Indian Overseas Bank IFSC Code and MICR Code

Indian Overseas Bank IFSC Code and MICR Code

Find Indian Overseas Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Indian Overseas Bank IFSC Code and MICR Code

Indian Overseas Bank IFSC Code and MICR CodeFind Indian Overseas Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Indian Overseas Bank IFSC Code Finder - Select Your State

Indian Overseas Bank IFSC Code Finder - Select Your StateOnline banking has pretty much become the need of the hour for all kinds of transactions, bookings, shopping, and other purposes. To ensure these transactions are prompt and secure, banking codes like the IFSC, MICR, and SWIFT codes are set in place.

If you're struggling with your Indian Overseas Bank IFSC code validation or other banking information, this article will help you get your perspective clear.

Check out the compositions and use-cases of different banking codes, how to use them, and understand where you can find them. Let's start by exploring the structure and purpose of bank IFSC codes.

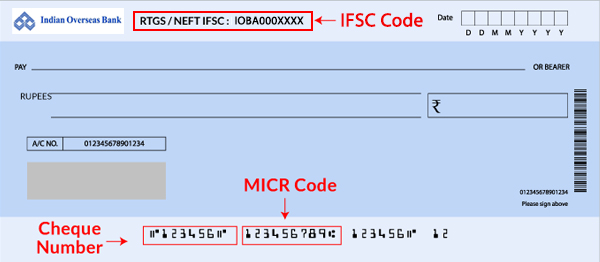

IFSC code is short for Indian Financial System Code. The Reserve Bank of India assigns this code to every bank and its branch all over India. The IFSC code has 11 characters in total, combining alphabets and numerals. This eleven-digit code incorporates bank code, a default digit zero, and ends with the branch code.

The IFSC code chain begins with the first four characters representing the bank code. The fifth digit, which is a default one, is set as 0. The chain ends with a six digits branch code. For initiating any online transactions via RTGS, NEFT, and IMPS, you need to input an IFSC code.

IFSC code identifies the bank and its branch. If anyone wants to transfer funds online to another bank account, then the IFSC code is the one that validates and ensures a successful transaction. It is essential to mention the IFSC code for transferring funds to legit bank account holders.

For instance, the Indian Overseas Bank Maharastra City Parbhani Branch IFSC Code is IOBA0002242 is IOBA0002242. The first four alphabets,' IOBA,' are the bank code. The fifth digit is set to '0'. The remaining chain ends with six digits, '002242', indicating the branch code.

The main purpose of using IFSC code is to accomplish successful electronic transactions. You can find the IFSC code on the front page of the bank's passbook and also over the bank cheque.

MICR code is short for Magnetic Ink Character Recognition code. It is a unique numeric code that authenticates and verifies banking documents like cheques, slips, etc. You can find MICR code print over cheques or on the bank's passbook front page.

MICR code speeds up the processing of transaction confirmations. This code is present at the bottom of the cheque beside the cheque number. The presence of MICR code verifies and audits the details available on the cheque.

The most helpful fact is that the MICR code is readable and understandable by humans and also verifiable by a machine. MICR code consists of 9 digits in total. The format of this code begins with the first three digits as the city code. The following three digits are the bank code, and then the last three digits are the branch code.

For instance, the MICR code for Deolali city in Nashik is '422020003'. In this example, the first three digits, '422', are the city code. The next three digits, '020', are the bank code. The ending three digits' 003' are the branch code.

The MICR code allows the bank and its branches to participate in ECS transactions with proper validation of cheques.

SWIFT Code, also called the Bank Identifier Code(BIC), is particularly given to recognize the branch internationally. It is preferred for initiating any international transactions between the two banks. You must mention the SWIFT code for several transactions, but it is most preferable for international transactions.

A SWIFT code usually consists of 8 or 11 digits combining alphabets as well as numerals. The structure of the SWIFT code begins with a series of digits which are the bank code. The following two characters are the country code.

The chain continues further with the subsequent two digits as the location code. This ends up in either three alphanumeric characters indicating the branch code or an optional code.

For instance, the SWIFT code for the Agra branch is 'IOBAINBB266'. In this example, the first four characters, 'IOBA,' indicate the bank code. The following two characters, 'IN,' imply the country code. The next two characters, 'BB,' show the location-based codes. The ending three digits' 266' indicate the branch code.

Now, you have read up on the different types of banking codes, their structure, and their uses. You'd also need to know where you can use these. Typical online NEFT, RTGS, and IMPS transfers require you to put in an IFSC code of the destination bank.

MICR codes are required for different official documentation and cheque processing purposes. And, your bank SWIFT code will come into play for international money transfers and fund collection. Your Indian Overseas Bank IFSC code can be found at different places, but it can be difficult to track which codes are the valid and most updated ones.

IFSC search tools can be a great place to start to find not only valid codes but other banking details for that particular bank branch. One of the best ways to toggle between searching and validating banking codes is using Find Your Bank.

