Punjab and Sind Bank was established on 24th June 1948. It’s a nationalized bank that offers all advanced banking facilities to its customers. The Punjab and Sind Bank net banking feature is one of the most beneficial services that has made internet banking easier for people.

The bank has its headquarters in Rajendra Place, New Delhi. The various digital banking services offered by the Punjab and Sind Bank have benefited its customers, helping them build a large customer base.

In this article, we’ll explore in detail about Punjab and Sind Bank net banking registration, login, setting and resetting the password, transferring funds, and more. To get step-by-step details about each process, keep following this guide till the end.

Punjab and Sind Bank Netbanking

The net banking facilities offered by Punjab and Sind Bank have made availing of different banking services relatively easy. By registering for the internet banking facilities, you can avail most of the services just by sitting at home.

Now you no longer have to visit the bank branch whenever you need to check your passbook statement, get account balance details, transfer funds, etc. Other important services like Punjab and Sind Bank retail banking and corporate banking are just a click away.

Moreover, the PSB Bank net banking is easy and secure, so customers don’t have to worry about any sort of discrepancies.

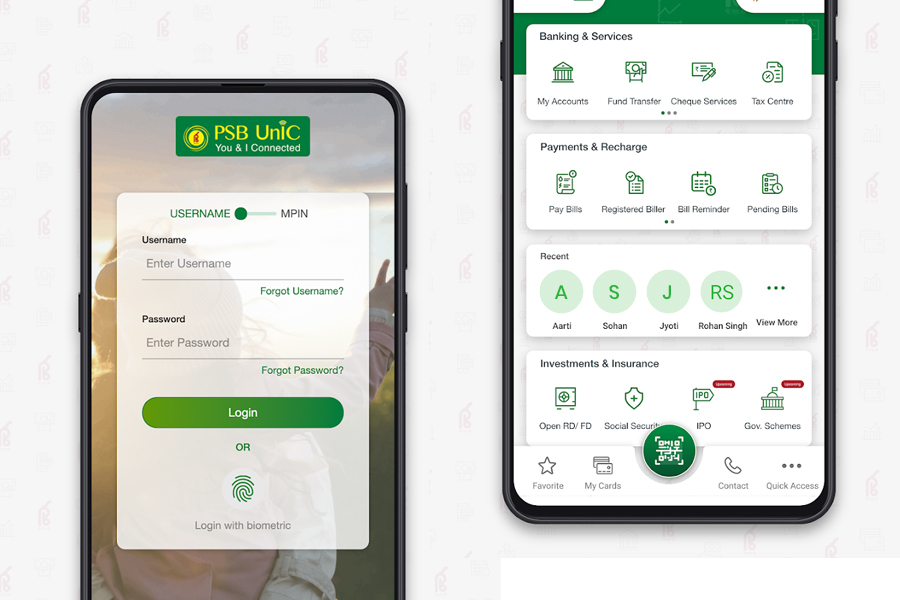

One of the most useful services of Punjab and Sind Bank is the PSB UnIC (You and I Connect), which is the Omni Channel Digital Banking solution that integrates the bank’s multi-channel and legacy system to provide uninterrupted services to their customers.

UnIC is similar to digital banking services, which have similar features like net banking, UPI, and mobile banking.

Benefits of Using Punjab And Sind Bank (PSB) Net Banking

There are multiple benefits of using the PSB Bank net banking. Most importantly, registering for internet banking services saves you a lot of time. With a smart device and a stable internet connection, you can avail all updated facilities with just a few clicks.

Here is a quick rundown of some of the facilities of PSB Bank net banking-

- Transferring funds within and outside the bank via NEFT, RTGS, and IMPS.

- Get all account details like mini statements and detailed statements.

- Apply for new debit and credit cards.

- Manage your cards.

- Get social securities subscriptions like- PMJJBY, PMSBY, and APY.

- Request for a new cheque book, enquire about cheque book status, inward cheque inquiry, stop a cheque, etc.

- Open or close fixed deposits (FD) and recurring deposits (RD).

- Pay utility bills.

- Check account balance and track transaction history.

How to Register for Punjab And Sind Bank (PSB) Net Banking?

New users can register for PSB Bank net banking by following a few simple and easy steps. But before you proceed with the online net banking registration, make sure you have the following details with you-

- The ‘Registered Mobile Number’ that is linked with your PSB Bank accounts for receiving SMS alerts like OTP etc.

- You need to update your ‘Date of Birth’ and ‘Mobile Number’ at your nearest PSB Bank branch.

