Jammu And Kashmir Bank IFSC Code and MICR Code

Jammu And Kashmir Bank IFSC Code and MICR Code

Find Jammu And Kashmir Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Jammu And Kashmir Bank IFSC Code and MICR Code

Jammu And Kashmir Bank IFSC Code and MICR CodeFind Jammu And Kashmir Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Jammu And Kashmir Bank IFSC Code Finder - Select Your State

Jammu And Kashmir Bank IFSC Code Finder - Select Your StateIFSC or the ‘Indian Financial System Code’ is an important credential provided by your branch. You might often wonder what role does your Jammu and Kashmir Bank IFSC code play in transactions. Well, it is a unique identification number comprising 11 digits and is issued by your bank under the guidance of RBI.

The primary purpose of the IFSC code is the identification of your bank branch. It is also mandatory for successful transactions through electronic payment systems like NEFT, RTGS, and IMPS. The RBI uses this code to monitor your transactions to ensure the security of your fund.

MICR code is another important detail you need to be familiar with. It is printed on the cheque leaf and is used by your bank to process, verify and clear cheque payments. To get wholly acquainted with these terms and understand how to use them, refer to the following detailed guide.

Your Jammu and Kashmir Bank IFSC code is an 11 digit alphanumeric code that you can find on the bank passbook and other documents as well. It is the most vital data you will be required to put in while making online payments. This code encourages paperless transactions and makes them safe and hassle-free.

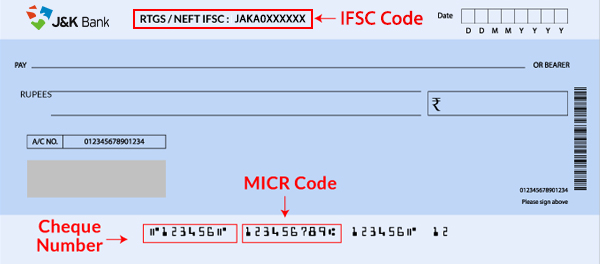

For example, Jammu and Kashmir Bank Air Cargo branch IFSC code is in the format ‘JAKA0AIRCAR.’ It can be segmented into three parts, where the first four characters (JAKA) depict the name of the bank, the fifth digit is always a zero, and the last six digits (AIRCAR) indicate the branch code.

Your bank utilizes this coded information to acknowledge payments.

Your J&K MICR code is a unique code as well, but it has a different function. You can find it on the cheque leaf. This code is printed using the MICR or Magnetic Ink Character Recognition technology. It is mandatory for the identification and clearance of your cheques.

For instance, the nine-digit code of the J&K Bank Baramulla branch is ‘193051107.’ The first three digits (193) give you the city name, aligned with the PIN code used for postal addresses in India, the next three digits (051) represent the bank, and the last three digits (107) represent your branch.

The SWIFT code or the Society for Worldwide Interbank Financial Telecommunication code is one of the Bank Identifier Codes (BIC). It is an identification code used by your bank to complete international transactions. It helps in authenticating and facilitating your payments.

It is a combination of several characters and is usually made of 8-11 digits. You can break this code down into four parts:

The SWIFT code of the Jammu and Kashmir Bank Srinagar branch is ‘JAKAINBBSRI.’ The code enables you to complete international wire fund transfers. It also aids in interbank communication.

The Jammu and Kashmir IFSC code, MICR code, and SWIFT code are crucial for completing payments, and hence you should always have them handy. There are several ways to find out these codes, and they are elaborated below:

It is an online webpage that provides several banking services. It is the most convenient way to find your bank credentials. To find your IFSC and MICR code, go to the website: https://findyourbank.in/ and enter the following details-

Once you complete the above-said procedure, you will be able to see all the required codes. Find Your Bank has also come up with a mobile application that you can download and access anywhere at all times. The mobile app makes it even less of a job to find these codes, as you can do it all in a matter of clicks.

You can find these credentials easily on your bank documents. The IFSC and MICR codes can be located on the bank passbook and cheque book. It is usually present on the first page of your passbook and among the details mentioned on the cheque leaf. You can find the SWIFT code in your bank statements.

You can find your J&K IFSC code and MICR code through the official website of RBI or the Reserve Bank of India. RBI stores the IFSC and MICR code for the branches of all the banks present in India.

Simply log in to the Netbanking or Mobile banking portal with the required bank credentials. Once you log in, you can surf the available options and obtain the desired code.

To find the SWIFT code specifically, look for the digital bank statement in the online banking platform, where you will be able to see the SWIFT code.

In case you face any inconvenience in the mentioned procedures, approach the customer care of your respective bank or branch, and they will guide you. You can also go to your branch and inquire in person.

Electronic fund transfer methods like NEFT, RTGS & IMPS make transactions very convenient and effortless. You can complete successful payments from the comfort of your home using some information.

Your JK Bank IFSC code helps you to settle these transactions. Along with it, you will also require:

Once you are ready with these details, you can initiate electronic transactions quickly.

