IDBI Bank IFSC Code and MICR Code

IDBI Bank IFSC Code and MICR Code

Find IDBI Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

IDBI Bank IFSC Code and MICR Code

IDBI Bank IFSC Code and MICR CodeFind IDBI Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

IDBI Bank IFSC Code Finder - Select Your State

IDBI Bank IFSC Code Finder - Select Your StateBanking codes add security and convenience to all forms of online banking. Whether it is a quick money transfer or a hefty cheque to be processed, IFSC and MICR codes make the process secure and easy for verification. Your IDBI Bank IFSC Code can be used for NEFT, RTGS, IMPS, and other net banking transfers.

This article will help you explore how IFSC, MICR, and SWIFT banking codes operate. You will also get some insight into what different segments of these codes indicate. Finally, you will read about where you can find these codes easily and accurately. Let’s get started with understanding IDBI Bank IFSC codes.

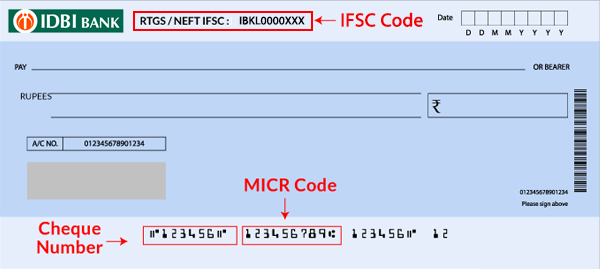

The IDBI Bank IFSC Code represents an IDBI Bank branch uniquely for a particular state in India. It is an 11-digit alphanumeric code assigned by RBI to every bank for the unique identification of a branch in a particular location. It begins with the first four characters as bank code, the fifth one as “0”, and the remaining six characters are the bank branch code.

For example, IDBI Bank New Delhi Punjabi Bagh Branch IFSC Code is represented as “IBKL0000248”. As per the standard format of IFSC, the first four characters, “IBKL,” represent the bank code assigned to IDBI Bank. The fifth one is kept as “0”. The last six characters represent the Punjabi Bagh Branch Code which is “000248”.

The IFSC Code is important for all online transactions like RTGS, NEFT, and IMPS. The correct IFSC Code links to the desired receiver’s bank branch.

The MICR Code is a unique identification number that is used for cheque authentication and filling the banking slips. The MICR Code makes the process of cheque identification faster. You will find the MICR Code printed on the cheque at the bottom beside the cheque number. The MICR Code for IDBI bank is printed using Magnetic Ink Character Recognition Technology that detects fraudulent cheques instantly.

The MICR Code is a 9-digit numeric pin. As per the format, it is divided into three parts. The first three digits hold the city code. The city code is none other than the pin code that represents the postal address code. The next three digits hold the bank code and the last three digits hold the branch code.

For instance, the MICR Code for IDBI Bank in Karnataka, Branch HSR Layout in Bangalore is “560259017”. The first three digits, “560,” indicate the Bangalore City Code, the next three digits, “259,” indicate the IDBI Bank Code, and the last three digits, “017,” indicate the IDBI Bank Branch Code.

The IDBI Bank SWIFT Code is a bit different as compared to IDBI Bank IFSC Code. The SWIFT Code is a Bank Identifier Code. BIC specifically denotes a particular bank or branch. Well, its purpose is to initiate bank transfers, particularly for international money transfers.

The IDBI Bank SWIFT Code format has eight letters. Its format holds the first four letters as the IDBI Bank Code, the next two characters represent the country code, the next two characters represent the location code, and the last three characters represent the IDBI Bank Branch Code. You can add an optional “XXX” code if necessary.

For instance, the IDBI Bank SWIFT Code for the Pune location is “IBKLINBB.” The first four characters, “IBKL,” indicate the IDBI Bank Code. The next two characters, “IN,” indicate the Country Code (India). The next two characters, “BB,” indicate the IDBI Bank Branch Code.

After reading about the composition of banking codes and how you can check for all elements of a valid code, the next question is where to find your banking code. We have listed below some easy and sure-shot ways of finding the right IDBI Bank IFSC Code.

