Suryoday Small Finance Bank IFSC Code and MICR Code

Suryoday Small Finance Bank IFSC Code and MICR Code

Find Suryoday Small Finance Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Suryoday Small Finance Bank IFSC Code and MICR Code

Suryoday Small Finance Bank IFSC Code and MICR CodeFind Suryoday Small Finance Bank IFSC Code, MICR Code and branch details for NEFT, RTGS & IMPS transactions.

Suryoday Small Finance Bank IFSC Code Finder - Select Your State

Suryoday Small Finance Bank IFSC Code Finder - Select Your StateThe modernization of the Indian banking system has made everyone's day-to-day financial transactions easy, queueless, time-saving against earlier cumbersome methods. If you want to send money to the person having an account in the Suryoday Small Finance Bank, you should know about the Suryoday Small Finance Bank IFSC Code.

IFSC is an acronym for Indian Financial System Code (IFSC). It is an eleven-digit alphanumeric code. It is unique for every bank and its various branches across PAN India. As mentioned above, an IFSC code helps you in transferring funds online.

The IFSC code is very important in online money transfers from one bank to another. Being different for every bank and its branch, it is used to identify the branches while using online services. These include services such as National Electronic Funds Transfer (NEFT), Real-time Gross Settlements (RTGS), IMPS, and Unified Payment Interfaces (UPI).

To find your bank's unique IFSC code, you can look into your bank passbook or cheque book. Similar to the IFSC code, you have another useful MICR code. It is a 9-digit code. It uniquely identifies the bank and its various branches that participate in the Electronic Clearing System (ECS).

The detailed guide can help you understand the terms IFSC code and MICR code of your Suryoday Small Finance Bank. So, let's dive straight into this.

The Suryoday Small Finance Bank IFSC Code is an 11-digit alphanumeric code. It is issued only by the Reserve Bank of India to all the Indian banks and their various branches of PAN India. To easily find your IFSC code, look into your passbook, cheque book, or online bank statements.

Let's break down this 11-digit code which RBI also uses to keep track of all your payments for security purposes. The initial four characters of the IFSC code are alphabetic, and they represent the name of your bank. On the other hand, the last six digits exemplify the branch of the bank. At last, the fifth character is reserved for use in the future and is always zero.

For example, the Suryoday Small Finance Bank, Sadashivpeth branch IFSC code is SURY0000017. In this, SURY denotes the name of the bank, the fifth digit is zero, and the last six digits, i.e., 000017, denotes the branch of the bank, which is the Sadashivpeth branch in this case.

Without a proper IFSC code, you can not process the online transfer of funds via electronic methods such as National Electronic Funds Transfer (NEFT), Real-time Gross Settlements (RTGS), IMPS, and Unified Payment Interfaces (UPI).

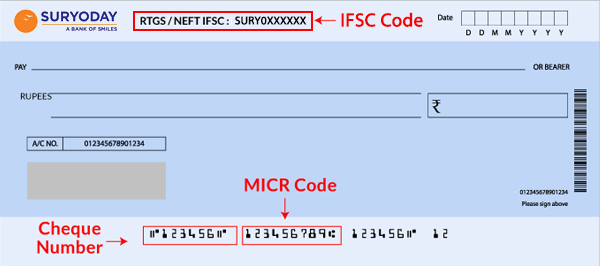

The Suryoday Small Finance Bank MICR Code is printed on the cheques using the MICR (Magnetic Ink Character Recognition technology). The reason for using magnetic ink is because it becomes easier to authenticate and process online payments faster.

The MICR code is a 9-digit code. It comprises the following three parts:

Consider this example.

The MICR code for the Gujarat branch of the Suryoday bank is 380757001. In this, "380" represents the city code. The next three digits, i.e., "757," denotes the bank code and "001" is the branch code.

You can find your MICR code on the bottom of a cheque leaf or next to the cheque number. Additionally, it is printed on the savings account passbook as well. Similar to the Suryoday Small Finance Bank IFSC Code, this MICR code is of great importance as it is required for online funds transfer.

It must be clear here that both IFSC and MICR codes are crucial to process online payments using the above-mentioned methods. Hence, you must be aware of the same.

However, in case you forget either of the codes, here is how you can find your Suryoday Small Finance Bank IFSC Code and MICR code:

The most common place to find any of your banking credentials in a few clicks is the website called Find Your Bank. Besides knowing your various codes, the site also allows you to redeem various banking-related services in a few clicks and from anywhere.

To find your Suryoday Small Finance Bank IFSC Code and MICR code from the Find Your Bank website, simply enter your:

After selecting the above options, click "Enter." The website will provide you with all the required details and codes according to your entries.

Another convenient way to get access to all the above information is through their mobile application. The mobile application is simpler to use than the other procedures.