Find Your Bank is an advanced search tool that helps redirect a targeted search to find the right banking codes and bank branch information in no time. With Find Your Bank, you can run a quick search for finding the right bank IFSC code and also search for other information related to your bank branch.

Whether you want to search for the right Indian Overseas Bank IFSC code or find relevant information for the bank address and other details of the bank branch, Find Your Bank can be a one-stop destination. What is more, is you can do it all in a few easy clicks.

1. Visit the official FindYourBank website.

2. Put in your bank details in the code finder, or select your concerned Indian Overseas Bank from the listing.

3. Choose the state and district of your bank branch.

4. Fill in the branch of your bank to complete the search.

With all your details filled in, the page will be redirected to all the relevant information about your bank IFSC code, MICR code, SWIFT code, and additional banking information about your bank branch. For frequent quick searches, you can just download the Find Your Bank mobile app for a quick and easy search on the go.

Your Indian Overseas Bank IFSC code can, in fact, be verified at several official banking documents. The passbook, for instance, will have the IFSC code printed next to the other banking information of the account holder.

Both the IFSC as well as MICR codes can be found in your chequebook, rather than with every individual cheque. The MICR code is printed at the bottom of every cheque leaf in magnetic ink next to the bank code printed at the left bottom.

A cheque leaf is, thus, a good place to find all account and money transfer information. This is the reason canceled cheques are often required for money transfers to your account.

Not sure if you're checking the current code or an old one? This can be an error even if you have all bank account documents, especially when a code has been updated or changed. Checking the RBI official website for the right Indian Overseas Bank IFSC code, or the banking code for any bank for that matter can be a good way of accessing all updated codes.

You can also visit Indian Overseas Bank's online banking portal to check whether you are using the right codes and their right versions. For SWIFT code, you might not find one printed that easily on bank documents.

Previous bank statements can be used to check SWIFT codes that you have used earlier. Just log in to your Indian Overseas Bank account and click on "view statement."

If you're starting afresh, don't hassle yourself and simply call Indian Overseas Bank's customer care number or visit your bank branch to confirm the branch SWIFT code. 1800 425 4445 is the customer service number for Indian Overseas Bank that you can use to make a quick SWIFT code inquiry or any other inquiry.

Due to digital transactions, fund transfers have been pretty flexible to initiate. As per the RBI guidelines, there are three different methods through which payment is made online.

These three online modes of payment are NEFT(National Electronic Fund Transfer), RTGS(Real-Time Gross Settlement), and IMPS(Immediate.

Payment Transfer). Each has its advantages, and these are explained below:

NEFT, shortened form for National Electronic Fund Transfer, is one of the online payment methods that elevate the transactions between two banks. You can transfer funds online Via NEFT using internet banking applications. You can even consider a physical visit to the bank for performing NEFT transactions.

Indian Overseas Bank allows its customers to use either of the ways for transferring funds. It clears the NEFT fund transfers in batch settlements. Your beneficiary receives the amount on the same day or the next day depending upon the accomplishment of batch settlements.

These batch settlements take an hour as per the stipulated time frame. The NEFT transactions online through internet banking are available 24 by seven, all 365 days. On the other hand, for offline NEFT transactions, Indian Overseas Bank follows strict timings.

The timings for offline NEFT fund transfers are from Monday to Friday, 9:00 AM to 7:00 PM. On the bank holidays, offline NEFT fund transfers aren't possible. Except for 2nd and 4th Saturdays, you can perform offline NEFT fund transfers from 9:00 AM to 7:00 PM.

Indian Overseas Bank applies charges for every outward NEFT transaction. These charges are presented in the table below:

| Transfer Amount | NEFT per transaction charges(in Rs) |

| Under Rs. 10000 | 1.50 |

| Rs. 10001 to Rs. 1 Lakhs | 4 |

| More than 1 Lakh to 2 Lakhs | 14 |

| More than 2 Lakhs | 24 |

Note: For NEFT fund transfers, Indian Overseas Bank applies GST charges. The minimum amount limit for NEFT transactions is Rs. 5000/- Whereas the maximum amount limit for NEFT transactions is Rs 2 Lakhs.

The documents required for initiating NEFT transactions are mentioned below:

RTGS is a shortened form for Real-Time Gross Settlement which is a faster mode of payment as compared to NEFT. You can transfer funds from one bank to another bank using RTGS with a validated IFSC code. RTGS transactions can be done either online using mobile banking or internet banking or visiting the bank physically.

Indian Overseas Bank follows a strict schedule for offline RTGS fund transfers. The timings for RTGS fund transfers are from Monday to Saturday, 8:00 AM to 6:00 PM, except for 2nd and 4th Saturdays. On public holidays, offline RTGS transactions aren't possible. The online RTGS transactions are flexible and available 24 by 7, all 365 days.