IFSC Search Tool - Find Your Bank

There can be several ways of finding your desired IDBI Bank IFSC Code. The most straightforward and easy way is through IFSC search tools. Find Your Bank is an advanced IFSC search tool that gives you a one-click option to find the right banking code. You can also access additional information such as the branch address and other details about the official bank branch.

To start with your search on Find Your Bank, you just need to follow some easy steps:

After selecting the last detail, the site will redirect you to a list of the particular branch’s IFSC code, MICR code, SWIFT code, branch address, and other details about the specific IDBI bank branch. For someone making transactions on the go, Find Your Bank’s mobile app can be handy on your phone to make a quick search as and when you need.

You can also find the IFSC and MICR codes on your bank cheque book and passbook. In the cheque book, each leaf contains the IFSC code on the top and the MICR code printed at the bottom next to the bank code. The IFSC code on the passbook can be found next to the account holder’s information.

Another excellent way of confirming your IDBI banking codes is by searching on your IDBI banking portal at https://www.idbibank.in/index.asp. You can also check specific codes of other banks at the RBI official website - https://www.rbi.org.in/Scripts/IFSCMICRDetails.aspx.

A SWIFT code search or confirmation can be a little more difficult. If you are looking for a SWIFT code that you’ve used before, your recent bank statement can give you a hint. Click on “View Statement” and check the previous transactions. If you’re starting afresh and unsure, simply call the IDBI Bank Customer Care number at 1800 209 4324 to find your branch SWIFT code.

The process of money transfer is possible because of various modes of money transfer provided by IDBI Bank. Out of these, RTGS, NEFT, and IMPS are the most commonly used modes for money transfer. More information is detailed about the procedure of transferring Money using IDBI Bank NEFT, RTGS, and IMPS here:

National Fund Transfer System, abbreviated as NEFT, is one of the fastest modes for fund transfer. Due to upgrades, it is now possible to transfer Money via NEFT using cell phones as well as with the system. For transferring the amount, an essential thing is filling up the proper IFSC Code of the Bank Branch.

NEFT transactions are forwarded in 48 half-hourly batches. NEFT services are available 365 days, 24x7. If an individual has transferred the amount within the cut-off time interval, then it reaches the receiver’s bank account on the same day. If, by chance, the transfer doesn’t fit into the cut-off time interval, then the amount reaches the receiver’s bank account the next day.

One can instantly transfer the amount by logging into their IDBI Bank account. The exact time for a transaction is 8:00 AM to 7:00 PM from Monday to Saturday except for the 2nd and 4th Saturdays.

Note: IDBI Bank doesn’t charge for NEFT transactions made via mobile banking or internet banking. It charges for the NEFT transactions initiated at the bank branches through the nominal accounts. The table shown below depicts the charges imposed for NEFT transactions at the bank branches

| Transfer Amount | NEFT per Transaction Charges |

| Up to Rs. 10,000 | NIL |

| Rs. 1 Lakh - Rs. 2 Lakh | Rs15 Per Transaction |

| Over Rs. 2 Lakhs | Rs 25 Per Transaction |

Before making a successful transfer, a few details are important to fill in. You need to add the beneficiary details to the payee list. It includes beneficiary’s bank account number, beneficiary name, IFSC Code of Bank Branch in which the amount is to be transferred, the desired amount to be transferred, and remarks, if any. IDBI Bank has set a transfer limit of Rs. 5 Lakhs/day with no lower limit.

Additional Note: GST Charges are applied on all IDBI NEFT transactions.

IDBI Bank RTGS

Real-Time Gross Settlement Payment, abbreviated as RTGS, is one of the fastest modes of fund transfer. It is one of the quickest modes for settling the payments. The RTGS fund transfer provides the flexibility to transfer funds within a day. Contrary to others, RTGS offers instant payments rather than offering net exchange settlements at the end of banking hours.

As per RBI timelines, the IDBI Bank follows a strict schedule for transferring funds via RTGS. Its fixed timings on weekdays are between 9:15 AM to 4:15 PM. The timings for Saturdays are 9:00 AM to 1:00 PM.

It’s noteworthy that bank transfers should be initiated at the given timeline. The list below depicts the charges imposed by the IDBI Bank on making payments via RTGS. The charges imposed are dependent upon the amount that is to be transferred. A minimum of Rs. 2 Lakh must be transferred for an RTGS transfer.