- The User ID and the Customer ID are the same. So when asked to enter the user ID, you have to enter your PSB Bank ‘Customer ID’.

Note: PSB Bank has recently introduced their You & I connected service, which is different from other banks’ internet services. Therefore, even if an existing customer of the PSB Bank registered for net banking previously, they will again have to register for the You & I connected feature.

Here are the steps you need to follow to register for Punjab and Sind Bank internet banking-

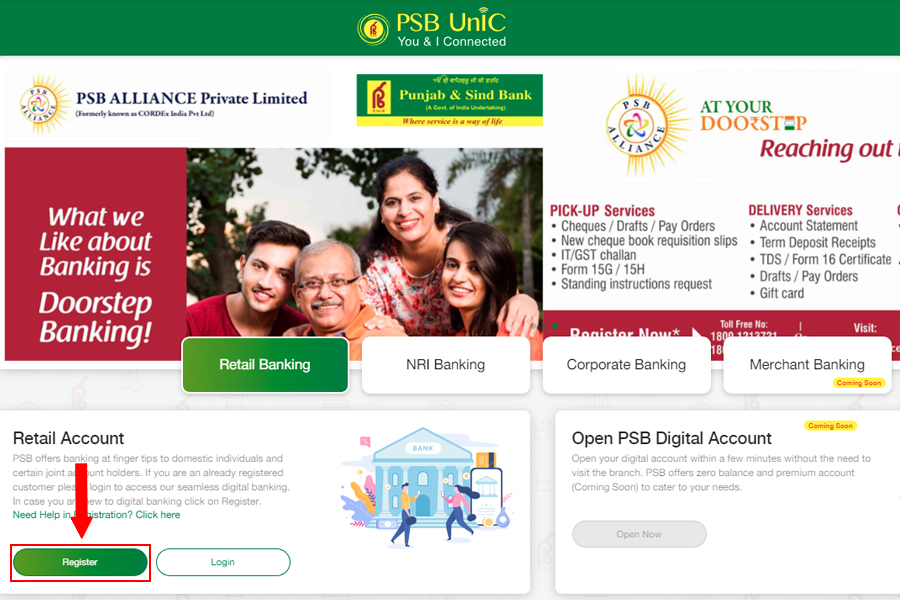

Step 1: First visit the PSB Bank Retail Net banking page by clicking here https://psbomnigateway.onlinepsb.co.in/PSB/#/nliLanding

Step 2: You can see ‘Retail Banking’, ‘NRI Banking’, ‘Corporate Banking’, and ‘Merchant Banking’.

Step 3: Click on ‘Retail Banking’.

Step 4: On the new page, you’ll find various options for services that are available for the customers.

Step 5: Under the ‘Retail Account’ tab, you’ll find the ‘Register’ button; Click there.

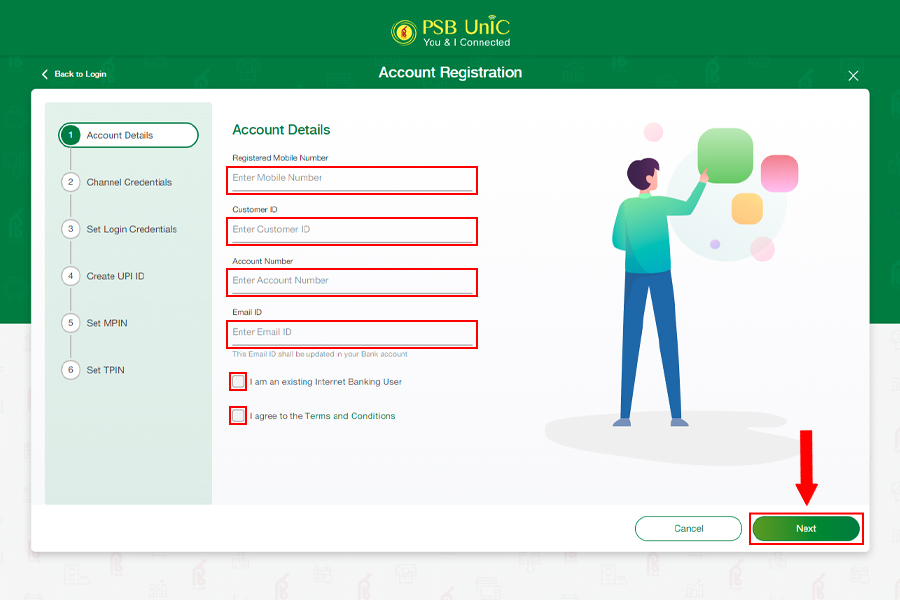

Step 6: On the new page, you have to enter your ‘Registered Mobile Number’, ‘Customer ID’, ‘Account Number’, and ‘Email ID’.