RBI enables RTGS fund transfers for initializing flexible and hassle payments on a real-time basis across the country. Indian Overseas Bank applies charges on certain amounts for RTGS fund transfers. The table below depicts the charges that are applicable on certain fund transfers:

| Transfer Amount | RTGS per transaction charges(in Rs) |

| Rs. 2 Lakhs to Rs. 5 Lakhs | 24 |

| More than Rs. 5 Lakhs | 49 |

For RTGS fund transfers, the minimum transaction limit is Rs. 2 Lakh, whereas the maximum transaction limit is Rs 5 Lakhs.

The following are the documents that are required for initiating RTGS fund transfers:

IMPS is an acronym for Immediate Payment Services. IMPS is an even faster mode of payment when compared with RTGS. It initiates fund transfers between two bank accounts instantly without any delay. This facility is only available online that too 24 by seven all 365 days.

It is meant to be the most flexible mode of payment that you can use for initiating immediate fund transfers. Indian Overseas Bank allows IMPS fund transfers only through Internet Banking or Mobile banking facilities. You can even transfer funds on public holidays to another bank account.

Indian Overseas Bank applies some charges on specific amounts for IMPS fund transfers. The table presents below mentions some costs that are applicable:

| Transfer Amount | NEFT per transaction charges(in Rs) |

| Under Rs. 10,000 | 2.50 |

| More than Rs 10,000 to Rs 1 Lakh | 5 |

| Rs. 1 Lakh - Rs. 2 Lakh | 15 |

For IMPS fund transfers. The maximum amount for transactions is Rs. 2 Lakh/- whereas the minimum amount for a transaction is Rs 10,000/-

The following are the details required for transferring funds through IMPS:

IOB, or Indian Overseas Bank, is one of the leading nationalized banks in the banking sector. It was first established in the Tamil capital of Chennai; hence IOB's headquarters are in Chennai. In total, there are 3700 IOB bank branches and 3300 ATMs. The headquarters itself has 1150 bank branches.

IOB is paired with overseas banks located in Singapore, Seoul, Colombo with a Joint Venture Bank India International Bank in Malaysia, Hongkong, and Bangkok. The bank branch present in Bangkok is the oldest branch that was first permitted to start the Indian Overseas Bank branch in Thailand.

IOB established its branches overseas in Bangkok on 23rd December 1947. Today, the Indian Overseas Bank in Thailand has completed six decades of banking facilitates. It provides a wide range of features like banking, investment solutions, and many more.

It has partnered with the leading Indian Business Community in Thailand to get updated with progress on multiple factors like international trade and other business requirements.

This bank has been stated as the most popular public sector bank that sources flexible facilities and provides easy, competitive remittance. The vision of IOB is not to leave any opportunity to ensure customer satisfaction.

It offers unlimited retail banking products and services to customers. IOB grants a fixed rate of interest on certain capital. It has always tried to facilitate customers with unlimited and robust banking services.

IOB provides a decent rate of interest of 3.05% on the capital available in a regular savings account. It also brings some interesting schemes for fixed deposits under a decent rate of interest. The chart below holds the rate of interest applicable on the savings account of general citizens as well as senior citizens as of 09.11.2020:

|

Tenure Period

|

Interest Rates for

|

|

| 7 days to 14 days | 3.40 | 3.90 |

| 15 days to 29 days | 3.40 | 3.90 |

| 30 days to 45 days | 3.40 | 3.90 |

| 46 days to 60 days | 3.90 | 4.40 |

| 61 months to 90 days | 3.90 | 4.40 |

| 91 days to 120 days | 4.40 | 4.90 |

| 121 days 179 days | 4.40 | 4.90 |

| 180 days to 269 days | 4.90 | 5.40 |

| 270 days t less than 1 year | 4.90 | 5.40 |

| 1 year 1 day to 400 days | 5.15 | 5.65 |

| 444 days | 5.20 | 5.70 |

| 2 years to less than 3 years | 5.20 | 5.70 |

| More than 3 years | 5.20 | 5.70 |

To Open a Savings account, the following documents are required:

Eligibility Criteria for Opening a Savings Accounts in IOB:

Your Indian Overseas Bank BSR or Basic Statistical Return Code can appear on various documents. Typically, you can find it on your TDS certificate, in your CIN number, and other OLTAS challan and deduct details.

The bank code is not the same as the IFSC code. Your bank code is actually a part of your Indian Overseas Bank IFSC code. For instance, in IOBA0002242, IOBA is the bank code within this IFSC code. Thus, the same bank has different IFSC codes assigned to it depending upon the concerned branch.

No, the IFSC codes of the two bank branches will not be identical. For a different branch within the same bank, the bank code, country code, and standard digits would be the same. But, the codes can be easily differentiated based on the branch code.

A SWIFT code is used to trigger communications between international banks for a smooth transfer process. With the IBAN or International Banking Account Number, you can get your bank account identified internationally for internal fund transfers.