The National Electronic Fund Transfer or NEFT was developed by the Reserve Bank of India and is the most opted online transaction method. It settles transactions in batches and works on the Deferred Net Settling or DNS system.

The details of the NEFT service of J&K bank is mentioned ahead.

| Timings | Available round the clock |

| Charges applicable |

Rs 2.50 for transactions up to Rs 10,000 Rs 5 for transactions above Rs 10,000 & up to Rs 1 Lakh Rs 15 for transactions above Rs 1 lakh and up to Rs 2 Lakh Rs 25 for payments above 2 Lakhs |

| Settlement | Batches |

| Maximum and Minimum limits | No limits imposed on NEFT |

GST applicable

You can complete NEFT payment through the Netbanking or Mobile banking service of J&K bank. You just need to log in to the desired platform and enter the details required as mentioned above and select the NEFT option. Enter your details and read the terms and conditions. After reviewing, complete the transaction.

RTGS or Real-Time Gross Settlement is a payment method that has settlements in real-time. Transactions are completed at the time of receipt only. It is based on an individual or gross system. Payments made through RTGS are irreversible. It is utilized mostly for higher amounts.

| Timings | J&K bank working hours |

| Charges applicable |

Rs 25 for 2 Lakhs to 5 Lakhs ( 8 am- 4.30 pm) Rs 20 for 2 Lakhs to 5 Lakhs ( beyond 4.30 pm) Rs 50 for transactions above 5 Lakhs (8 am- 4.30 pm) Rs 45 per for transactions above 5 Lakhs ( beyond 4.30 pm) |

| Settlement | Real-time |

| Minimum and maximum limit |

The minimum limit is Rs. 2 lakhs There is no maximum limit |

To use the RTGS service, simply login to the online banking service of J&K Bank with your details. You will require Jammu and Kashmir Bank IFSC code and other credentials mentioned earlier. Select the RTGS fund transfer option and input the details. Before completing the transaction, read the terms and conditions.

It is a fast electronic fund transfer method available throughout the year, even on bank holidays. It is renowned for being instant and quite feasible. To avail of the IMPS service, use the internet or mobile banking service of J&K Bank. Make sure to have the following credentials at the time:

| Timings | Available all times |

| Settlement | Instant |

| Charges |

Rs. 5 up to Rs. 1 Lakh Rs. 15 on Rs. 1 Lakh to Rs. 2 Lakhs |

| Minimum limit | Rs. 1 |

| Maximum limit | Rs. 2 Lakhs |

Use the IMPS service of J&K bank by visiting the mobile application of J&K bank. Log in with your bank credentials. Next, select the ‘IMPS’ option from the fund transfer menu and enter the required details as mentioned above. You will be required to provide a passcode in order to verify the transaction. This passcode will be provided to you during the process.

Once you verify, an affirmation text message along with your transaction number will be sent to your respective mobile number. This would indicate the successful completion of your transaction. You can use the transaction number to keep track of the transaction, and it also helps to raise concerns in case of inconvenience.

In order to receive money, provide the remitter required details.

The Jammu and Kashmir Bank, established in 1938, is a scheduled Commercial Bank with its headquarters in Srinagar. It is among the oldest private banks in India and can be stated as the leading bank in Jammu & Kashmir and Ladakh.

Reserve Bank of India has assigned the J&K bank to carry out all the banking affairs for the government of Jammu & Kashmir, and Ladakh. It makes sure to uplift all sectors through special banking services. The schemes cover businesses, employees of all sectors, farmers, independent workers, corporates, etc.

J&K bank provides different account types to their customers. Primarily it could be categorized as savings and current account. Further details are mentioned ahead.

| Savings Account |

Eligibility- Resident individuals, Hindu undivided families, Minors above 10(eligible for a self-operated minor account) Documents: Photographs, identification proof, other required documents for minors |

| Current Account |

Eligibility- Resident individuals, Joint accounts, partnerships, firms, associations, etc. (as specified by RBI) Documents: Photographs, identification proof, partnership deed, documents for associations and registrations, etc., as specified by the bank. |

Charges and interests can vary. Approach your branch to get accurate information.

Yes, J&K is a completely safe bank. It is among the list of oldest private banks and provides reliable and customer-centric services. It is designated by RBI, and all your payments and funds are safely monitored. You can approach your branch directly in person or make a call to the customer care number anytime for queries.

Your J&K Bank IFSC Code is a unique identification code that represents your branch. It is mandatory for completing online fund transfers through NEFT, RTGS, and IMPS. It also helps in tracking the origination and final placement of payments.

You cannot directly find the Jammu and Kashmir Bank IFSC code through the account number. However, there are multiple easy ways to obtain your IFSC code. Follow the guidelines mentioned in the article.

Visit the online banking platform. Go to the login portal, then click on the forgot password link. You will be guided to fill in the required details. Keep the bank credentials ready.

NEFT and RTGS transactions can be done during the banking hours of J&K bank. In most cases, NEFT is accessible all the time.