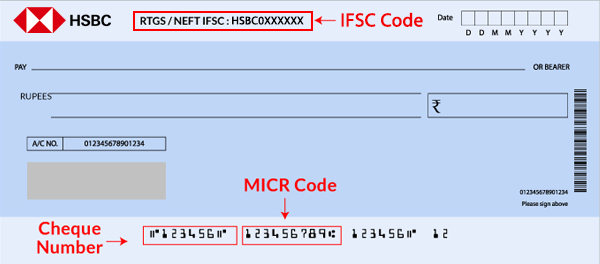

Magnetic Ink Recognition (MICR) is a technology used for printing paper-based documents or databases such as cheques. MICR code also helps in identifying branches of the bank, but it is not related to online transfers. Banks use a MICR reading machine to identify the branch and initiate a faster cheque processing. HSBC MICR Code has nine digits containing numerics only.

The structure of the HSBC MICR code goes like the first three codes are for the city, the next three codes are for the bank, and the final three codes are for the branch. For example, the MICR code HSBC Allahabad branch is 380039002. The code is different for every branch.

Unlike IFSC code and the MICR code, which are used for national transactions, SWIFT code is used for sending and receiving financial information globally. The Society for Worldwide Interbank Telecommunication (SWIFT) assigns codes to banks for international fund transfers. The SWIFT code is known as the BIC code ( Bank Identifier Code) as well. The BIC or the SWIFT code of HSBC bank is an eleven-character code containing both numbers and alphabets.

Here the first four characters represent the bank, followed by two letters representing the country, the next two numbers stand for the location, and the last three characters are for the branch (it is optional). The SWIFT code of the HSBC Mumbai branch is HSBCINBB.

You can find the HSBC IFSC code, MICR, and SWIFT code through the following means-

You can search for any HSBC branch IFSC, MICR, and SWIFT code in the find your bank website and also in their mobile app. To find these codes in the find your bank site, you need to-.

Other ways to find these codes

Nowadays, all banks come with their individual sites and mobile apps. It is very easy to find the IFSC, MICR, and SWIFT codes through them.

The IFSC and MICR codes are also printed on the checkbooks and passbooks; hence, you can search for them there as well.

The Reserve Bank of India website provides information regarding the IFSC, MICR, and SWIFT codes of all banks, including HSBC Bank.

Another way to find these codes is by contacting your HSBC customer care service. It is the easiest and most convenient way to find the IFSC, MICR, and SWIFT codes.

Online fund transfer methods like NEFT, RTGS, and IMPS have made sending money quite easily. If you want to know how to utilize these systems, look out for the points below-

National Electronic Fund Transfer (NEFT) has become one of the most popular methods of making online fund transfers. NEFT is a DNS-based system meaning money is transferred in different batches. To send money through NEFT, you need to enter the beneficiary account number, beneficiary name, IFSC code, and email id.

Let's look into the charges of NEFT in the table below.

| Amount |

Charges |

|

Upto Rs. 10,000 |

Rs. 2.5 per transaction |

|

From Rs. 10,001 to Rs. 1 Lakhs |

Rs. 5 per transaction |

|

Rs. 1 lakh to Rs. 2 lakhs |

Rs. 15 per transaction |

|

Rs. 15 per transaction |

Rs. 25 per transaction |

The timings for making NEFT transactions are-

RTGS is primarily used for making high-value transfers domestically. You will need the same documents for sending money through RTGS as you required during NEFT. Let's look into the charges, timings, and transfer limits of RTGS in the chart below-

| Amount |

Charges |

Timings |

|

Rs. 2 lakhs to Rs. 5 lakhs |

Rs. 25 per transaction |

Monday to Friday 9 am- 5 pm |

|

Above Rs. 5 Lakhs |

Rs. 50 per transaction |

Saturdays except for 2nd and 4th Saturdays 9 am to 5 pm. |

If you need to make an instant fund transfer, IMPS is the system you must rely on. To make payments through IMPS, you need to have the following-

Additionally, the minimum and maximum transfer amount of IMPS is Re.1 and Rs. 2 lakhs, respectively, and it is available 24*7 all around the year. Now let's look into the charges and limitations of HSBC IMPS transfer mode.

|

Amount |

Charges |

|

Upto Rs. 1 lakhs |

Rs. 5 per transaction |

|

Rs. 1 lakh to Rs. 2 lakhs |

Rs. 15 per transaction |

HSBC is a British financial service holding and multinational investment bank. It originated in British Hong Kong, and the current form of HSBC bank was established in London by the Shanghai and Hongkong banking corporation in 1991.

Presently the bank has 3,900 branches across 65 countries worldwide. According to Forbes magazine, as of 2014, HSBC is the world's 6th largest public company. HSBC is categorized into four business categories- global banking and markets, commercial banking, global private banking, retail banking, and wealth management.

You can find the HSBC Basic Statistical code or the BSR code TDS certificates, Challan Identification Number (CIN).

We will need the HSBC IFSC code to make successful online fund transfers through NEFT, RTGS, etc.

You can find the HSBC branch codes through the bank's official website and also on the Reserve bank of India Website. Find your bank also provides the IFSC codes of all HSBC branches.

No, you can't use NEFT for international fund transfers. It is meant for regional transfers only.

No, you won't find the HSBC IFSC code on your HSBC credit card.