PSB Bank You & I Connect is a new product; hence, existing customers who have already registered for internet banking will also have to register for the service.

But the existing customers can register using their old credentials. If you are an existing customer, you need to Click on the box that says; ‘I am an existing Internet Banking User’. Then Click on the ‘Terms and Conditions’ box, and you’ll be redirected to the new page.

Step 7: The following step is for user authentication. There are three ways to authenticate the process: ‘Internet Banking’, ‘Debit Card’, and ‘Bank Token’.

But the ‘Internet Banking’ option is only for existing users where they have to enter their ‘Username’ and ‘Password’ to authenticate the process.

Step 8: The new users have to opt for either the ‘Debit Card’ or the ‘Bank Token’ option. If you choose the ‘Debit Card’ option, you need to enter your card number and pin to authenticate.

You can opt for the third option if you don’t have your debit card yet. To get the bank token, you need to click on the ‘Request Bank Token’ link, and your request will be sent to the branch.

Step 9: Once you request the token, you need to visit the branch, and the bank will verify all your account details and give you the token. Once you receive the bank token, you must repeat the registration procedure and enter the six-digit bank token number in the dedicated space.

Step 10: Now, bank customers have to set the ‘Login Credentials’ on the new page. You have to set your ‘User Name’, ‘Set the Password’, and then retype the password to confirm it.

Make sure to remember your username and password since you’ll need them every time you log in to the internet banking portal.

Step 11: The next step is to create your ‘UPI ID’. You may skip this step if you don’t want to register for the UPI services yet. If you want to register, you have to ‘Create a UPI ID’, and if you are eligible for the UPI services, you need to set a ‘Six-digit Mpin’.

Now again, you have to set a ‘Six-digit Tpin’. Both the Mpin and Tpin should not contain repetitive numbers (112233) or sequential numbers (12345). Also, you need to change both the Mpin and Tpin every six months.

Step 12: Once you complete setting the pins, your PSB Bank internet banking registration is complete, and you can now use your user ID and password to log in and utilize the net banking facilities.

How to Login to Punjab And Sind Bank (PSB) Net Banking?

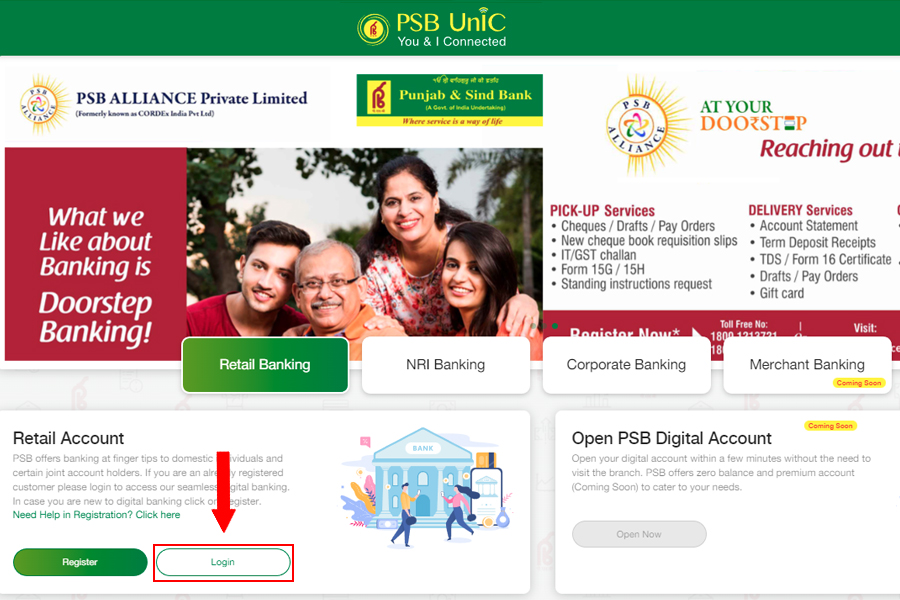

Follow the steps mentioned below to login to PSB Bank net banking-

Step 1: Visit the Official Net Banking Page of PSB Bank

Step 2: On the ‘Retail Account’ tab, Click on the ‘Login’.