RTGS transfer charges are as follows

| Transfer Amount |

NEFT per transaction charges |

| Inward Transactions | NIL |

| From Rs. 2 Lakh - Rs. 5 Lakh | Rs 30 per transaction without exceeding the amount |

| Over Rs. 5 Lakhs | Rs 55 per transaction without exceeding the amount |

Following are some important details that are mandatory to raise the request for transferring funds through RTGS:

IDBI Bank IMPS

IDBI Bank IMPS Fund transfer allows customers to initiate an online fund transfer categorically for those who are IMPS Bank account members. The IMPS Fund transfer request can be raised easily through mobile banking or internet banking in a secure way. The IMPS Fund transfer facility is granted by the National Payment Corporation of India via National Financial Switch.

The following charges are imposed by the IDBI Bank for making an IMPS fund transfer:

| Transfer Amount | IDBI IMPS Charges |

| Under Rs 1000 |

NIL |

| From Rs 1001 to Rs 100000 |

Rs.5 per transaction |

| Over Rs. 1 Lakhs |

Rs.15 per transaction |

Listed below are the required details for transferring funds via IMPS:

Note: IDBI Bank has set a limit of Rs 50,000 per day for online fund transfer.

IDBI stands for Industrial Development Bank of India. It was established on July 1st, 1964, under an act of Development Financial Institution. Headquartered in Mumbai, it has 3,683 ATMs, and 1,892 local and overseas branches collectively. From its inception, it has been a full-service universal bank that offers multiple financial and banking solutions such as fixed deposits, investment solutions, recurring deposits, loan services, and more.

IDBI Bank aims to grant customers excellent services and deliver committed solutions. They have set their pace to offer a range of digital solutions that benefits the pan-India network of bank branches and ATMs. Their vision is to build long-term relationships with existing customers and to be the most promising bank on the horizon.

The table below depicts the interest rates for the IDBI saving balance. It is calculated on a daily basis, depending upon the balance maintained in the savings account. These rates are levied as of May 2021:

| Savings Balance | Rate Of Interest (%p.a) |

| Under Rs 50 Lakhs | 3 |

| From Rs 50 Lakhs to Rs 2 Cr | 3.25 |

| Over Rs. 2 Cr |

3.40 |

Rates of Interest for term deposits of general and senior citizen’s account for IDBI as listed as follows as of April 16, 20

| Tenure Period(Days) |

Interest Rates for General Citizens (%) |

Interest Rates for Senior Citizens (%) |

| 0 day to 6 days | NA | NA |

| 7 days to 14 days | 2.70 | 3.20 |

| 15 days to 30 days | 2.70 | 3.20 |

| 31 days to 45 days | 2.80 | 3.30 |

| 46 days to 60 days | 3.00 | 3.50 |

| 61 days to 90 days | 3.00 | 3.50 |

| 91 days to 180 days | 3.50 | 4.00 |

| 181 days to 270 days | 4.30 | 4.80 |

| 271 days to 364 days | 4.30 | 4.80 |

| 365 days | 4.90 | 5.40 |

| 400 days to 2 years | 5.00 | 5.50 |

| 2 years 1 day to 3 years | 5.10 | 5.60 |

| 3 years 1 day to 5 years | 5.25 | 5.75 |

| 5 years 1 day to 10 years | 5.25 | 5.75 |

For opening a savings account in IDBI Bank, the following documents are required:

The IDBI CIF number can be found on your chequebook, passbook, or prior bank statements. To confirm your IDBI Bank CIF number, you can also call the IDBI Customer Care toll-free number or visit the nearest bank branch.

The IDBI Bank BSR code is a 7-digit Basic Statistical Return Code. This is typically used for tax and income tax processes. The BSR code is assigned by the RBI for a particular IDBI bank branch.

No, two IDBI bank branches will not have the exact same code. However, the code can be really similar at times with the same country code and bank code. Ensure to check the branch code to avoid any confusion.

The IDBI Bank IFSC code has several use cases with online banking, including NEFT, RTGS, and IMPS transfers. You need to punch in the receiver’s valid IFSC code to initiate a transfer.