Indian Bank IFSC Code and MICR Code

Indian Bank IFSC Code and MICR Code

Find Indian Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Indian Bank IFSC Code and MICR Code

Indian Bank IFSC Code and MICR CodeFind Indian Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Indian Bank IFSC Code Finder - Select Your State

Indian Bank IFSC Code Finder - Select Your StateYour job may force you to stay away from your family. But with the help of the internet, you can take care of your family's finances - thanks to online banking. All you need is the IFSC Code. For instance, if you want to deposit money to your parents' Indian Bank account, you need the Indian Bank IFSC Code.

With the internet's help, you can even transfer funds to a different country using the SWIFT key. What if you want to create a paper trail of your transactions? Don't worry; you can still use the cheque. The MICR Code will make the process faster. Confused by all these "Codes"? What are they, exactly? Let's find out about the Indian Bank IFSC Code, MICR Code, and SWIFT Code.

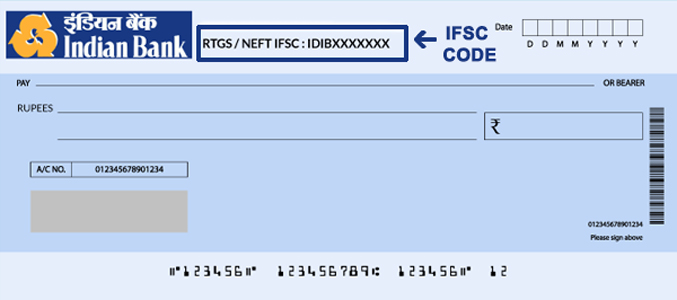

Are you new to the idea of net banking? Then the term IFSC Code must have confused you a couple of times. Transactions to an account at Indian Bank, like all other banks, require you to use the correct Indian Bank IFSC Code. If you look carefully, you'll notice that the Indian Bank IFSC Code contains 11 digits. There are both letters and numbers. What do these stand for?

The four letters at the beginning indicate the bank name. The Indian Bank IFSC Code starts with IDIB. This part of the code remains the same for all branches of the bank in all locations. The second part of an Indian Bank IFSC Code has six digits, both alphabetical and numerical. They represent a particular branch of the bank. This part of the code, which starts after a "0" following the alphabetical part, is always unique.

The numerical part of the code sets one Indian Bank IFSC from another. The RBI assigns the IFSC Codes to the different branches of a bank. Now, let's consider an example. Suppose your parents have an account at the Bopal branch of Indian Bank in Gujarat. The Indian Bank Bopal Branch IFSC Code is ALLA0212749. Of these, ALLA represents the bank, and 212749 represents the Bopal branch.

If you want to send money within India, you need the IFSC Code. It is used for RTGS, IMPS, and NEFT. You must use the right code to prevent refunds and delays.

Is net banking going to phase out cheques soon? Experts in the banking sector don't think so. Thankfully, with the help of the MICR Code, fund transfers by cheque have become much faster. If you look at a leaf from your cheque book, you'll notice a code at the bottom. At the time of clearing the cheque, banks read this code using a magnetic reader. This helps banks to process cheques much faster compared to manual processing.

The faster the bank and branch of the cheque are recognized, the quicker it's sorting and processing. The advanced MICR technology makes that possible. Like the IFSC Code, it helps to identify the branch - except during cheque payments.

The Indian Bank MICR Code has nine numbers. Let's say you need to write a cheque from your Indian Bank account in Gariahat, Kolkata. The cheque will have a MICR Code of 700019011.

If you live abroad, sending money to your family back home can be a scary thought. But once again, net banking comes to the rescue! But here, too, you'll need a code to get the payment rolling, and it is called the SWIFT Code with 8-11 digits.

This code is also used to send money abroad from India. These international transactions are completed using Wire Transfer. It becomes possible because nearly all banks in the world are associated with the SWIFT network.

The Indian Bank SWIFT Code, also called the BIC Code, helps identify banks and branches. Based on the location, bank, and nature of the transaction, you must find the SWIFT Code. So talk to the bank before making the transaction.

Clearly, the Indian Bank IFSC Code, MICR Code, and SWIFT Code are essential parts of every banking transaction. Now the question is, how do you find these? There are many ways to find these, like third-party search engines and bank resources.

An easy way to go about this is to use an online search tool like Find Your Bank. This platform has a website and an app that you can use to access the details needed anywhere you want. Here's how it works:

In addition, you can also refer to the following to find the details:

You'll find the Indian Bank IFSC Code at the top of the leaf. The MICR Code is at the bottom. There are four sets of digits there. The second series is the MICR Code.

Your Indian Bank passbook contains the MICR Code and IFSC on the first page.

Your paper statement, as well as your e-statement on the Indian Bank site and on your email id, contains the IFSC Code and the MICR Code. The SWIFT Code, if applicable, is also on the statement.

Indian Bank's digital banking facilities, both the website and the app, can give you the information you need.

Calling the bank or visiting them to know the codes is a great option.

All the relevant information is available on the RBI website. Of these, contact the bank branch might be the best option for you when you need the SWIFT Code. That's because this code might change depending on the bank location, correspondent bank, or currency.