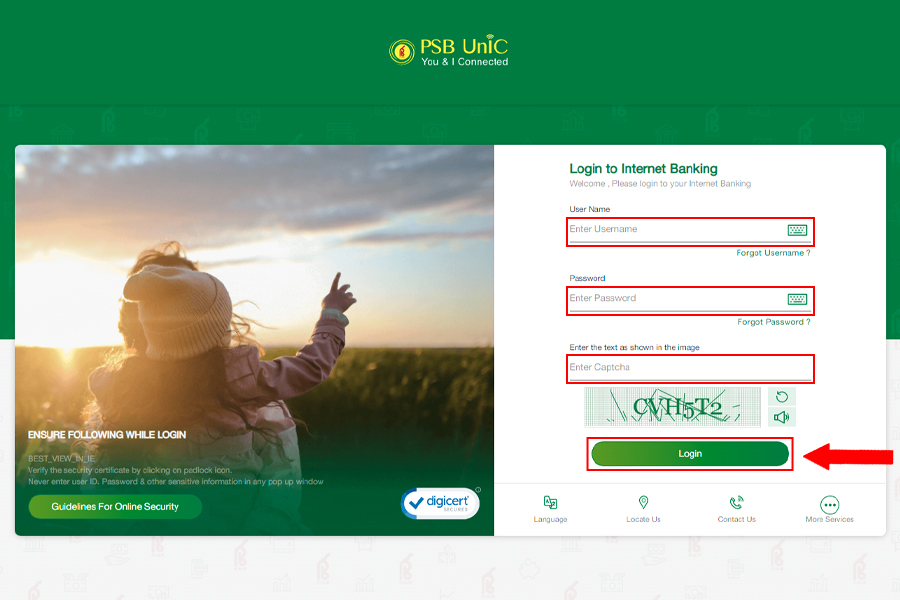

Step 3: On the new page, enter your ‘User Name’, ‘Password’, and the ‘Texts Shown in the Image’ and click on the ‘Login’.

Step 4: You have completed your PSB bank ‘Retail Login’. If you have a proprietor account, you have to click on the corporate account tab and enter your ‘Corporate Login’ details.

Punjab and Sind Bank Mobile Banking

You can avail of various services after registering for the PSB Bank mobile banking facilities. Some of the services offered by the PSB Bank mobile app or net banking app are-

- Mini statement

- Balance inquiry

- Immediate payment service (IMPS)

- Inter-bank money transfer through NEFT

- Intra- bank fund transfers

- Pay all types of utility bills

- PSB branch and ATM locator

- Inquire cheque status

- Stop cheques

- Mobile and DTH recharge, etc.

- Enable or disable the transaction facility

How to Activate Mobile Banking in Punjab and Sind Bank?

You can register for Punjab and Sind Bank mobile banking facilities by submitting the mobile bank registration form at your nearest PSB Bank branch. You can download the form by clicking here.

Once you submit the mobile banking registration form at the branch, you’ll receive your Mpin at your registered mobile number. After receiving the Mpin, you can complete your mobile banking online registration by downloading the PSB Bank mobile app from the Play Store or App Store and login in using your Mpin.

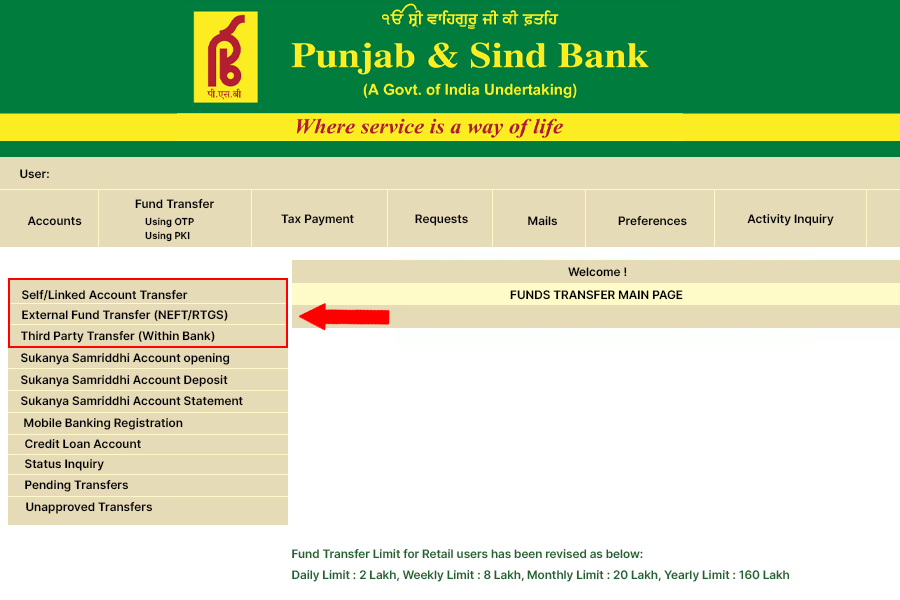

How to Transfer Money From Punjab and Sind Bank Online?