You can also find your IFSC and MICR code on your various bank documents, such as your passbook and cheque book. For the MICR code, check the bottom of any cheque leaf or next to the cheque number.

You would know that both IFSC and MICR codes of every bank are only issued by the Reserve Bank of India (RBI). Hence, you can also find them from the official website of RBI.

Today, you can seamlessly access your bank online through net banking on a vast range of devices such as a laptop or mobile. To access your IFSC and MICR code through either of these, log in to the platform and scroll through the available options to obtain the codes.

If none of the other methods works, you can directly contact your bank's customer care to get your IFSC and MICR codes.

Are you fed up with the old-school fund transfer methods that are slow and highly inefficient? Do you want peace of mind while transferring money online to any part of India? If so, you must switch to electronic payments like NEFT, RTGS, and IMPS that are way more efficient and advantageous than the former.

However, you need the following information/documents to process payments from the above modes.

Read ahead for a detailed explanation of each of these payment methods.

NEFT is the acronym for National Electronic Funds Transfer. It's a convenient and quick method to transfer online funds. It was developed by the RBI for a quick & hassle-free online transfer from one bank account to another across India.

You can carry out NEFT transfers either through mobile or net banking. The transaction charges for Suryoday Small Finance Bank NEFT transfers are as follows.

| NEFT amount | Charges |

| Up to Rs. 10,000 | Rs. 2.5 + GST |

| Rs. 10,000 to Rs. 1 lakh | Rs. 5 + GST |

| Rs. 1 lakh to Rs. 2 lakh | Rs. 10 + GST |

| Above Rs. 2 lakhs | Rs. 10 + GST |

| Rs. 2 lakh to Rs. 5 lakh | Rs. 25 + GST |

| Above Rs. 5 lakh | Rs. 50 + GST |

The timings for an NEFT transfer are all days except Sundays, and 2nd and 4th Saturdays, from 8 am to 6:30 pm. The minimum amount you can send via NEFT can be anything below Rs. 1 lakh, which is also the maximum limit. The settlement time in NEFT is in batches.

RTGS is an acronym for Real-Time Gross Settlement. As the name suggests, RTGS payments happen in real-time without delays. Due to this, this mode is usually preferred for making higher transfers. The best advantage of using the RTGS process is its fast settlement cycle that is in real-time.

The transaction charges for the RTGS process are as follows.

| RTGS amount | Charges |

| Up to Rs. 10,000 | Not applicable |

| Rs. 10,000 to Rs. 1 lakh | Not applicable |

| Rs. 1 lakh to Rs. 2 lakh | Not applicable |

| Rs. 2 lakh to Rs. 5 lakh | Rs. 25 + GST |

| Rs. 5 lakh to Rs. 10 lakh | Rs. 50 + GST |

You can transfer funds via RTGS on weekdays and Saturdays during the bank working hours. The minimum amount you can send via RTGS is Rs. 1 lakh, and there is no maximum limit. The settlement time in an RTGS transfer in real-time.

The Suryoday Small Finance Bank also offers IMPS, another swift bank-to-bank fund's transfer method. It stands for Immediate Payment Service. In an IMPS transfer, the funds are transferred to another bank within a few minutes or instantly. It is faster than NEFT transfer.

For any of the above methods of money transfer, you need the following documents.

The minimum and maximum limits of IMPS transfer in the Suryoday Small Finance Bank are Re.1 and Rs. 2 lakh, respectively. You can send money through IMPS 24/7, including holidays. The settlement time in an IMPS transfer is instant.

The Suryoday Small Finance Bank was started in 2017. The predominant aim behind the launch of this small finance bank was to bring the best banking facilities to every section of society. This bank offers a very wide range of services.

Some of the major services include MFI loans, Shopkeeper loans, Vikas Loans, and other products for all its customers who belong to different parts of the country. Furthermore, the Suryoday Small Finance Bank is the only bank in the state of Maharashtra to have the 'Small Finance Bank' license from the Reserve Bank Of India. Moreover, the bank has also obtained the credit ratings A-/A1 by CARE.

Additionally, the Suryoday Small Finance Bank also has the provision to transfer money through RTGS, IMPS, and NEFT methods, as discussed above. You can use their digital banking solutions for more convenience and quick resolutions of your queries.

Yes, the Suryoday Small Finance Bank is included in the Second Schedule to the Reserve Bank of India Act, 1934.

The Suryoday Small Finance Bank has provision to transfer money online through RTGS, IMPS, and NEFT. You can use these online money transfer methods, either using net banking or mobile banking, from the comfort of your home.

Yes, the bank is one of the reputed banks in India with branches in various cities. It is registered under the Reserve Bank of India (RBI). As of now, the bank has a customer base of over millions.