Now you know how to get the Indian Bank IFSC Code, MICR Code, and SWIFT Code. It's time for the real action, i.e., sending money. There's not much to say about money deposits using a check. So let's take a look at the different fund transfer methods by net banking and their charges.

If you want to send money online to an account within the country, you can use NEFT. This is a secure method that takes around 2 hours to complete as the transaction requests are processed in batches. If it is not processed during specific hours, the transaction will be completed the following working day. To make an NEFT payment, you need to add the payee's details to your list of beneficiaries. These details include the account holder's name, account number, bank name, and location. Of course, you have to add the Indian Bank IFSC Code. Indian Bank charges a small amount for NEFT transactions. They are as follows:

| Transaction Amount | NEFT Fees |

| Up to 10,000 INR | 3 INR |

| 10,000 INR to 1,00,000 INR | 6 INR |

| 1,00,000 INR to 2,00,000 INR | 14 INR |

| 2,00,000 INR and Above | 29 INR |

If you have to transfer a high-value amount, you can resort to RTGS. You must make a fund transfer of at least INR 1 Lakh. Since these transactions are processed individually, RTGS is completed quite quickly within the same say after adding the details of the beneficiary, including the Indian Bank IFSC Code.

For RTGS, too, you'll have to pay a fee to Indian Bank. The charges are as follows:

| Transaction Amount | RTGS Fees |

| 2,00,000 INR to 5,00,000 INR | 29 INR (plus tariff, as applicable, up to 35 INR) |

| 5,00,000 INR and Above | 58 INR (plus tariff, as applicable, up to 63 INR) |

The fastest method of transferring funds up to INR 2 Lakh is IMPS. Indian Bank makes this service available throughout the day. The funds will reflect in the receiver's accounts within minutes.

For this method, you don't necessarily need to add the details to your beneficiary list in advance. You can make the payment by adding the details at the time of payment.

The charges you have to pay Indian Bank for IMPS transfers are as follows:

| Transaction Amount | IMPS Fees |

| Up to 25,000 INR | None |

| 25,000 INR to 2,00,000 INR | 6 INR |

Indian Bank is one of the most trusted banks in the country. This state-owned bank was founded in 1907. Since then, it has built quite a reputation for itself. It has its headquarters in Chennai.

Indian Bank has 6000+ branches, 5000+ ATMs, and around 1500 cash deposit facilities around the country. It is one of the top-performing banks in the country. Plus, with Allahabad Bank merging with it, it's now the 7th largest bank.

What's more, it has a network of 227 correspondent banks located in 75 nations. This bank has garnered a total revenue of ₹24,717 crores as of 2020. The bank, with its long history, strives to improve banking experiences for its customers.

Indian Bank savings account types include:

| Account Type | Minimum Balance | Minimum Requirement |

| Savings | -500 INR (without cheque operation) & 1000 INR (with cheque) - Non-urban locations - 1000 INR (without cheque) & 2500 INR (with cheque) - Urban/Metro Locations - None for pensioners/students on scholarship |

Individuals, two or more people for joint accounts, HUF, trusts, institutions, agencies, clubs, etc. |

| IB Smart Kid | 100 INR (without cheque) & 250 INR (without cheque) |

Anyone between 1 and 18 years of age, under parental supervision |

| SB Platinum | 25,000 INR | High Net-Worth Individuals and Organisations |

| IB Samman | None | Anyone above 60 Years |

| IB Mahila Shakti |

1,000 INR | Women aged 18 years and above |

| IB Kishore | NIL | Anyone between 10 and 18 years of age who can put a signature |

| IB Gen X | 1,000 INR | Resident individual between the ages of 18 and 40 |

| IB Salaan | NIL | Defence Personnel |

| Pensioners Account |

NIL | State, Central, and EPF pension recipients |

| Small Account |

NIL | NREGA Employee |

| Account for Students under Govt Loan and DBT |

NIL | Students receiving Govt. Scholarships and Direct Benefit Transfers |

The interest rate paid by Indian Bank on Savings Accounts was 3% until November 2020, after which it was reduced to 2.9%. To have an account, you must be an Indian resident and have valid KYC documents to prove your nationality, age, etc. For some accounts, you will also need proof of employment.

You can also have an account at Indian Bank if you are a non-resident returning to India permanently or living abroad but want to make deposits and remittances in an Indian account.

A CIF number is a unique code assigned to bank account holders. If you have an account in the Indian Bank, your 9-digit CIF will include all the details associated with your account. From your loan to your PAN card number, everything is connected to this code. It won't change if you decide to close an existing account and start a new one.

The purpose of the Indian Bank IFSC Code is to give a unique identity to every branch. So IFSC Codes of different branches of the same bank will never be the same. The only similarity will be the bank code at the beginning, which reveals the bank's identity. So, the Gariahat (Kolkata) branch and the Colaba (Mumbai) branch will each have a different Indian Bank IFSC Code, though both start with IDIB.

Your Indian Bank IFSC Code helps to identify the branch and location of the payee account to process the payment quickly. If you enter an incorrect Indian Bank IFSC Code, the transaction will not be completed, and the amount will be refunded to your account. You will not lose the money, but the entire process will be delayed. If the transfer is within the same bank, the transfer might be completed even after entering the wrong Indian Bank IFSC Code.