The PSB bank online fund transfer is easy and simple. You can send money both within the bank and to any third-party branch by following just a few simple steps. Punjab and Sind Bank also has digital fund transfer facilities like NEFT, RTGS, and IMPS.

Below mentioned are the steps you must follow to transfer money from Bank-

Step 1: Visit the Official Website of Punjab and Sind Bank and ‘Login’ into your account.

Step 2: Now go to the ‘Payment and Transfer Tab‘ and select the ‘Fund Transfer’.

Step 3: Now select between ‘Inter-Bank’ or ‘Intra-Bank’ transfer and select any transfer modes like- NEFT, RTGS, or IMPS.

Step 4: From the list of beneficiaries added, you need to select the one to whom you want to make the fund transfer.

Step 5: Enter the amount you want to transfer and, Click on the ‘Terms and Conditions’ box.

Then Click on ‘Confirm‘, and your money will be sent to the beneficiary’s account.

Fund Transfer Limit and Charges

You can transfer funds using NEFT, RTGS, or IMPS. Here are the PSB Bank fund transfer limits and charges for each method-

NEFT

| Transaction limit | Charges Branch Channel | Digital Channel |

| Upto Rs. 10,000 | Rs. 2.50 per transaction | Nil |

| Rs. 10,000 to 1 lakh | Rs. 5 per transaction | Nil |

| Rs. 1 lakh to 2 lakhs | Rs. 15 per transaction | Nil |

| Above Rs. 2 lakhs | Rs. 24 per transaction | Nil |

Punjab and Sind Bank NEFT services are available 24*7 all through the week. There are no maximum or minimum transfer limits for NEFT fund transfers.

RTGS

| Transaction Limit | Charges Branch Channel | Digital Channel |

| Rs. 2 lakhs to 5 lakhs | Rs. 24 per transaction | Rs. 20 per transaction |

| Above Rs. 5 lakhs | Rs. 49 per transaction | Rs. 45 per transaction |

The RTGS services are also available 24*7 and seven days a week. RTGS is used for making high-value fund transfers; hence the minimum amount is Rs.2 lakhs.

How to Generate and Change Passwords in PSB Bank Net Banking?

Follow these steps to generate and change passwords in PSB Bank net banking-

Step 1: After you register for Internet Banking, you’ll receive a ‘Net Banking Activation’ and ‘Login Password Generation SMS’. Users have to enter the password within fifteen days of receiving the SMS.

Step 2: To change or ‘Generate Bank’ passwords go to the Official Retail Net Banking Page.

Step 3: Then Click on ‘Login’ and enter your ‘Customer ID’, ‘Registered Mobile Number’, and ‘Request ID’ (which was generated at the time of registration)

Step 4: After entering these, you’ll receive an ‘OTP’ to authenticate the process. Enter the ‘OTP’, and now you can generate or reset your net banking password.

How to Check Your Punjab and Sind Bank Account Balance?

You can check your PSB Bank account balance both online and offline. To check your balance online, log in to either PSB net banking or mobile banking account, and there you’ll find the balance inquiry tab.

You can check your balance offline through the SMS alert system. For that, type- ‘PBAL’, then your ‘Account Number’, and send it to +91 97730 56161 or +91 80826 56161.

Conclusion

Hopefully, this article on Punjab and Sind Bank net banking was informative enough. Before you register for the internet banking services, make sure to go through all the registration and password setting steps to avoid any mistakes later.

Do you have any further queries regarding the PSB Bank digital banking? If yes, let us know in the comments.

Frequently Asked Questions

What is the Punjab and Sind Bank Customer Care Number?

The Punjab And Sind Bank Customer care number is 1800-419-8300.

How Can I Check My Punjab and Sind Bank Mini Statement?

You can check your Punjab And Sind Bank mini statement through mobile or net banking and through the SMS alert system as well. To check the mini statement through SMS alert, type- ‘PTXN’(Your account number) and send it to +91 80826 56161 or +91 97730 56161.

What Type of Bank is Punjab and Sind Bank?

Punjab and Sind bank is a public sector bank. It is one of the six banks nationalized by the Gol in April 1980.

Is Punjab and Sind Bank a Government Bank?

Yes, Punjab and Sind Bank is a government-owned bank.

Who is the Current CEO of Punjab and Sind Bank?

Swarup Kumar Saha is the current CEO of the Punjab and Sind Bank. He took charge as the CEO on 3rd June 2022.

Leave a Reply